Build Auto Lending Software for Vehicle Financing

Design, automate, and scale auto loan workflows with custom-built auto lending software tailored for dealers and finance teams.

Auto Credit Workflows

Auto lending software manages borrower applications, vehicle financing logic, dealer integrations, and structured repayment schedules. These systems orchestrate approval workflows, risk scoring, and documentation processes securely. Vehicle financing requires multiple decision touchpoints across credit evaluation, collateral verification, and compliance controls. Without automated backend governance, operational delays and risk exposure increase substantially.

Platform Architecture Logic

A no-code web app builder enables lenders and fintech teams to visually configure auto loan products, scoring logic, repayment plans, and dealer workflows without coding. This accelerates delivery while maintaining structured governance. Auto lending systems often integrate with inventory management and dealer networks to streamline credit offers. These integrations align with structured loan origination software that handles application intake and approval routing.

Core Auto Lending Features

These features define what a production-ready auto lending platform must support for regulated vehicle credit operations.

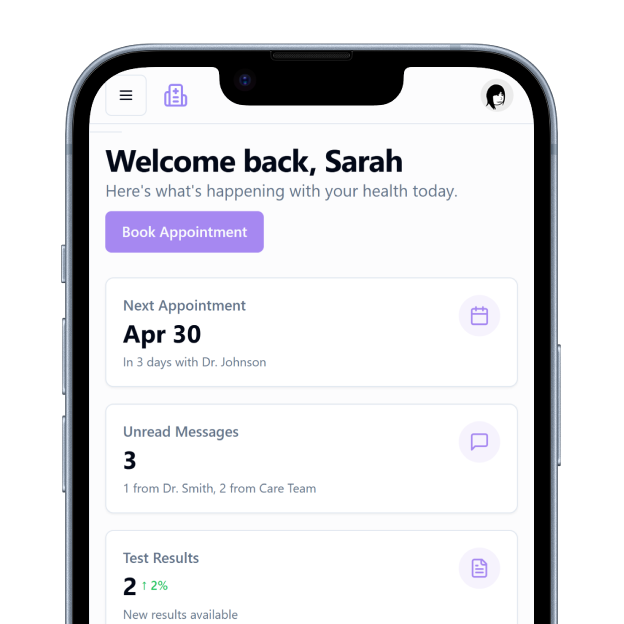

Vehicle Loan Intake Engine

Securely capture borrower and asset financing details online.

Automated Risk Scoring

Apply configurable scoring rules for quick underwriting decisions.

Dealer Network Integration

Enable dealers to submit applications and securely manage offers.

Collateral & Valuation Logic

Evaluate vehicle values and lien information accurately.

Repayment Schedule Management

Track loan installments and due dates efficiently.

Audit & Compliance Logging

Record actions and approvals with structured logs.

Integration & Control Capabilities

These capabilities ensure auto financing systems are secure, governed, and enterprise-ready.

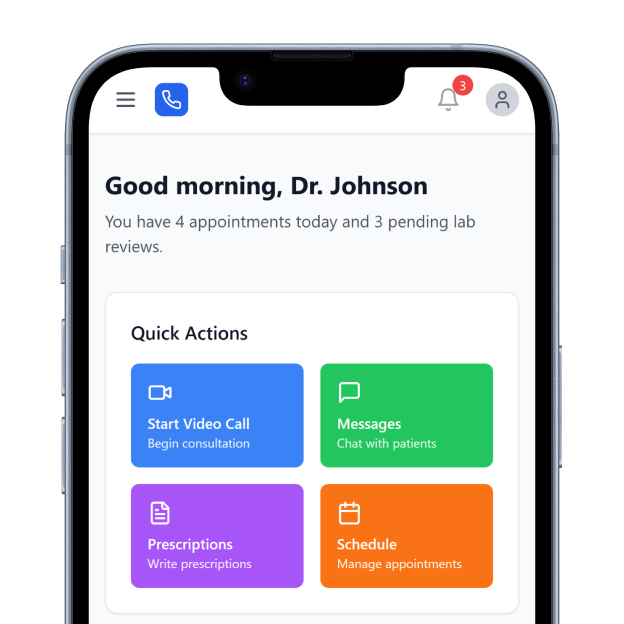

Visual Workflow Designer

Build financing flows without backend code in a visual interface.

Role-Based Permissions

Assign access levels securely for dealers, borrowers, and admins.

API Connectivity Layer

Connect credit checks, vehicle data, payment, and verification services.

Scalable Deployment Architecture

Support high loan volumes with resilient backend infrastructure.

Key Use Case Scenarios

How It Works

Build Intake Forms

Define Credit Rules

Integrate Dealer Systems

Deploy to Production

Credit Compliance & Risk Controls

Auto lending systems must enforce encryption, document governance, and audit tracking to safeguard borrower and collateral data. These safeguards help lenders maintain regulatory compliance and reduce operational risks. Strong compliance workflows ensure accurate lien tracking, identity verification, and structured approval controls within production environments.

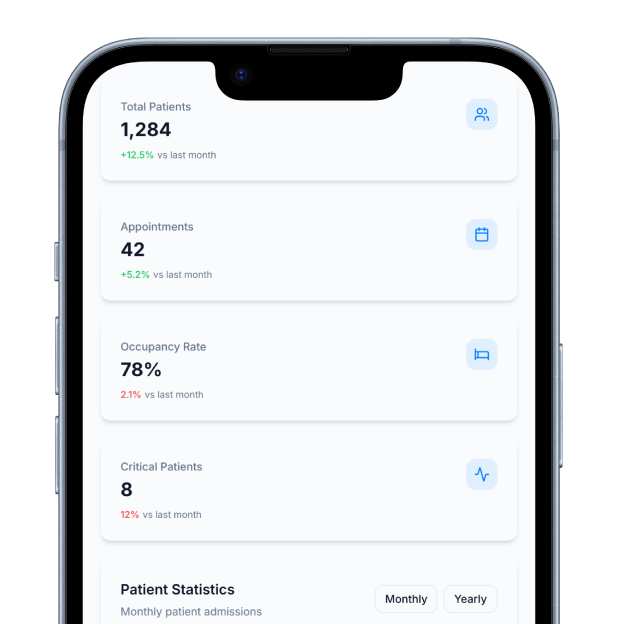

Operational Scalability

High-volume auto lending requires scalable infrastructure, rapid decisioning engines, and performance dashboards. This improves pipeline visibility and portfolio insights across dealer and retail operations. Scalable architecture ensures smooth credit delivery even during peak lending periods and high application volumes.