Build an Intelligent Accounting and Invoicing Platform

Launch robust, customizable accounting and invoicing software that simplifies finance operations for businesses, fully tailored and built visually on DrapCode.

Simplify Accounting Workflows

Key Features of Accounting and Invoicing Platform

Invoice Generation

Create, send, and track digital invoices with custom fields, tax logic, and automated follow-ups.

Ledger Management

Maintain accurate ledgers, track credits/debits, and auto-update entries linked to each transaction.

Recurring Billing

Set up automatic recurring invoices for subscriptions, retainers, or milestone-based billing models.

Multi-Currency Support

Bill clients globally with accurate exchange rates and tax configurations for international operations.

Tax & Compliance

Apply regional tax rules, generate GST/VAT-ready reports, and export audit-friendly statements instantly.

Payment Tracking

Sync incoming payments, reconcile dues, and alert users of pending invoices through automated notifications.

Why Build with DrapCode

Rapid Customization

Tailor every aspect of the platform—from invoice templates to user roles—without writing code.

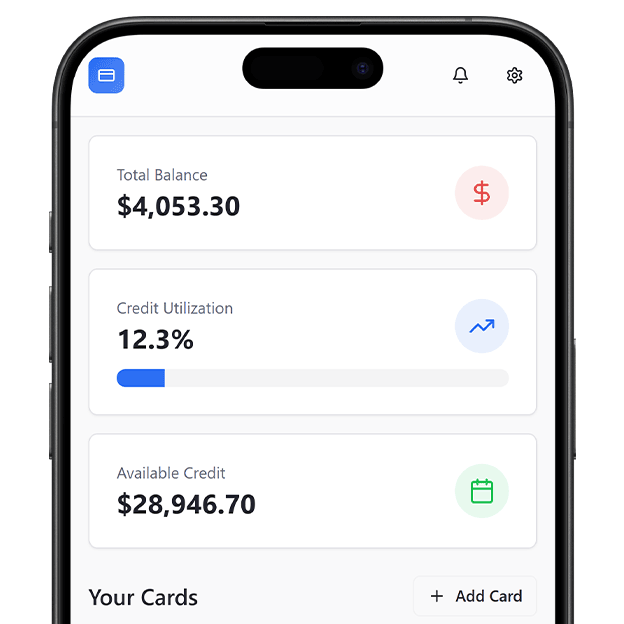

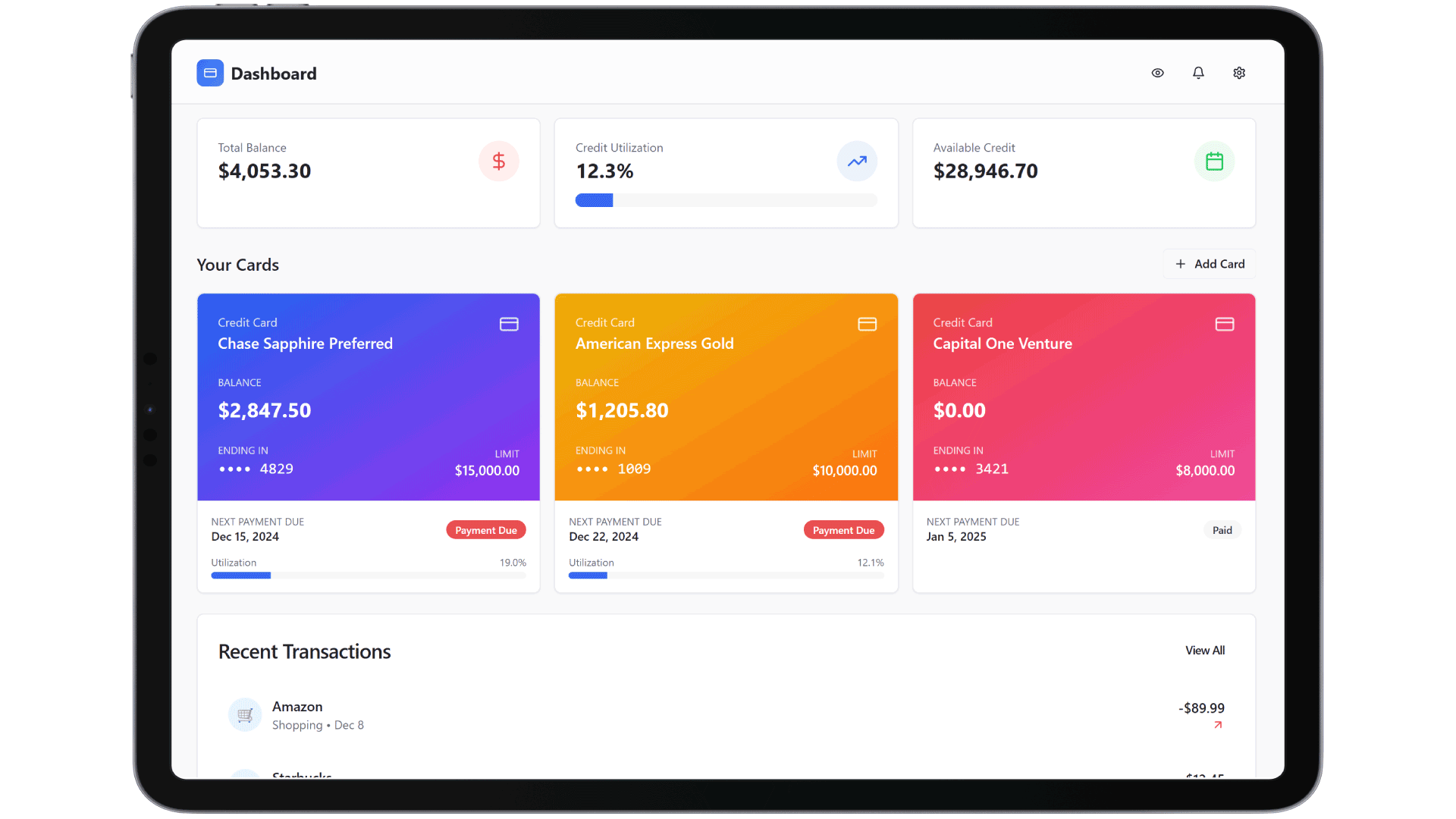

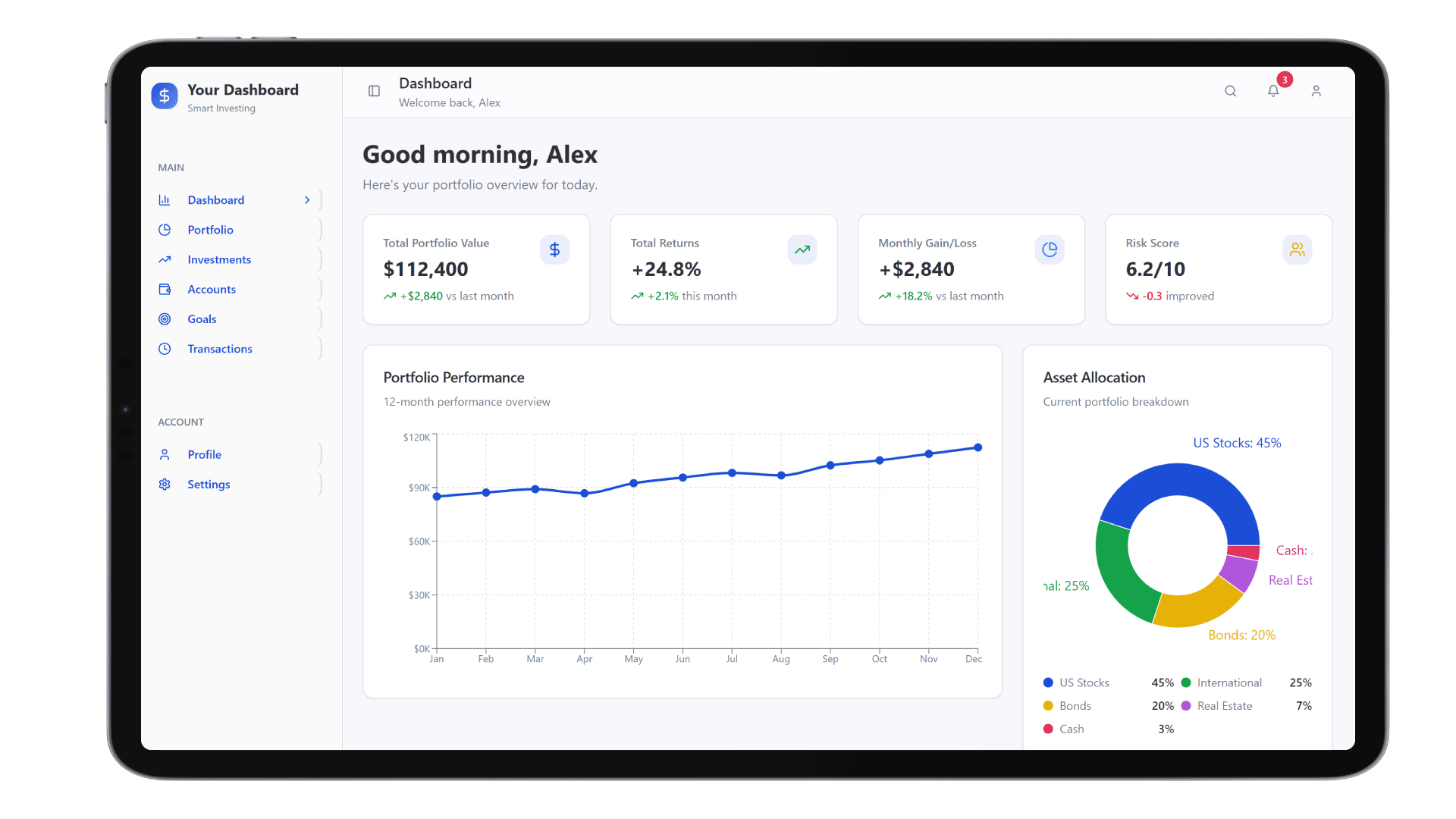

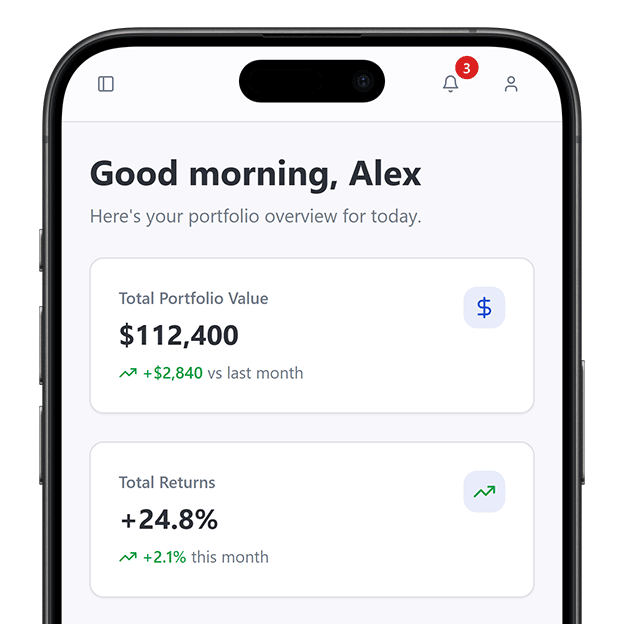

End-to-End Visibility

Consolidate all financial activities—billing, payments, reporting—into a unified dashboard.

Integration Ready

Easily connect with the Credit Cards Portal or Business & Retail Banking Platform for seamless transaction syncing.

Secure and Scalable

Manage sensitive financial data securely with role-based access and scalable cloud infrastructure.

Real-World Use Cases

Credit-Linked Invoicing

Integrate TransUnion Integration APIs to generate credit-profile-based payment terms, improving receivables predictability.

Risk-Aware Payment Schedules

Use CIBIL Integration data to auto-adjust invoice cycles based on client payment behavior and risk scoring.

Invoice Financing Integration

Enable invoice financing and factoring using Advantage Credit Integration APIs directly within your billing flow.

How to Launch Your Accounting Platform

Design Layout

Configure Modules

Enable Integrations

Deploy & Monitor

Connect It Across Your Finance Stack

Integrate your accounting and invoicing software with platforms like the Credit Cards Portal or the Business & Retail Banking Platform to automate payment intake and reconciliation. This unifies accounts receivable and banking flows in real time.

Add New Revenue Tools Easily

By connecting to systems like your Crowdfunding Platform , you can automate investor payouts, track funding receipts, and maintain full ledger integrity—all from one system built using DrapCode.