Build a Custom Investment & Robo Advisory Platform

Create compliant, intelligent investment management systems using DrapCode’s no-code builder—streamlined for financial advisors and end users alike.

Automated Investing Made Scalable

Key Features of Robo-Advisory Platforms

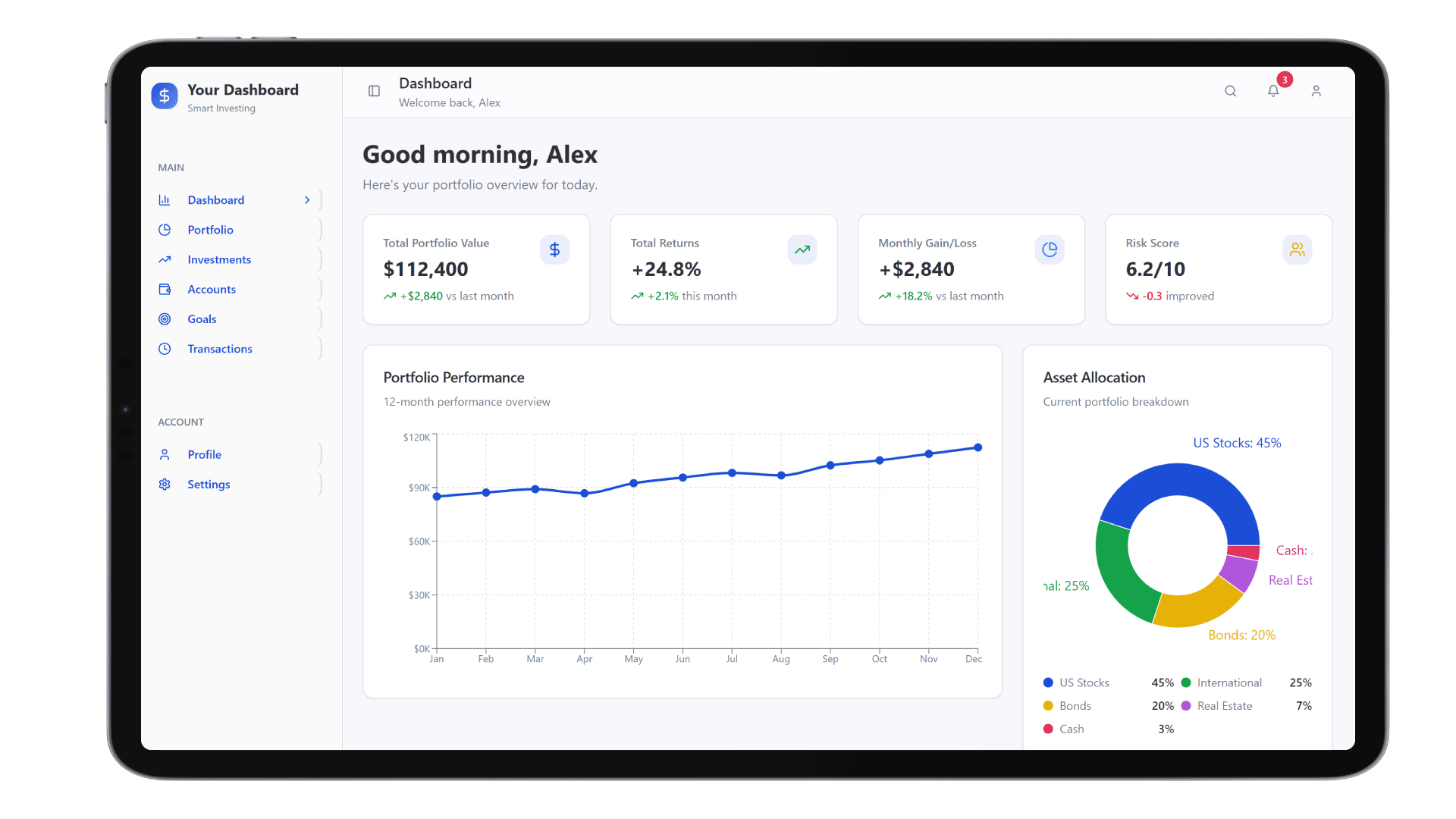

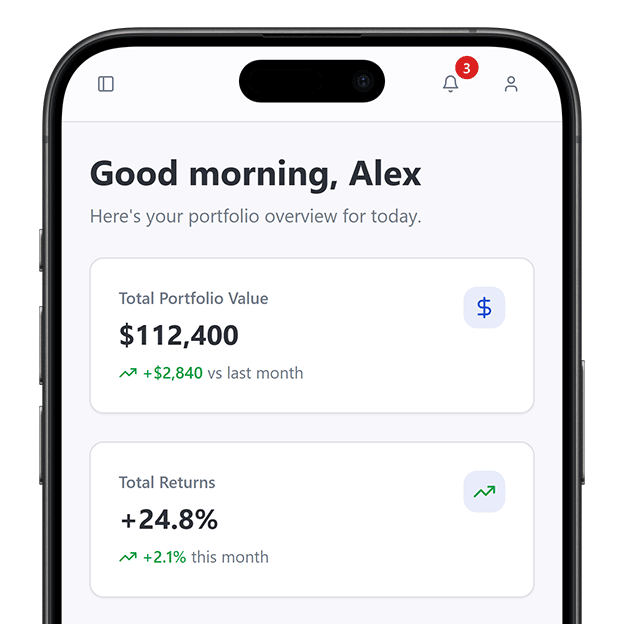

Goal Tracking

Let users define goals and visualize progress with AI-powered financial projection and asset recommendations.

Automated Allocation

Use algorithms to auto-allocate funds across asset types based on risk profile and investment horizon.

Risk Profiling

Embed dynamic questionnaires to assess user risk appetite and adjust portfolio recommendations instantly.

Real-Time Sync

Connect to market feeds for pricing, NAVs, and stock changes, ensuring up-to-date portfolio performance.

Advisor Portal

Offer hybrid models where advisors monitor and adjust AI-led portfolios for select users or use cases.

Comprehensive Reporting

Generate downloadable reports showing returns, historical trends, and asset exposure—instantly and securely.

Why Build with DrapCode

Faster Deployment

Design and deploy investment platforms without months of custom development or third-party engineering.

Fully Scalable

Accommodate hundreds to millions of users with seamless cloud infrastructure and dynamic load balancing.

Embedded Finance Ready

Build with support for wallet, KYC, payments, and bank account integrations using prebuilt templates.

Security-First Design

Every DrapCode deployment includes secure user authentication, encrypted storage, and activity logging.

Real-World Use Cases

Real-Time Account Aggregation

Enable users to connect and fund investment accounts through Dapi Integration , offering instant transaction syncing.

Smart KYC & Risk Insights

Use Plaid Integration to fetch financial history and verify identity before generating AI-based investment suggestions.

Embedded Banking Integration

Integrate with Decentro Integration APIs to offer payments, payouts, and account validation within your advisory stack.

How to Launch with DrapCode

Define Architecture

Add Financial APIs

Deploy Robo Logic

Scale & Monitor

Expand Across the Wealth Tech Stack

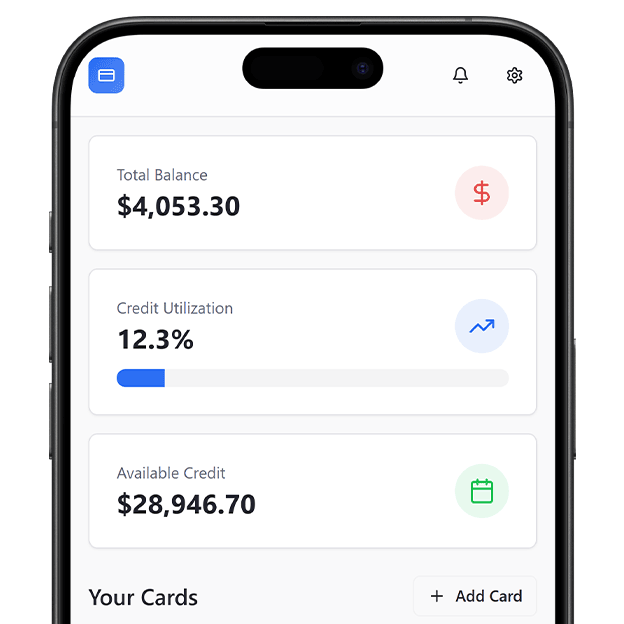

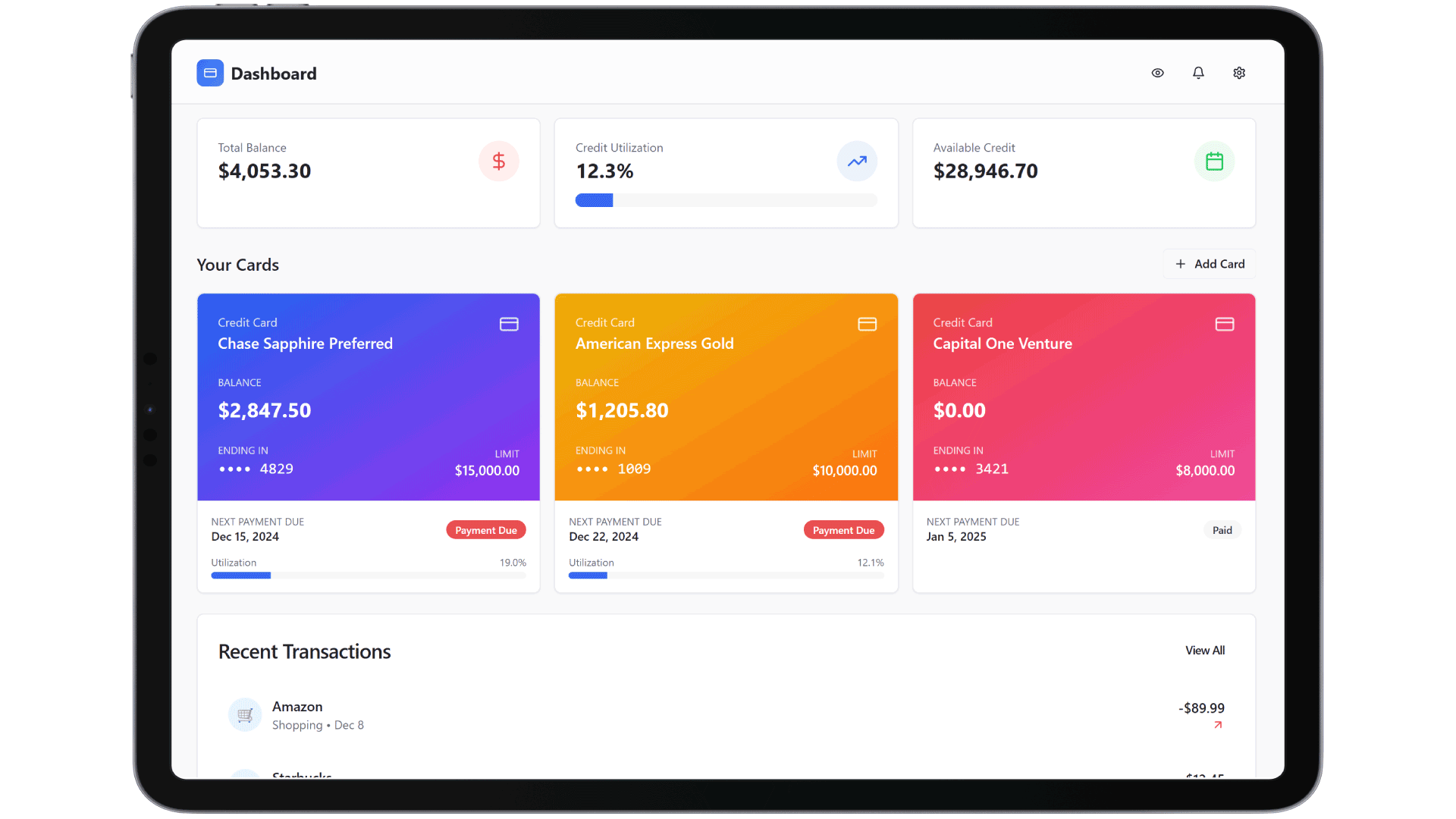

Once live, your robo-advisory tool can connect seamlessly with other fintech solutions. Whether it is a Credit Card Portal or an Accounting & Invoicing Platform, DrapCode’s integrations ensure your data flows securely and automatically.

Built for B2B and B2C Portfolios

From enterprise white-labeled tools to direct-to-consumer apps, DrapCode supports a variety of financial models. Connect with Business & Retail Banking Platforms to complete the ecosystem for your clients. Business & Retail Banking Platforms