DrapCode is Secure, and Scalable with TransUnion CIBIL

Integrate with TransUnion CIBIL

Build platform on DrapCode and integrate TransUnion CIBIL as an Integration in your projects with ease.

TransUnion CIBIL Integration

Integrating TransUnion CIBIL’s credit capabilities into applications is crucial for businesses involved in credit assessment and risk management. DrapCode's no-code platform makes TransUnion CIBIL integration simple, allowing seamless access to valuable credit data within your app.

Why TransUnion CIBIL Score Matters

The TransUnion CIBIL score is a widely recognized measure of creditworthiness, trusted by financial institutions and lenders. With TransUnion CIBIL integration, businesses can leverage reliable credit score data to enhance their risk evaluation processes and make informed decisions.

Accessing TransUnion CIBIL Credit Report Online

TransUnion CIBIL integration simplifies the process of accessing credit reports, allowing businesses to automate credit checks. This feature provides quick, real-time insights that improve the accuracy and efficiency of credit evaluations.

Features provided by TransUnion CIBIL as an Integration

Build apps quickly with your data stored in the external data source and use DrapCode as a 100% frontend builder.

Credit Scoring

Access real-time credit scores, enabling quick, informed decisions for efficient credit risk management and assessment.

Credit Reports

Access comprehensive credit reports to evaluate creditworthiness and make informed lending decisions for individuals or companies.

Credit Checks

Automate the credit check process, saving time and reducing errors, speeding up evaluations and enhancing operational efficiency.

Credit Scoring Models

Supports customizable scoring models, tailoring credit evaluations to specific requirements, industries, and risk preferences.

Security and Compliance

Ensures sensitive financial data is protected with robust security protocols and compliance with industry regulations.

Credit Monitoring and Alerts

Provides real-time alerts about credit profile changes, helping businesses manage risks and stay up-to-date on credit status.

Data Analytics

Offers advanced analytics for insights into credit trends and patterns, aiding better strategy development and risk assessments.

API Integration

Flexible API integrates seamlessly, enabling easy incorporation of credit data into applications without complex coding.

Multi-User Access

Supports multi-user access for collaborative decision-making in credit management.

How TransUnion CIBIL Integration Works

TransUnion CIBIL integration works via API connections, allowing applications to retrieve real-time credit scores and reports, embedding reliable data seamlessly into your workflow.

Secure and Compliant Data Handling

With high security and compliance standards, TransUnion CIBIL integration ensures sensitive credit data is protected, meeting regulatory requirements and safeguarding user information.

Customizable TransUnion CIBIL Integration Options

TransUnion CIBIL integration offers flexible options, allowing businesses to customize credit checks based on their needs. Whether for automated checks or direct report access, this adaptability suits various industries.

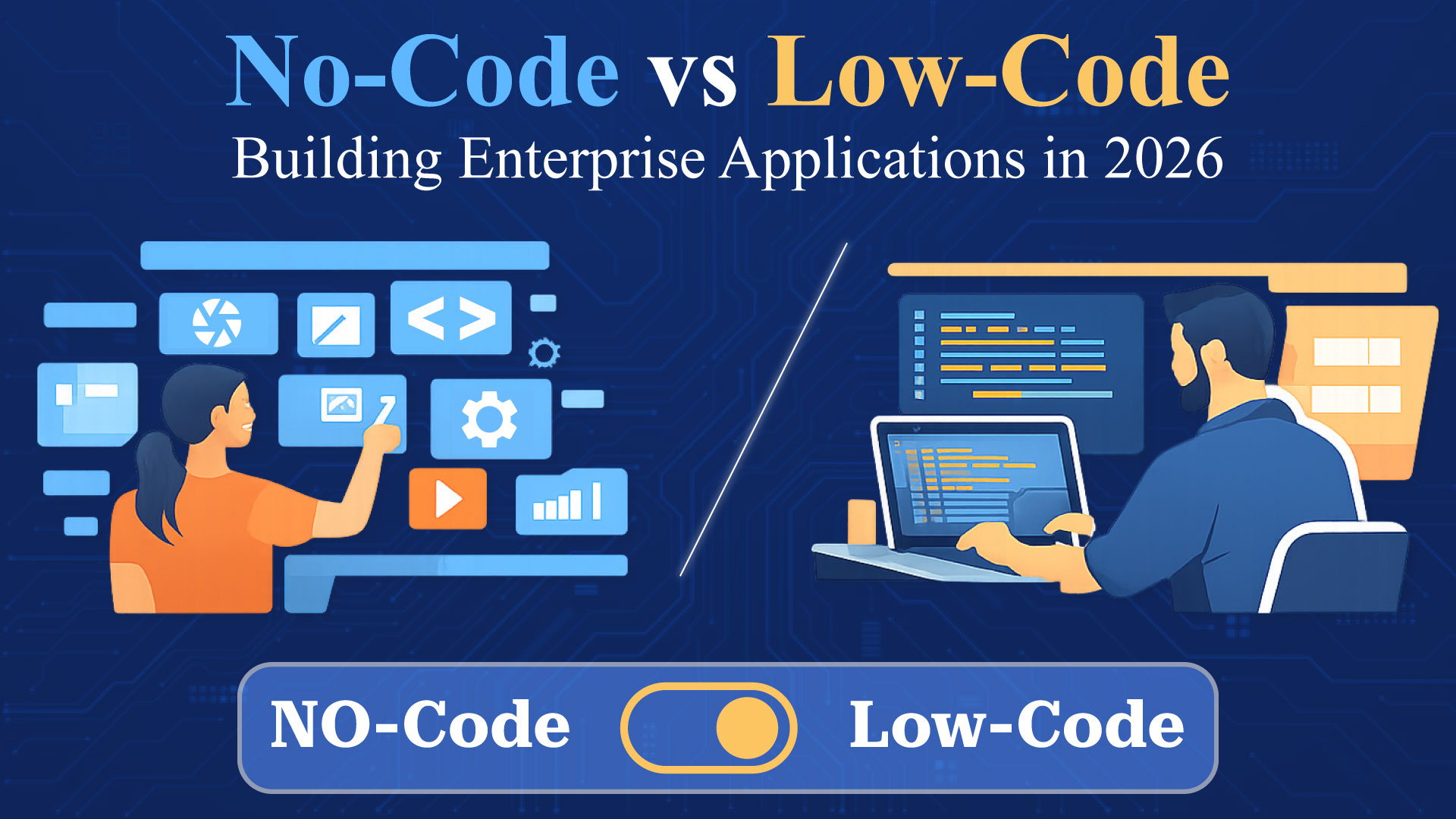

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Code Export

Design a website on drapCode and you can easily export the source code once you are done making it.

Customizable UI

We provide pre-built templates and features to promote loads of customization.

Enterprise Grade Standard

We offers enterprise-grade standards, ensuring a reliable and scalable platform for building robust solutions

Multi-Tenant

A single instance of the application made on Drapcode can serve multiple customers.

Self Hosting

You can easily deploy and host website using Drapcode.

Multiple Environment

Enable multiple environments such as Sandbox, QA, Pre-Prod to test your application before making it live for end users.

Financial Apps with TransUnion CIBIL

For financial applications, TransUnion CIBIL integration provides essential tools for credit assessment, including easy access to detailed reports. This enhances app functionality and supports reliable decision-making.

Easy Access to Credit Reports

Allowing users to view their TransUnion CIBIL report online saves time and simplifies credit assessments, a valuable feature for fast-paced financial environments.

Reliable Data for Decision-Making

TransUnion CIBIL integration provides real-time, accurate credit data, enabling businesses to make precise financial decisions and improve creditworthiness evaluations.

Frequently Asked Questions

What is TransUnion CIBIL integration, and why is it beneficial?

How does TransUnion CIBIL integration work in web applications?

Can users view their TransUnion CIBIL credit report online?

Is data secure with TransUnion CIBIL integration?

How does TransUnion CIBIL integration benefit financial apps?

Are we partnered or associated with the software we integrate with?

Blogs & Insights

We'd love to share our knowledge with you. Get updates through our blogs & know what’s going on in the no-code world.