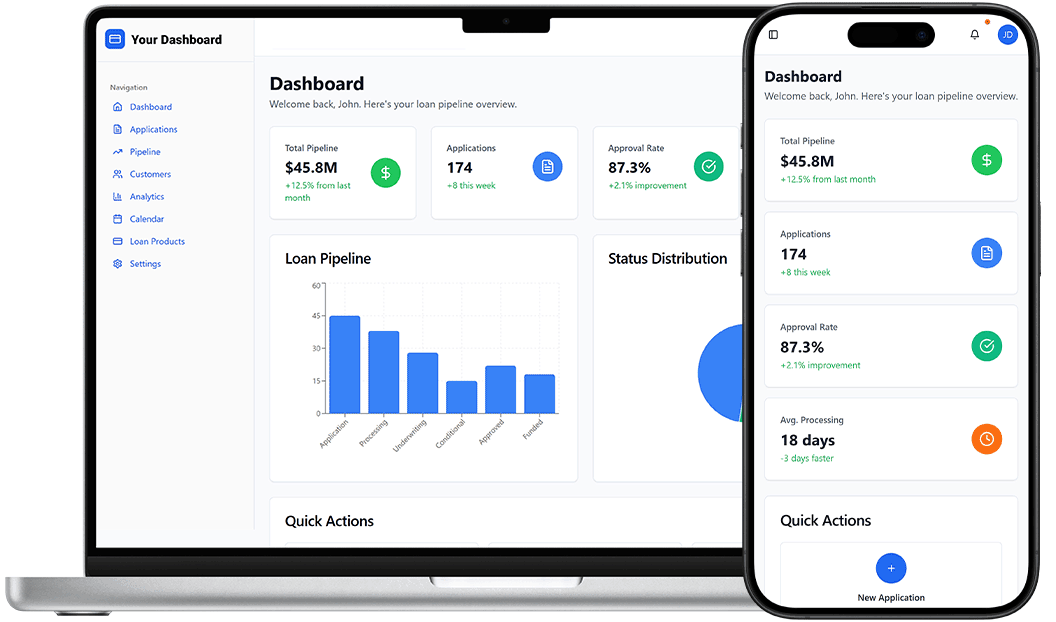

Build Powerful Digital Lending Platforms with No-Code

Transform your lending operations with DrapCode’s enterprise-grade no-code platform. Create sophisticated digital lending software, loan origination tools, and lending automation software without any coding knowledge.

Trusted by 1000+ brands across the world!

What is Digital Lending?

Digital lending revolutionizes traditional loan processes by leveraging technology to provide faster, more efficient, and accessible financial services through digital platforms.

No-Code

Build digital lending platforms without writing a single line of code.

Enterprise Security

Bank-grade security with compliance built in for regulatory requirements

Rapid Deployment

Build and launch your digital lending platform in weeks, not months.

Advanced Analytics

Real-time insights and predictive analytics for better lending decisions.

Why choose DrapCode for Digital Lending Software

Our no-code lending platform empowers you to build comprehensive lending automation software with all the features of traditional development, but with the speed and simplicity of visual design.

Complete Loan Origination Tools

- Automated Application ProcessingStreamline loan applications with intelligent forms and automated data validation.

- Advanced Credit ScoringIntegrate with multiple credit bureaus and implement custom scoring algorithms.

- Real-time Decision EngineMake instant lending decisions with configurable business rules and AI-powered insights.

- Secure Document ManagementHandle sensitive financial documents with encryption and audit trails.

Specialized Digital Lending Solutions

Build industry-specific lending platforms tailored to your business needs with our comprehensive suite of no-code lending platform tools.

Ready to Build Your Digital Lending Platform?

Join thousands of financial institutions and lending companies that trust DrapCode to power their digital transformation. Start building today with our no-code platform.