Build Custom Loan Origination Software

Launch secure, no-code loan origination platforms to streamline borrower onboarding, underwriting, and approval workflows with DrapCode.

Origination Workflow Overview

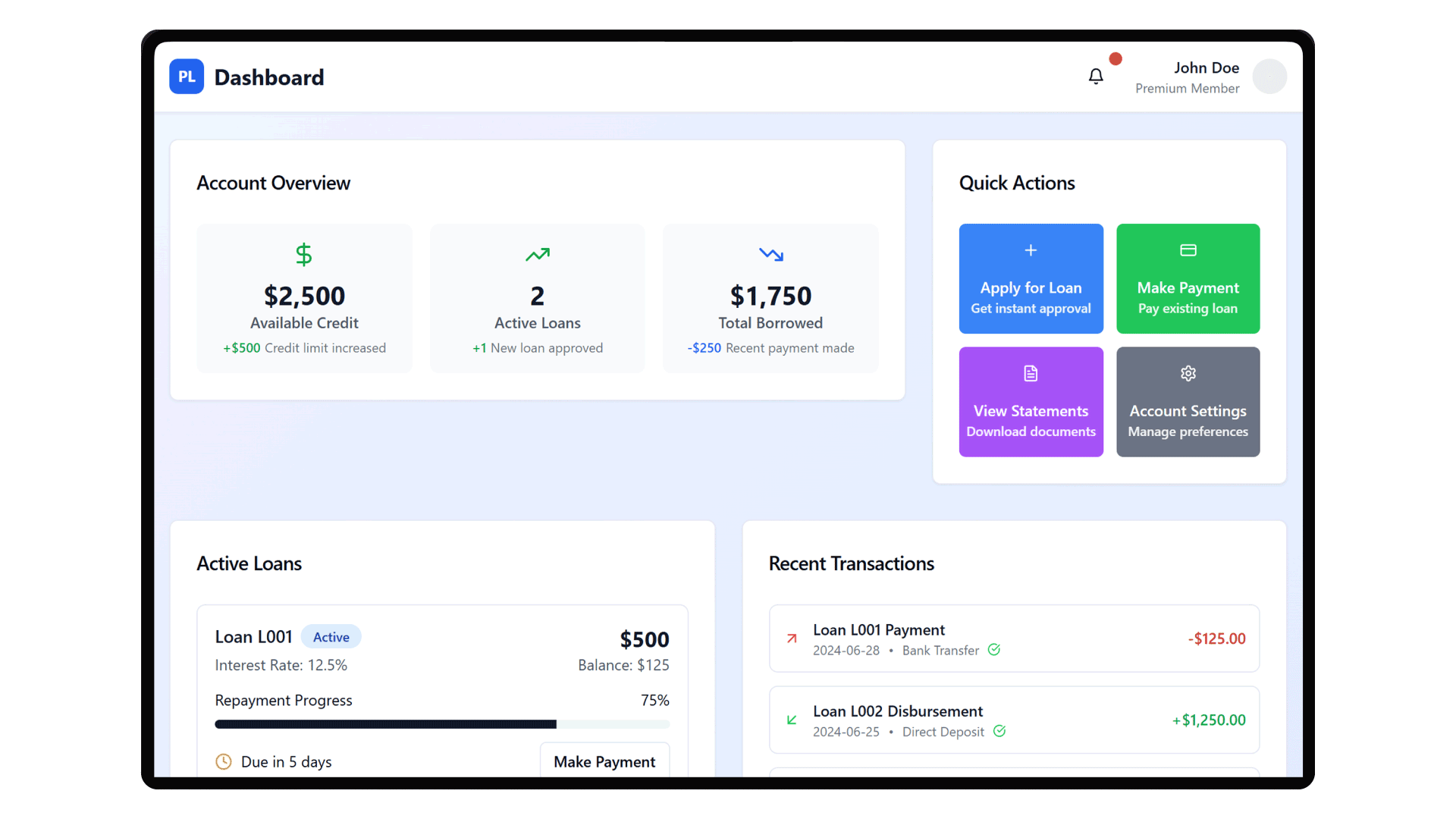

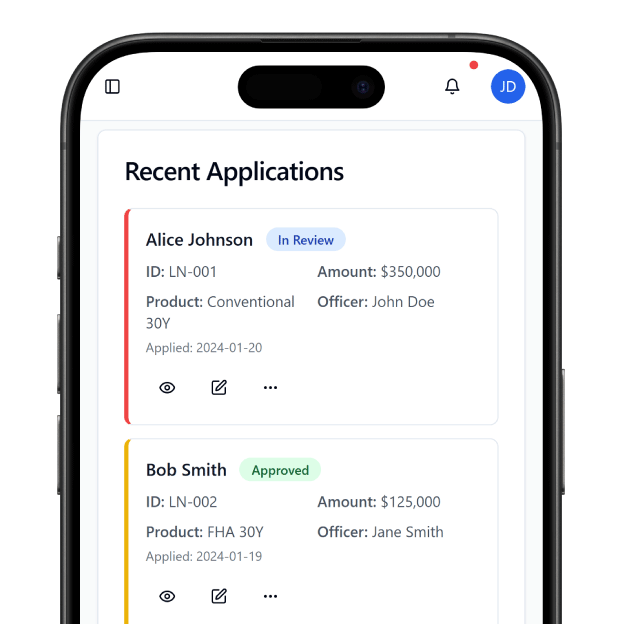

Loan origination software manages the full lifecycle of loan applications, from intake and validation through underwriting to approval. It reduces manual intervention, improves decision accuracy, and accelerates time-to-approval. Modern loan origination solutions require backend workflow logic, compliance checks, and structured scoring rules that differentiate production-grade lending systems from simple form builders and prototypes.

No-Code Origination Architecture

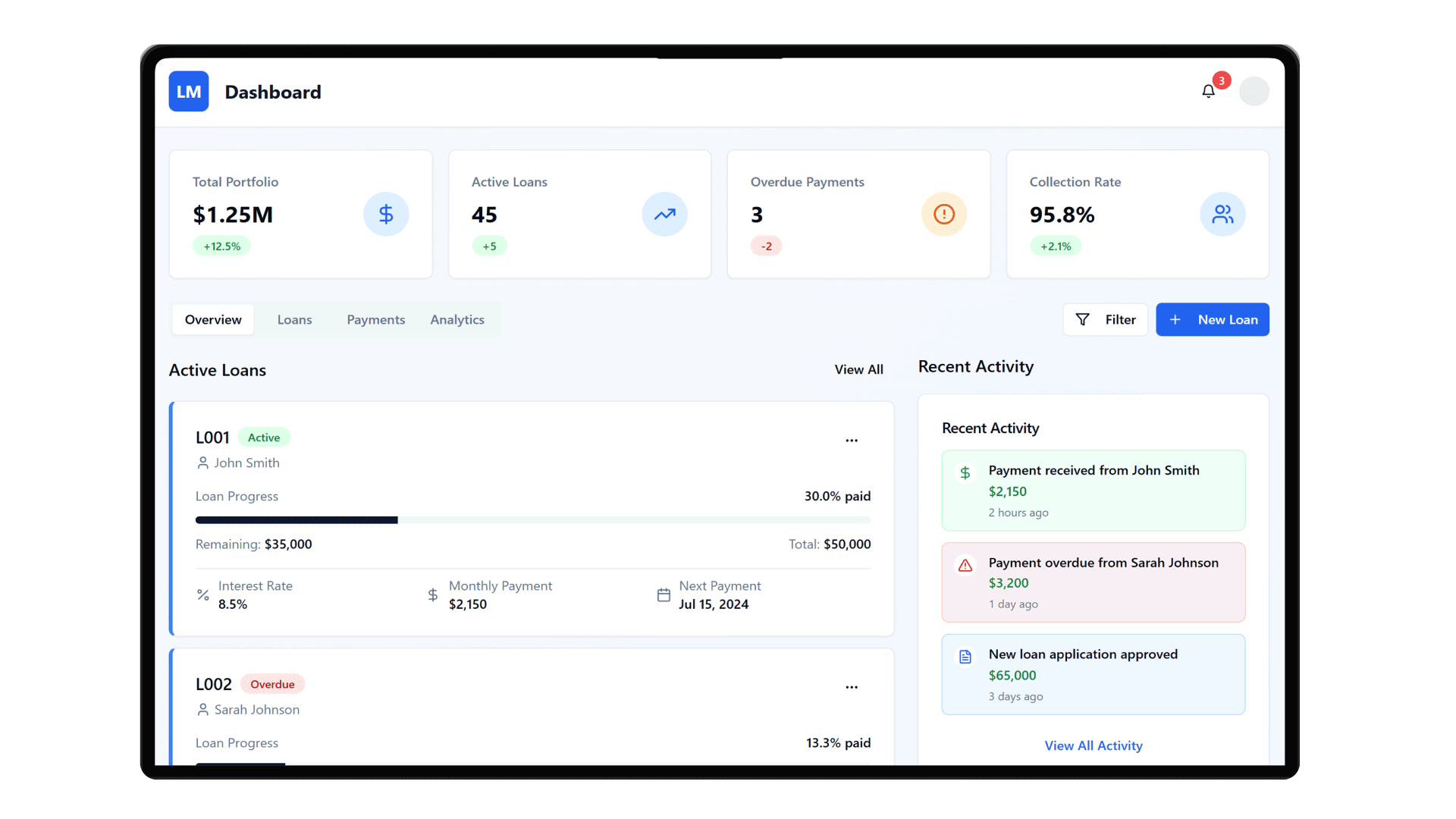

A no-code web app builder enables teams to visually configure application forms, risk rules, document capture, and approval hierarchies. This eliminates traditional backend development and speeds up platform delivery. Loan origination systems frequently integrate with servicing platforms to complete the credit lifecycle. This is commonly achieved through loan management software that handles repayment logic and lifecycle tracking.

Core Origination Features

These features define what a production-ready loan origination system must support for regulated credit operations.

Application Intake Engine

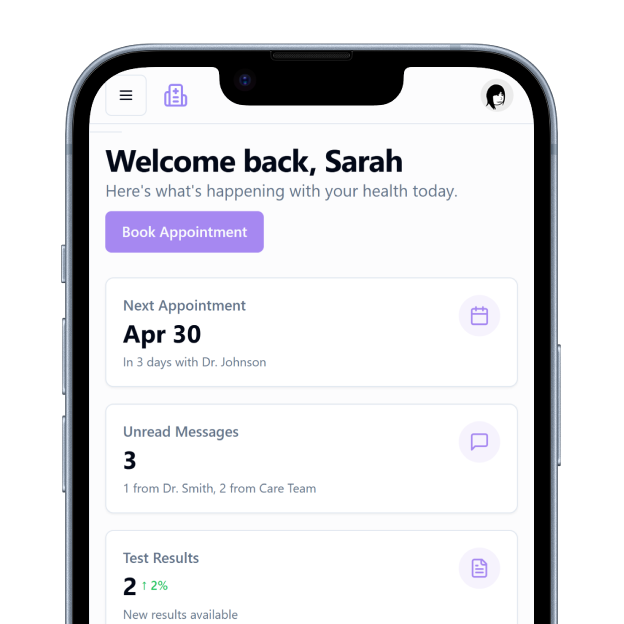

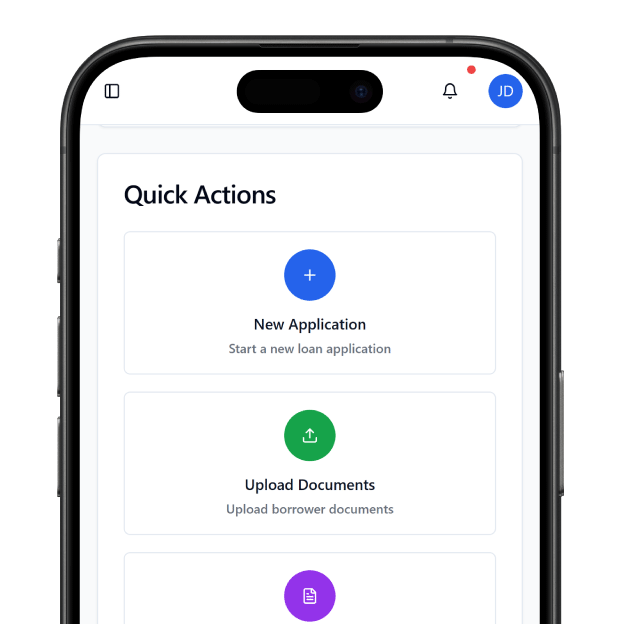

Capture borrower details, forms, and documentation securely online.

Identity & KYC Verification

Verify address, identity, and compliance data with secure logic.

Risk Scoring Logic

Apply rules and models to automatically assess creditworthiness.

Multi-Level Approvals

Securely configure role hierarchies for layered credit approvals.

Document Management

Store, retrieve, and validate borrower files securely.

Automated Decisioning

Trigger structured decisions based on configurable rules and thresholds.

Origination Platform Capabilities

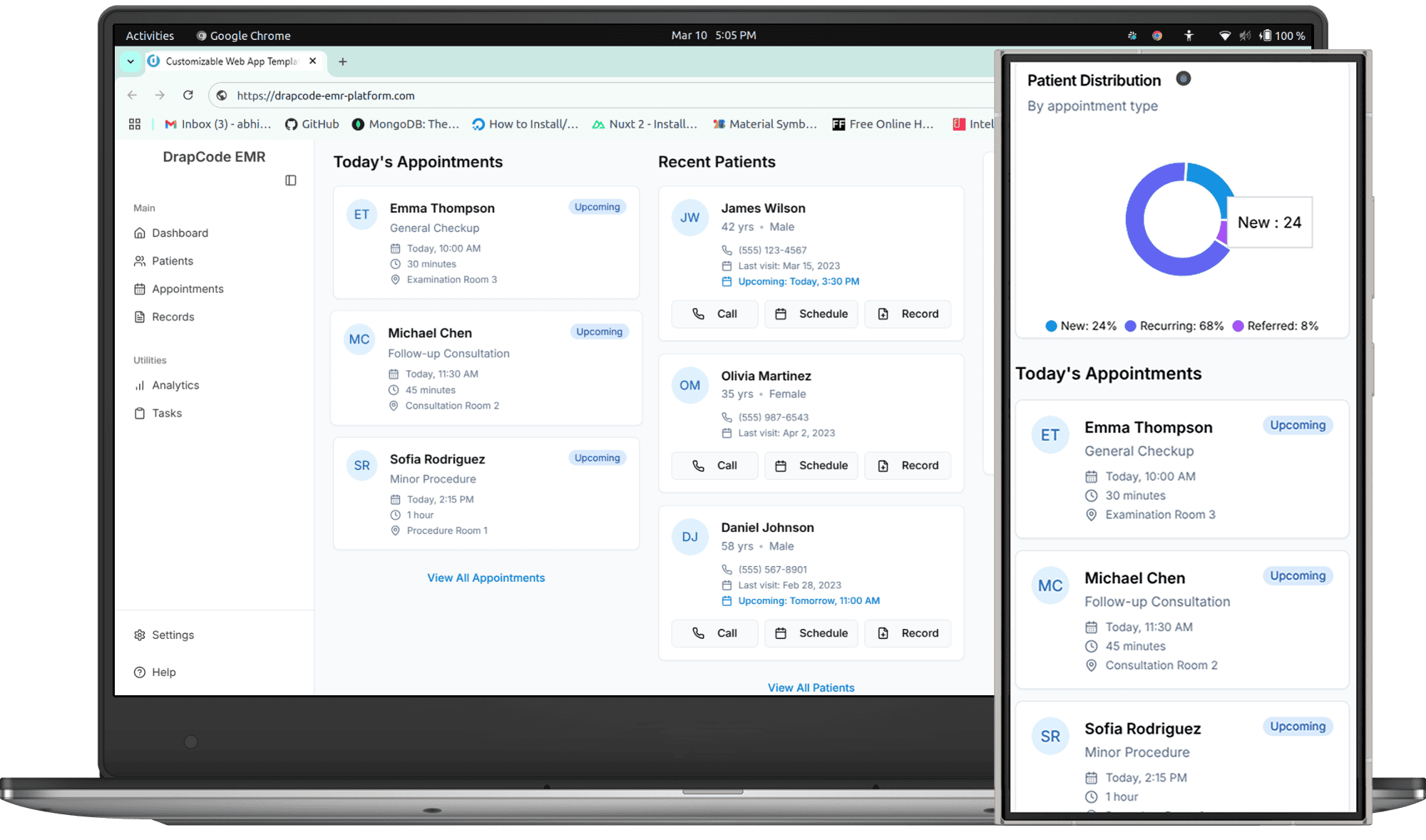

Visual Workflow Builder

Design application flows and underwriting logic without coding.

Role-Based Access Controls

Manage user permissions and governance with secure configurations.

API Integration Layer

Securely connect credit bureau, payment, and risk systems.

Scalable Deployment Architecture

Support high volumes of simultaneous loan applications reliably.

Use Case Scenarios

Origination Implementation Flow

Build Application Forms

Define Risk Rules

Configure Approvals

Deploy Production System

Compliance & Risk Governance

Loan origination systems must enforce encrypted storage, audit logging, and role-based access controls to ensure compliance. These safeguards are critical for financial operations subject to standards and audit requirements. When origination triggers require partner collaboration, lenders often bring in channel networks. These onboarding and co-selling workflows are enabled via a channel and business partner portalthat manages partner roles and pipelines.

Why DrapCode for Loan Origination

Loan origination platforms require structured backend logic, workflow governance, and compliance automation. Traditional engineering is slow, costly, and difficult to maintain at scale. DrapCode’s no-code web app builder provides:

- Visual underwriting workflow design

- Secure role hierarchies and approvals

- API connectivity for external services

- Scalable production deployments