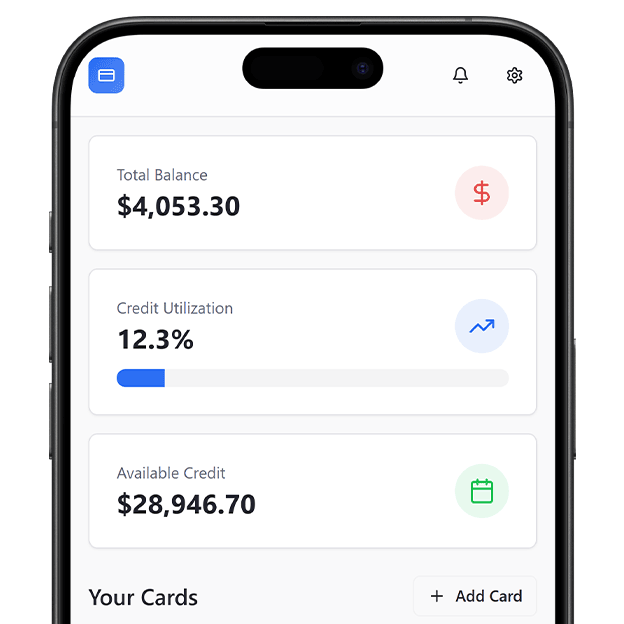

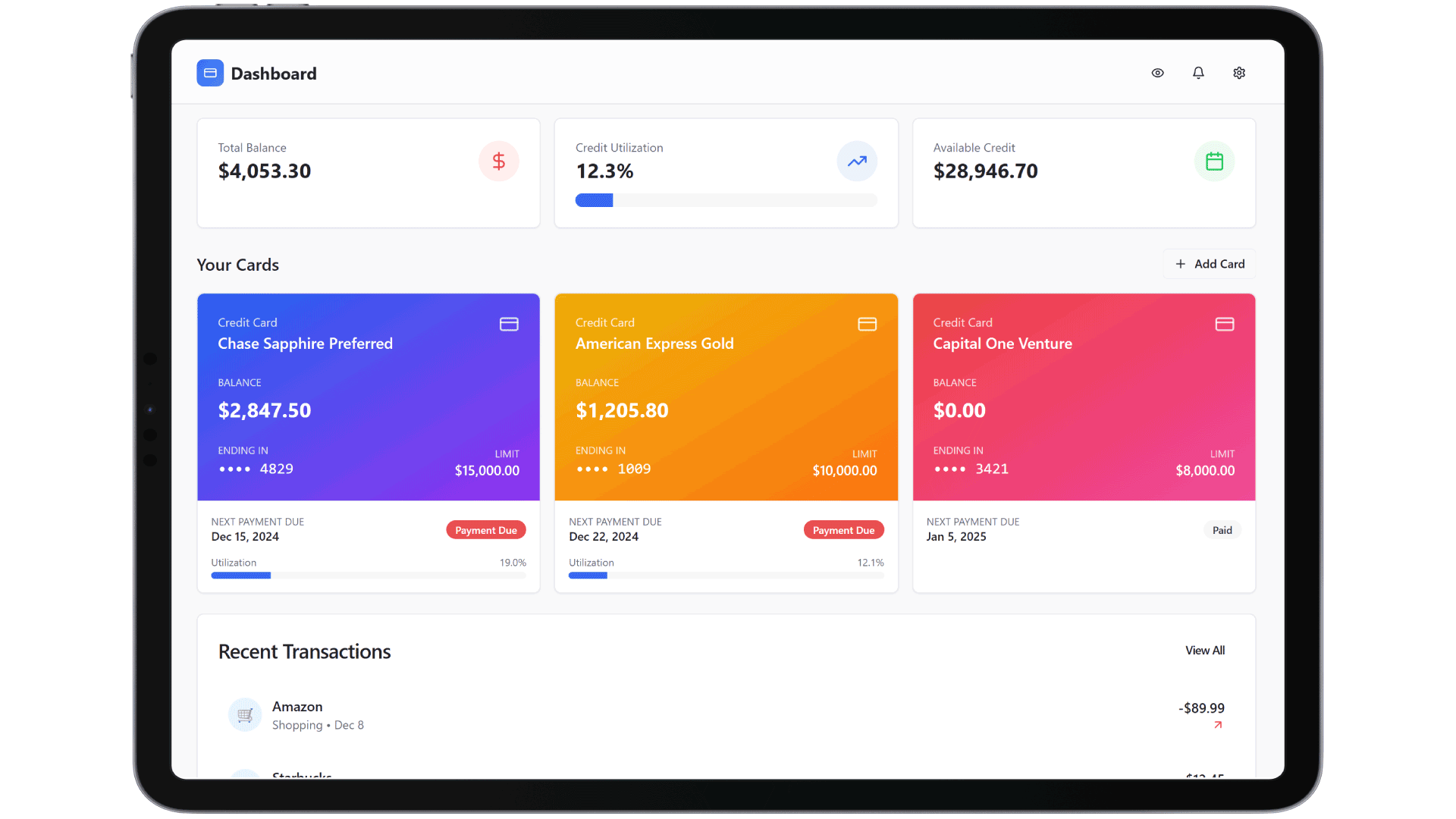

Launch Your Custom Credit Card Portal

Build secure, responsive credit card portals with full control over customer onboarding, transaction history, and payments—without complex backend coding.

Empower Digital Card Management

Key Features of Credit Card Portal

Customer Onboarding

Capture KYC, verify credit history, and approve new users instantly via API or manual flows.

Card Issuance

Generate digital cards, set limits, and sync with external processing systems like Visa, Mastercard, or RuPay.

Payment Management

Offer multiple payment methods, track dues, set reminders, and apply late fee logic automatically.

Transaction History

Display user-friendly summaries, downloadable statements, and smart filters for detailed financial insights.

Credit Limit Control

Set dynamic or fixed credit limits, allow temporary upgrades, and configure alerts for threshold breaches.

Dispute Resolution

Enable users to raise transaction disputes and track case progress with real-time status updates.

Why Build with DrapCode

Visual Development Speed

Design and deploy credit card payment software faster using a drag-and-drop interface without writing code.

Highly Configurable Modules

Customize credit card journeys to match your brand, compliance needs, and product rules.

Enterprise-Grade Security

Encrypt cardholder data, use RBAC for admins, and log all user activities to ensure PCI-DSS compliance.

Easy API Integrations

Connect with bureaus, payment gateways, and fraud detection tools using DrapCode’s flexible API capabilities.

Real-World Use Cases

Credit Scoring Integration

Sync real-time credit scores from CRIF Integration to streamline card approval, credit limit suggestions, and risk profiling.

Fraud Risk Monitoring

Use Experian Integration APIs to enhance fraud checks, identity verification, and suspicious activity detection at the transaction level.

Financial Behavior Insights

Integrate Equifax Integration to pull financial behavior data for smarter underwriting and personalized card offers.

How to Build Your Credit Card Portal

Design Layout

Add Modules

Connect Services

Go Live

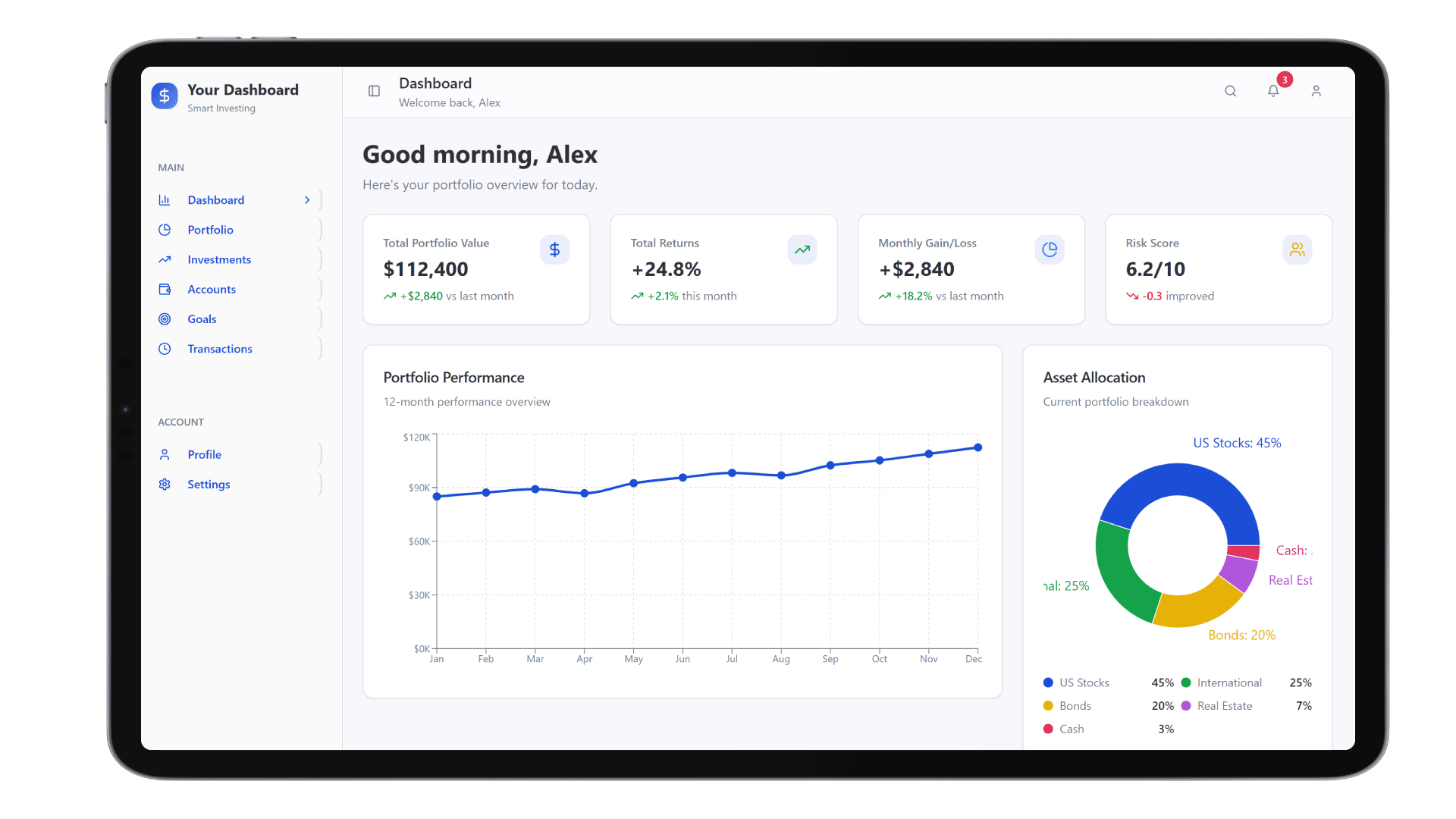

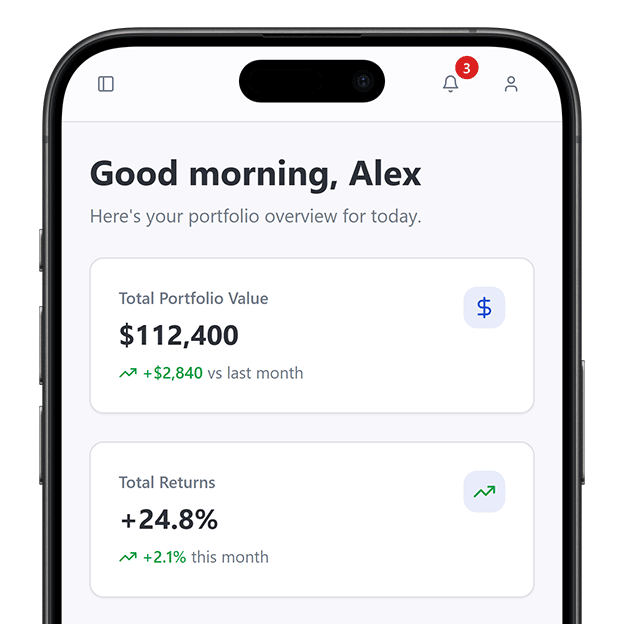

Extend Capabilities Across Financial Products

Your credit card portal can work seamlessly with other offerings. For instance, integrating with a Wealth Management Portal or Investment & Robo-Advisory Platform helps users analyze credit impact on investment decisions or manage payments from a single dashboard.

Connect Insurance and Credit Services

Bridge your Insurance Portal with your credit card platform to offer payment protection plans or automatic premium billing using credit limits. With DrapCode, it’s easy to build interconnected finance workflows in a single application layer. Insurance Portal