Launch Real Estate Crowdfunding Platforms without Heavy Engineering

Build and deploy secure, scalable, and customizable real estate crowdfunding platforms tailored for investors, agents, and developers with DrapCode.

Investment Marketplace Model

Real estate crowdfunding platforms enable multiple investors to pool capital into property-backed opportunities. These systems manage investor onboarding, property listing workflows, and structured capital allocation. Because investments involve regulatory and financial oversight, platforms require robust governance, audit tracking, and capital-flow transparency. Manual coordination increases operational risk and reduces investor confidence.

Platform Infrastructure

A no-code web app builder allows teams to configure investor profiles, property offerings, capital allocation rules, and payout workflows visually. This eliminates custom backend engineering while maintaining operational control. Crowdfunding systems frequently integrate structured funding logic and capital distribution workflows.These operations align with broader equity crowdfunding platforms that manage multi-investor financing environments.

Core Crowdfunding Capabilities

These capabilities define what a production-ready real estate crowdfunding platform must support for regulated property investment operations.

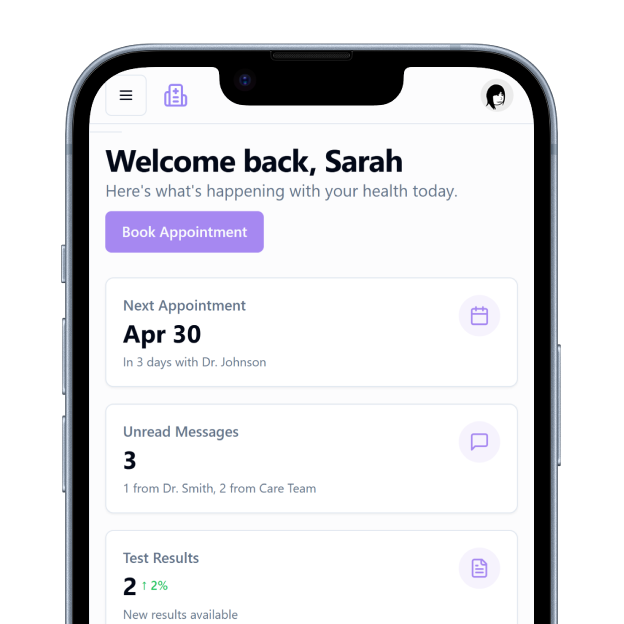

Investor Onboarding Engine

Register, verify, and approve investor profiles securely online.

Property Listing Management

Publish investment opportunities with structured documentation workflows.

Capital Pool Allocation Logic

Automatically distribute investor funds across property projects.

Return Distribution Tracking

Calculate dividends and manage payout schedules accurately.

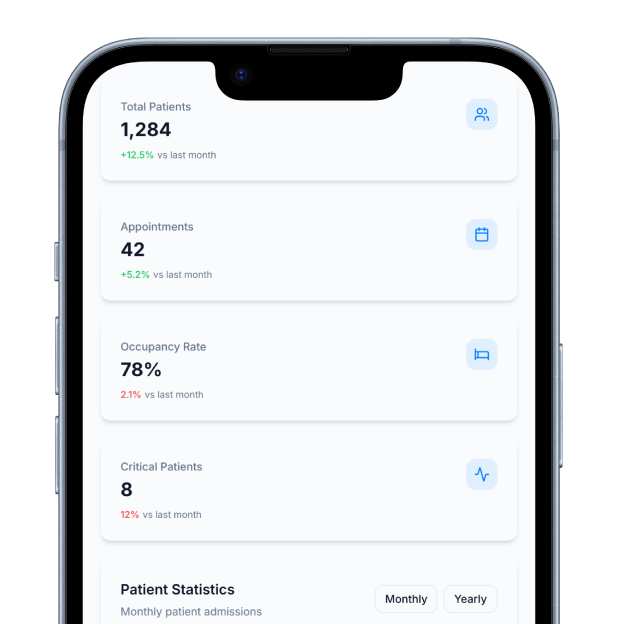

Performance Reporting Dashboards

Visualize portfolio returns and investment metrics securely.

Compliance & Audit Logging

Record transactions and investor activities for governance.

Governance & Control Framework

These controls ensure the platform remains secure, compliant, and scalable for property investment ecosystems.

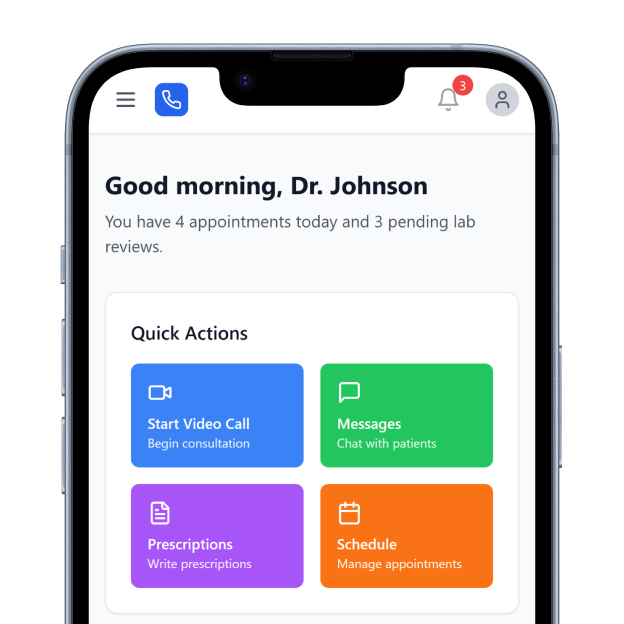

Role-Based Access Controls

Configure investor, sponsor, and admin permissions securely.

Workflow Automation Tools

Automate funding approvals and distribution triggers reliably.

API Connectivity Layer

Integrate payment systems and financial verification services.

Scalable Infrastructure Backbone

Support large investor volumes without performance issues.

Use Case Applications

How It Works

Configure Investor Profiles

List Investment Opportunities

Allocate Capital Automatically

Track Returns Transparently

Regulatory Compliance

Real estate crowdfunding platforms must enforce strict identity verification, transaction logging, and capital audit tracking. These controls protect investors and ensure financial transparency. Structured documentation management reduces operational risk and supports regulatory oversight in property financing ecosystems.

Capital Ecosystem Expansion

Crowdfunding models often expand into broader structured financing systems. These investment networks integrate with mortgage lending platforms to manage property-backed credit. Additionally, property development funding frequently intersects with business liquidity workflows supported by commercial lending software.