Build Invoice Financing & Bill Discounting Platform

Create a custom lending platform to streamline invoice-based financing, automate credit checks, and manage early payment workflows—securely built with DrapCode.

Receivables Financing Overview

Invoice financing and bill discounting portals empower businesses to convert outstanding invoices into working capital. These systems provide secure platforms for validating invoice data, automating funding decisions, and tracking receivables. Modern receivables financing demands structured credit logic, compliance checks, and partner collaboration workflows. This goes beyond simple listing tools and requires backend automation to support liquidity flows.

Portal Architecture Framework

A no-code web app builder allows lenders to visually configure invoice submission forms, discounting logic, payout calculations, and partner access rules. This eliminates heavyweight engineering while providing secure governance. Receivables financing portals often integrate with portfolio-tracking and loan-servicing systems to provide end-to-end control. This alignment is commonly achieved with trade finance portals that support structured short-term finance workflows.

Core Portal Capabilities

These capabilities define what a production-ready invoice financing and bill discounting portal must support for regulated liquidity solutions.

Invoice Submission Engine

Capture, validate, and store invoice details securely online.

Dynamic Discounting Rules

Apply configurable discount logic based on credit and timelines.

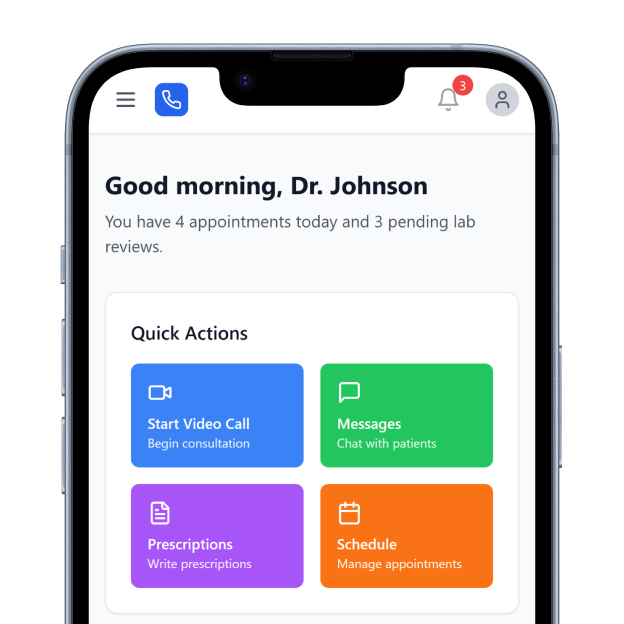

Funding Decision Workflow

Automate approval routing with risk and compliance triggers.

Payout & Settlement Logic

Track payments, settlements, and reconciliation workflows accurately.

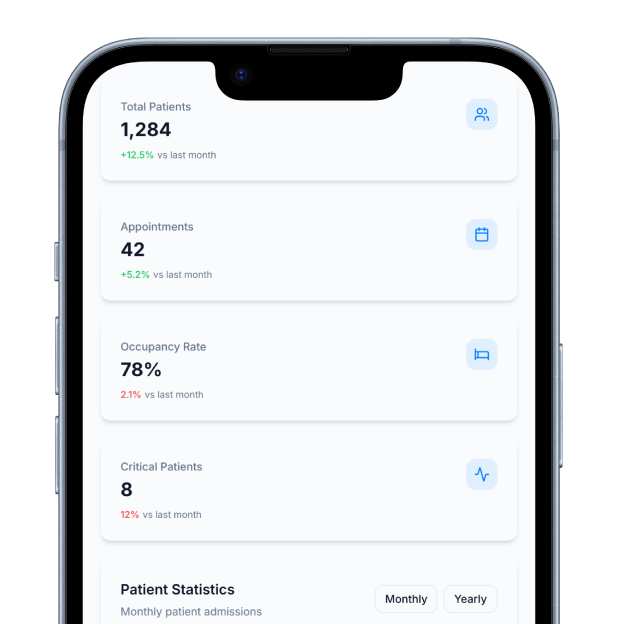

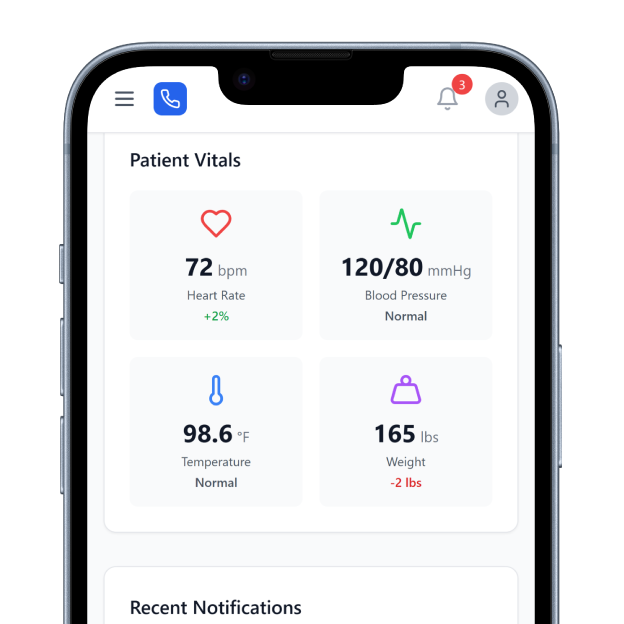

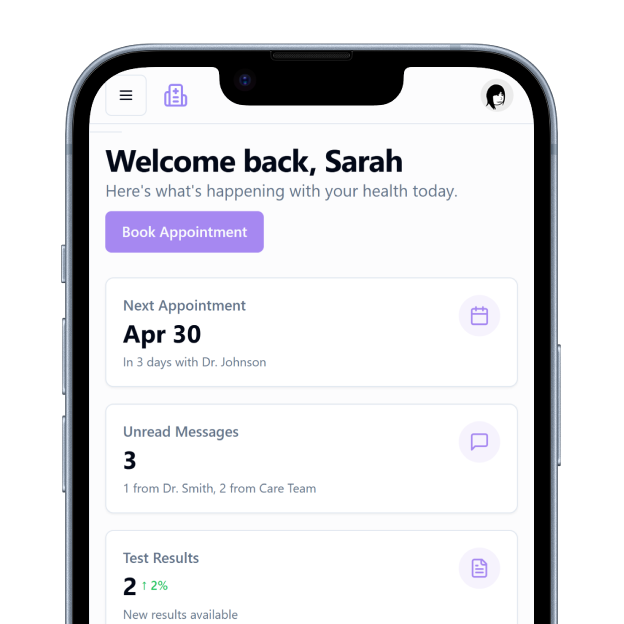

Partner Portfolio Dashboards

Visualize receivables, funding status, and risk metrics securely.

Compliance Logging Tools

Record audit details and transaction trails for governance.

Control & Integration Features

These features ensure the portal remains secure, governed, and ready for enterprise financing operations.

Visual Workflow Designer

Design discounting and approval logic without backend code.

Role Hierarchy Controls

Assign partner, admin, and borrower access securely.

API Connectivity Tools

Connect to financing, payment, and reporting systems reliably.

Scalable Deployment Backbone

Support large invoice volumes with resilient uptime and performance.

Use Case Applications

Portal Implementation Path

Define Invoice Schema

Build Discount Logic

Integrate Payment Systems

Deploy in Production

Compliance & Liquidity Governance

Receivables financing platforms must implement encryption, audit logs, and access controls to safeguard financial data. These systems also need clear dispute tracking, fund reconciliation history, and partner transparency. Integration with broader credit tracking and portfolio analytics helps lenders assess risk and maintain liquidity oversight.

Operational Scalability & Control

High-volume receivables financing requires resilient infrastructure capable of managing large invoice datasets, processing cycles, and performance metrics. Structured monitoring dashboards provide real-time insights into funding status, risk exposure, and capital flows. Enterprise deployments benefit from controlled governance, role separation, and activity logging.