Build Secure, Custom Trade Finance Portal

Use DrapCode to build a trade finance portal, streamline global transactions, automate risk workflows, and launch compliant solutions without coding.

Unlock Smarter Trade Financing

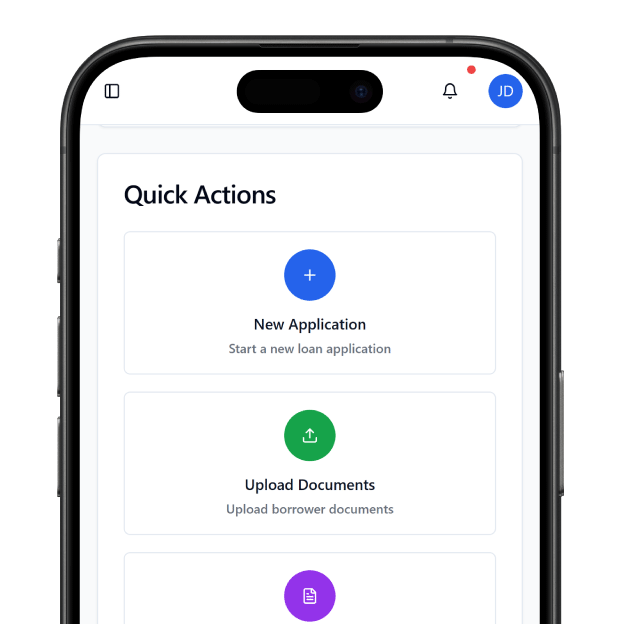

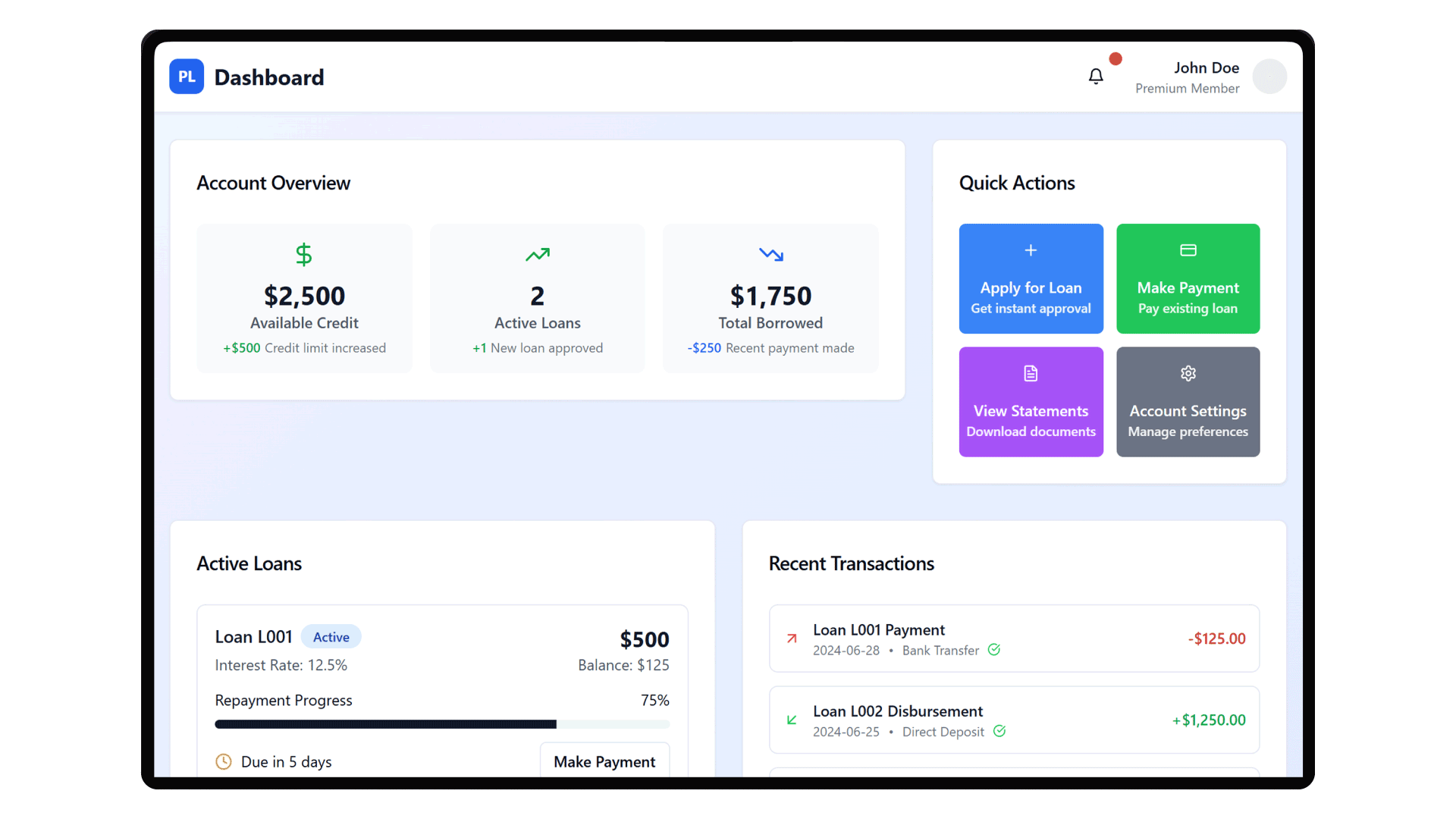

Key Features of Trade Finance Portal

Document Management

Allow importers/exporters to upload bills of lading, invoices, and compliance documents in structured formats.

Credit Checks

Trigger automated credit assessments from external bureaus before initiating financing approvals.

Workflow Automation

Digitize tasks like compliance checks, disbursal triggers, and communication between lenders and clients.

LC & BG Management

Track issuance and expiry of Letters of Credit and Bank Guarantees within one unified portal.

Custom Approval Logic

Configure multi-level approvals across risk, compliance, and management for large transaction workflows.

Trade Analytics

Get insights into processing times, disbursal trends, and risk exposures across multiple trade corridors.

Why Build with DrapCode

No Developer Dependency

Deploy trade finance systems without writing code—ideal for product managers and business ops teams.

Global Standard Ready

Support UCP 600, SWIFT messages, and other global documentation formats out-of-the-box.

Credit Integration

Easily connect to credit bureaus and KYC providers with prebuilt connectors and API-ready modules.

Role-Based Access

Ensure secured access to documents and records based on user roles like banker, borrower, or auditor.

Real-World Use Cases

Export Financing

Enable real-time credit scoring for exporters by integrating with TransUnion , allowing for better underwriting accuracy.

Collateral Verification

Use Advantage Credit to verify trade-related collateral and track secured finance limits per transaction.

Importer Risk Management

Connect with PCB Credit to assess importer credibility before issuing Letters of Credit or purchase order financing.

Configure and Launch in 4 Simple Steps

Template Setup

Workflow Builder

Credit & Document APIs

Trade Finance Launch

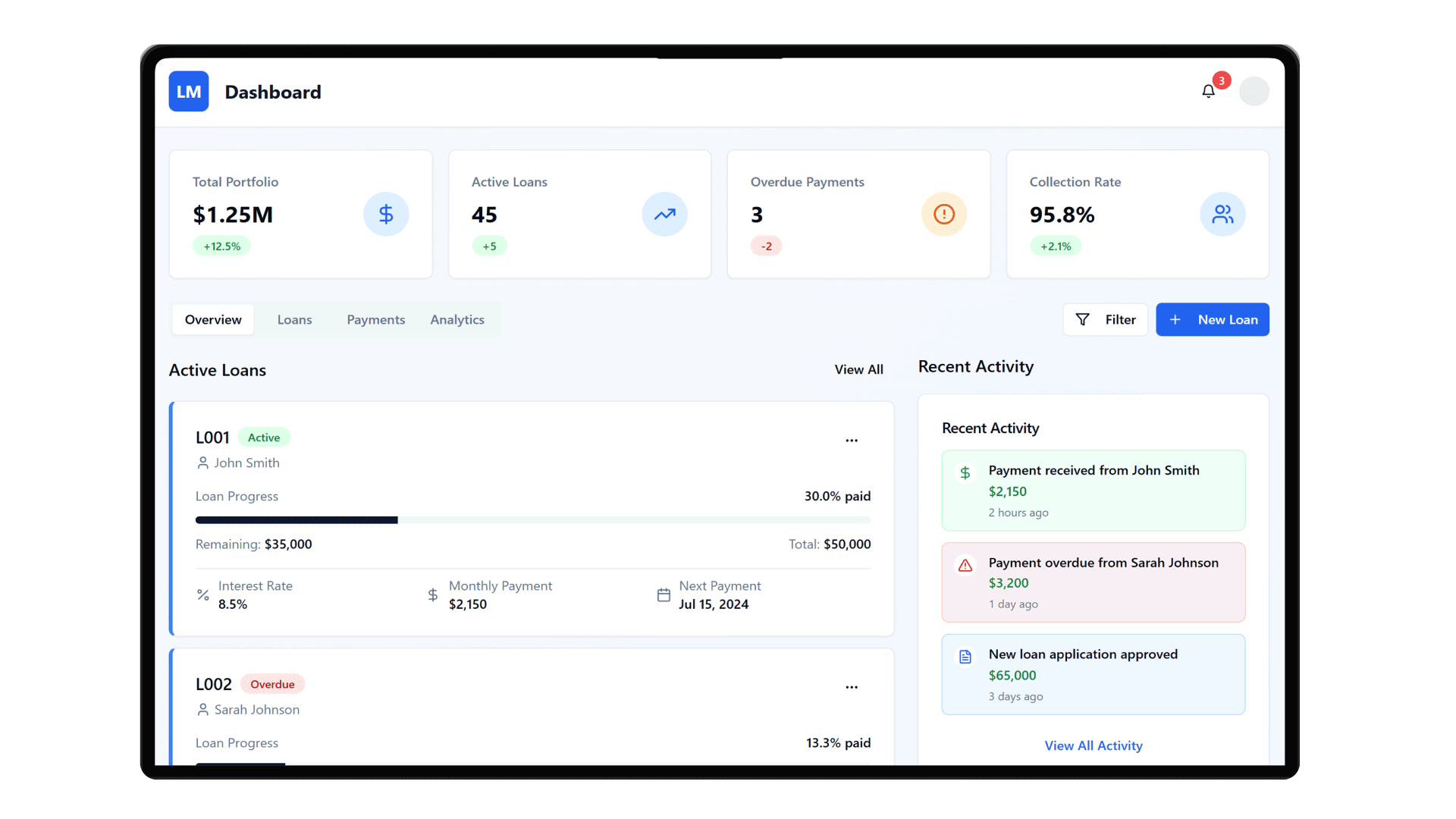

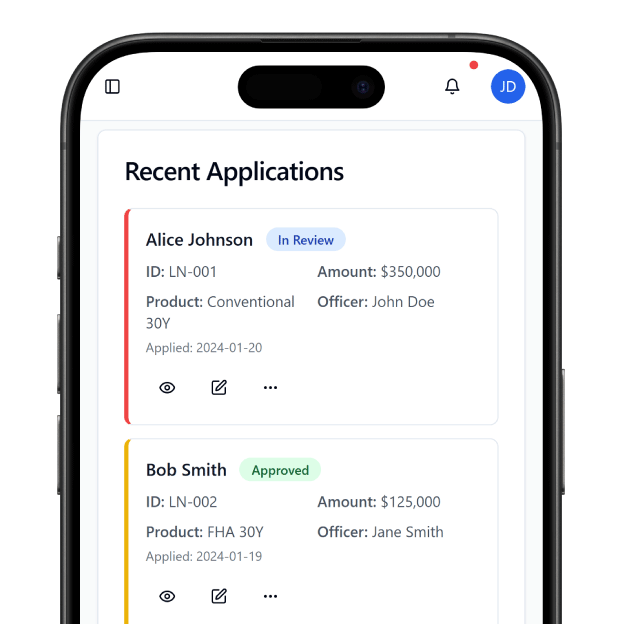

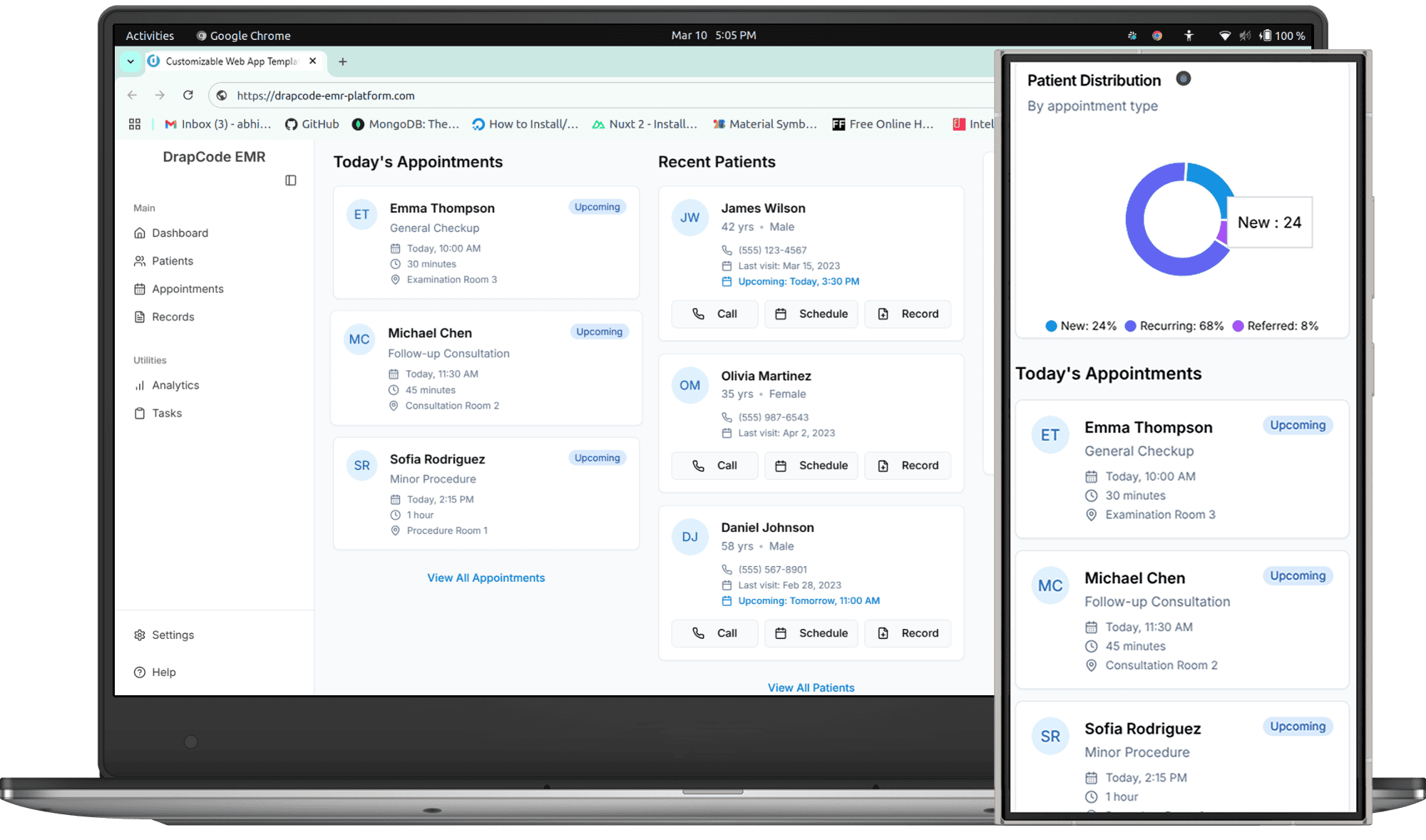

Connected Lending Ecosystem

Link your trade finance solution with broader financial operations like Healthcare Lending Platforms, Bank Loan Management Software, or Education Loan Software for cross-product financing and centralized reporting.