DrapCode is Secure, and Scalable with Experian

Integrate with Experian

Build platform on DrapCode and integrate Experian as an Integration in your projects with ease.

Experian Integration

Integrating Experian credit score checks into your applications provides powerful insights into users’ creditworthiness. With no-code solutions like DrapCode, setting up Experian integration becomes effortless, allowing instant access to credit information.

Why Experian Credit Score Matters

An Experian credit score is a trusted indicator of financial reliability, essential for applications in lending, finance, and credit management. With Experian integration, businesses can provide reliable credit data directly within their apps.

Simplified Access to Experian Credit Report

Integrating Experian reports simplifies credit assessments, enabling businesses to access Experian reports for real-time decision-making. This online integration improves the speed and accuracy of credit evaluations.

Features provided by Experian as an Integration

Build apps quickly with your data stored in the external data source and use DrapCode as a 100% frontend builder.

Credit Scores

Experian integration provides immediate access to Experian credit scores. This feature allows businesses to conduct real-time credit assessments for quick, data-backed decisions.

Credit Reports

Through integration, applications can access full Experian credit reports, including details on credit history, outstanding debts, and payment behaviors, essential for evaluating creditworthiness.

Fraud Detection Tools

Experian offers fraud detection features to help identify potential risks and secure the application process. This adds an extra layer of security, preventing fraudulent activities.

Identity Verification

Experian integration includes identity verification tools, ensuring the legitimacy of users. This feature is vital for compliance with financial regulations and for securing user accounts.

Credit Monitoring and Alerts

Experian’s integration can provide ongoing credit monitoring with alert notifications for changes in a user's credit status. This feature helps users and businesses stay informed of any credit-related updates.

Risk Scoring Models

Experian offers risk scoring models to assess a user’s likelihood of default or risk level, helping businesses make informed decisions based on tailored risk assessments.

Credit Analysis

The integration allows businesses to customize credit checks based on specific criteria, giving more control over what credit factors are considered and how they’re applied.

API Access for Flexibility

Experian provides API access, making it easy to integrate credit data into various applications, from lending platforms to financial services, with flexible functionality.

Data Privacy and Compliance

Experian integration ensures high standards of data security and compliance with regulations, protecting sensitive financial information and building user trust.

How Experian Integration Works

Experian integration is designed for easy setup via API connections, allowing your app to fetch Experian credit scores and credit reports securely and quickly, ideal for real-time credit assessments.

Secure and Compliant Credit Data

Ensuring data privacy is crucial in credit evaluations. Experian integration meets high-security standards, protecting user financial data while adhering to industry compliance.

Customizable Experian Integration Options

Tailor the Experian integration to suit your business needs, from automated credit checks to custom Experian report access. The system adapts to various industries, offering versatile credit solutions.

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Code Export

Design a website on drapCode and you can easily export the source code once you are done making it.

Customizable UI

We provide pre-built templates and features to promote loads of customization.

Enterprise Grade Standard

We offers enterprise-grade standards, ensuring a reliable and scalable platform for building robust solutions

Multi-Tenant

A single instance of the application made on Drapcode can serve multiple customers.

Self Hosting

You can easily deploy and host website using Drapcode.

Multiple Environment

Enable multiple environments such as Sandbox, QA, Pre-Prod to test your application before making it live for end users.

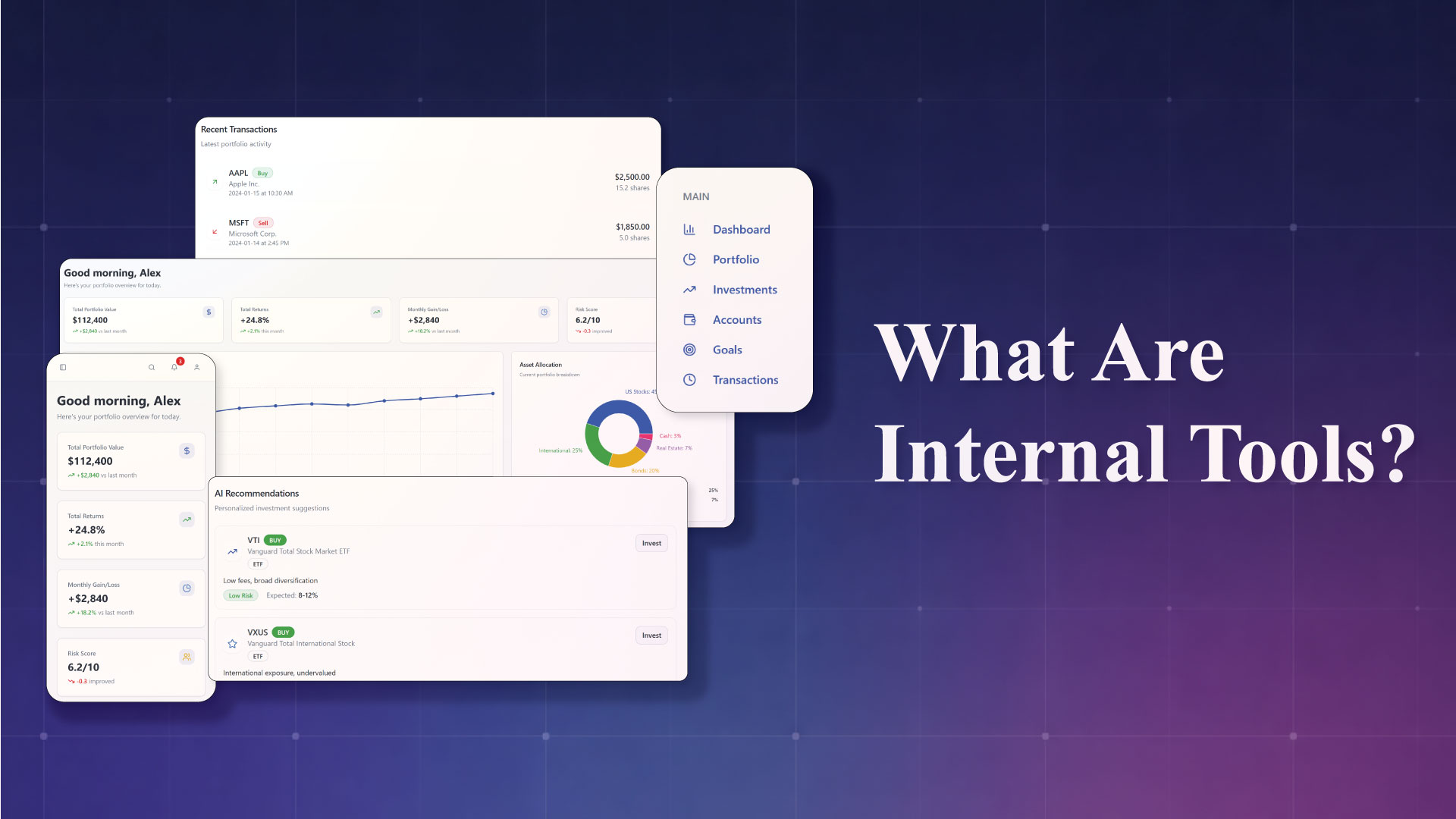

Boosting Financial App Capabilities

Financial applications benefit immensely from Experian integration by offering secure, automated credit checks and providing a full Experian credit report online for deeper credit analysis.

Easy Online Access to Experian Report

Allowing users to access their Experian report online simplifies the credit check process, saving time and supporting quick credit decision-making in fast-paced environments.

Reliable Credit Data for Businesses

Using Experian integration delivers reliable, accurate credit data. Having real-time Experian credit scores available strengthens credit decision-making processes.

Frequently Asked Questions

What is Experian integration, and why is it essential?

How does Experian integration work with web apps?

Can users view their Experian report online through the app?

Is the credit data secure with Experian integration?

What are the benefits of adding Experian integration to a financial app?

Are we partnered or associated with the software we integrate with?

Blogs & Insights

We'd love to share our knowledge with you. Get updates through our blogs & know what’s going on in the no-code world.