Build a Custom Bank Lending Software

Build a bank lending platform with DrapCode, automate credit decisioning, manage loan workflows, and deploy compliant digital lending experiences without code.

Institutional Lending Workflows

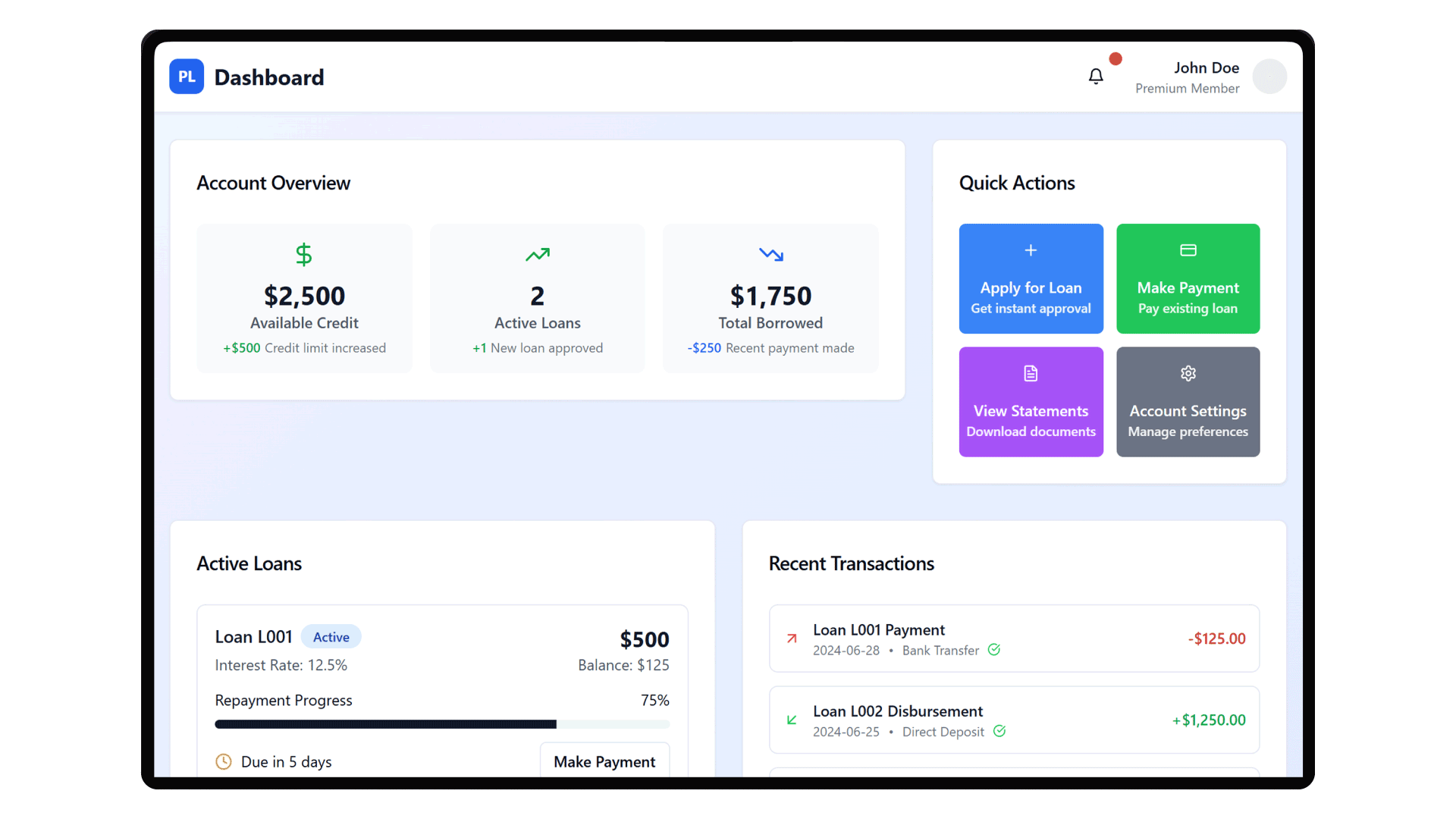

Bank lending platforms manage high-volume credit products with structured underwriting, portfolio risk assessment, and compliance controls. These systems enable banks to serve retail, SME, and corporate borrowers with consistent governance. Commercial, home, and business lending require robust backend logic, audit trails, and multilayer decision workflows. Without structured platforms, operational risk and compliance complexity rise significantly.

Platform Architecture Insights

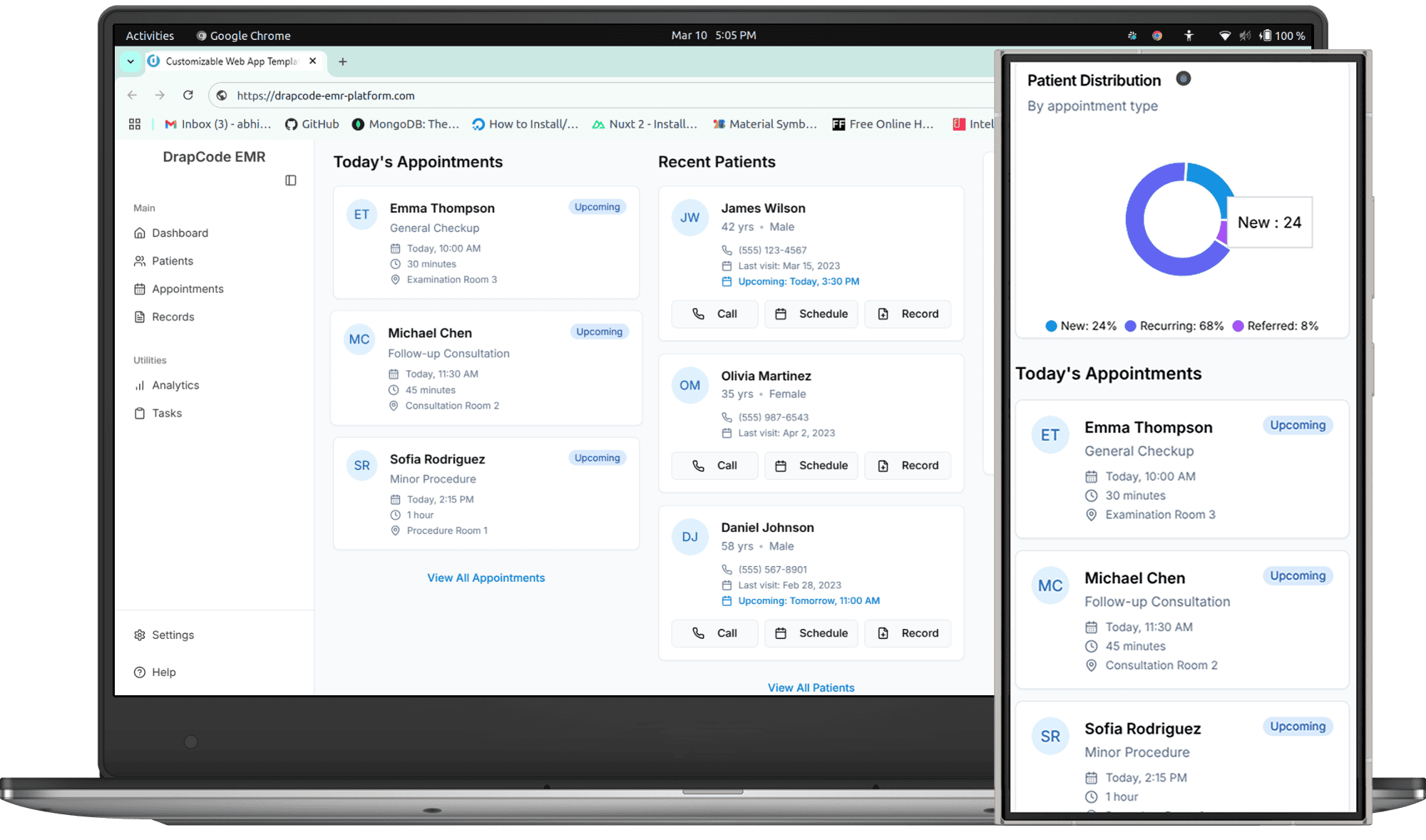

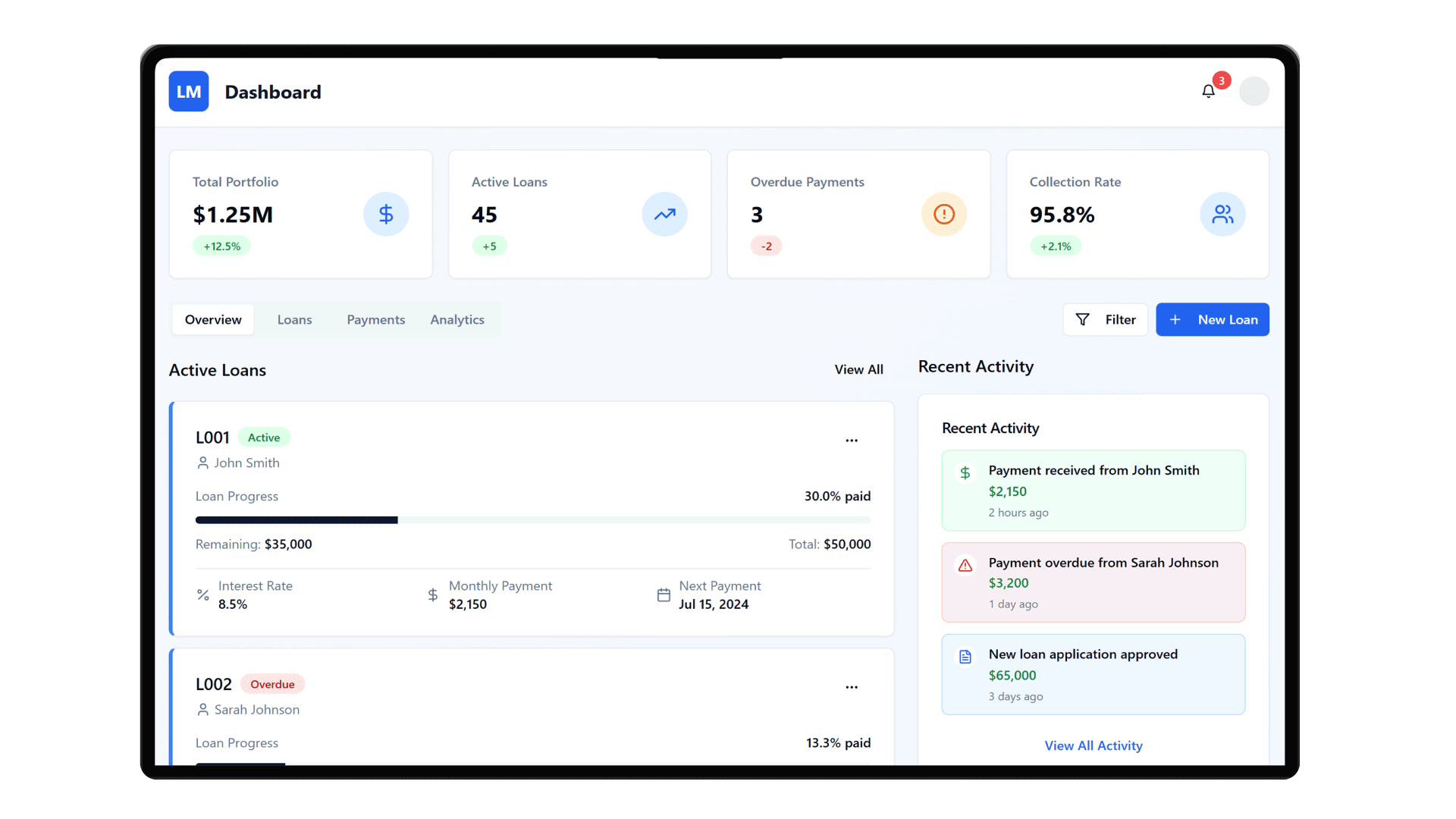

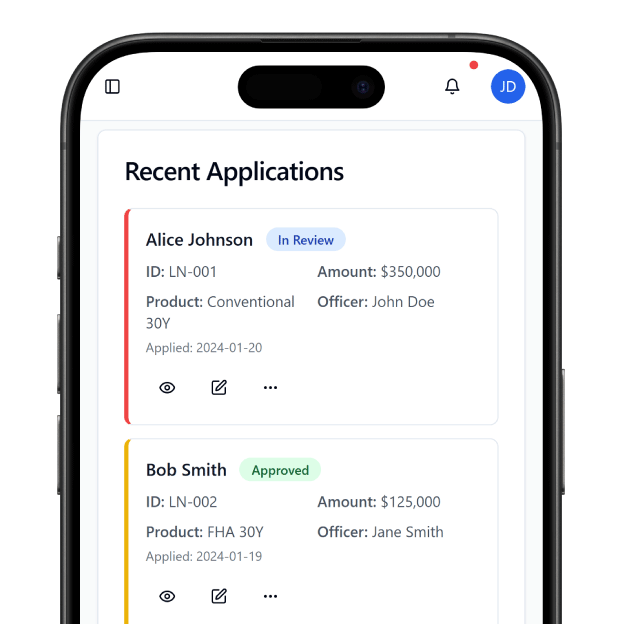

A no-code web app builder lets teams visually define credit products, risk scoring logic, approval authorities, and documentation workflows without backend coding. This accelerates deployment while preserving enterprise governance and security. Bank lending ecosystems often integrate with analytics, reporting, and general ledger systems to unify financial operations. These functions align with commercial lending software that supports enterprise credit management and performance tracking.

Core Bank Lending Features

These features define what a production-ready bank lending platform must support for secure institutional credit operations.

Structured Credit Product Engines

Configure a range of loan products with structured term logic.

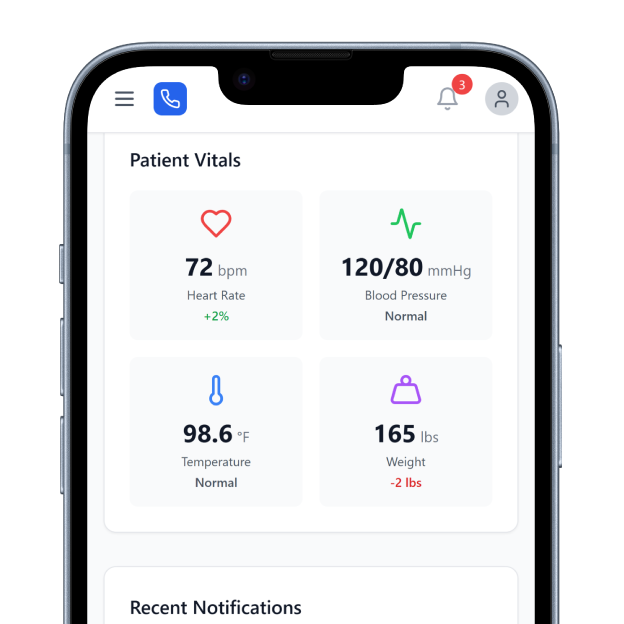

Enterprise Risk Scoring Models

Apply advanced credit analytics with configurable scoring engines.

Multilayer Approvals & Authority

Support tiered decision levels with governance logic.

Collateral & Asset Management

Track and validate security across lending portfolios.

Documentation & Compliance Controls

Store audit trails and regulatory paperwork securely.

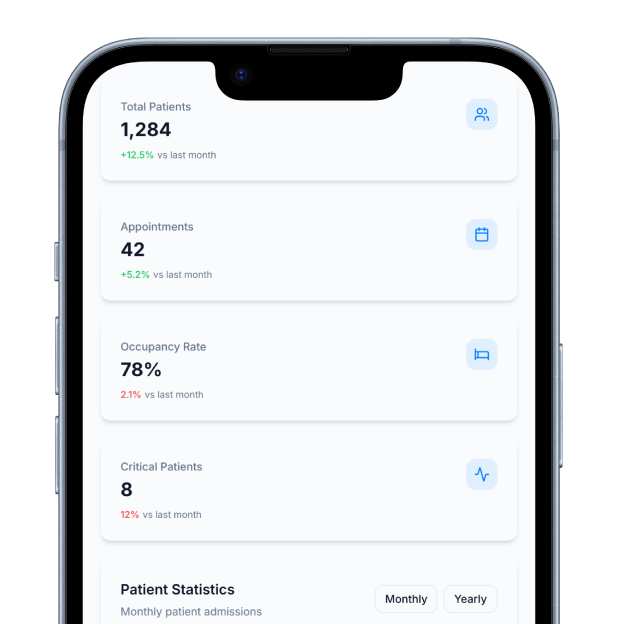

Integrated Reporting Dashboards

Visualize portfolio insights and performance metrics reliably.

Governance & Integration Controls

These capabilities ensure bank lending systems remain secure, compliant, and enterprise-ready.

Role-Based Permission Controls

Securely configure lender, admin, and risk officer access.

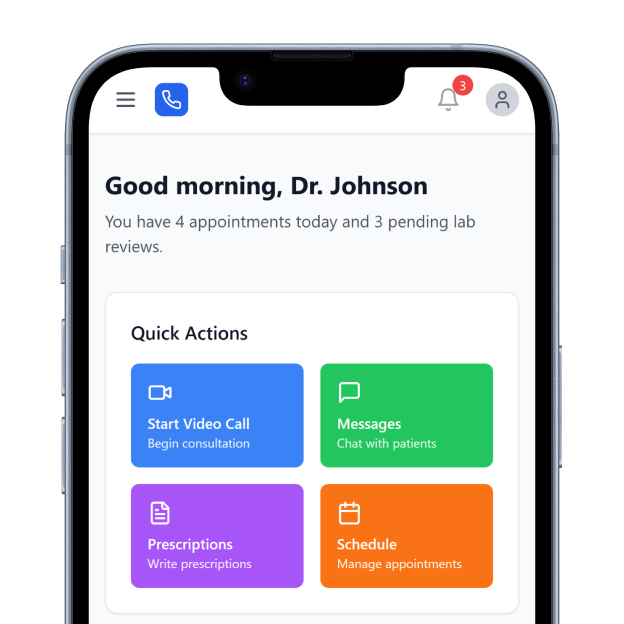

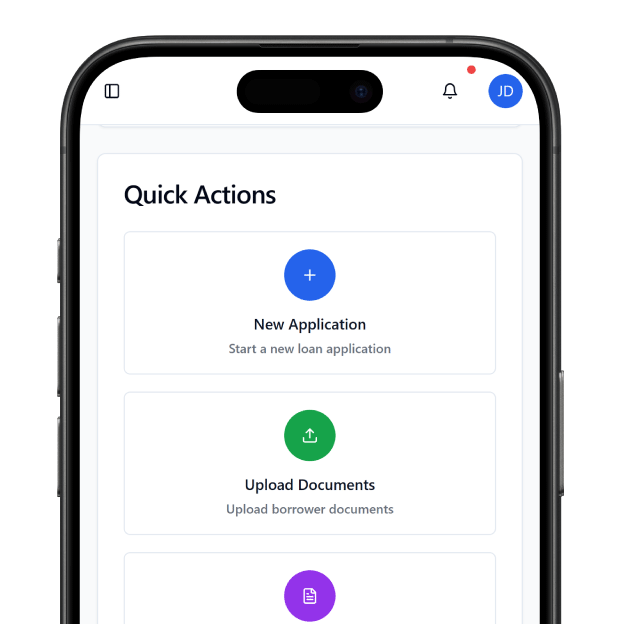

Visual Workflow Automation

Build credit workflows and approvals without backend code.

API Connectivity Layer

Connect analytics, payment, and core banking systems.

Scalable Deployment Architecture

Support high transaction volumes with resilient infrastructure.

Use Case Applications

How It Works

Build Credit Catalog

Design Approval Flows

Integrate Analytics Systems

Deploy Production Platform

Risk & Regulatory Governance

Bank lending platforms must enforce strict encryption, audit logging, and access controls to maintain regulatory compliance. These safeguards protect institutional credit portfolios and ensure consistent governance. Structured workflows improve risk visibility, portfolio health tracking, and compliance readiness across multiple product lines.

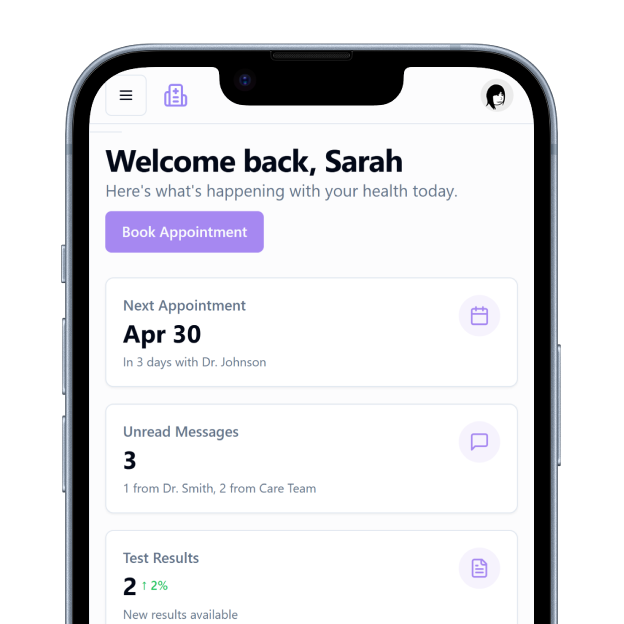

Operational Scalability

High-volume institutional credit requires resilient infrastructure, real-time decision engines, and stable performance dashboards. This ensures efficient processing and improved borrower experiences during peak lending cycles. Robust architecture supports diverse credit products and unified portfolio management.