Build Secure & Scalable Insurance Portal

Create secure, modular insurance portals with DrapCode’s no-code platform, offering fast deployment and seamless policyholder engagement.

Modernize Insurance Workflows

Key Features of Insurance Portals

Policy Management

Digitize policy issuance, updates, and renewals with automated workflows and secure user portals.

Claims Processing

Streamline claims intake, document uploads, and status tracking with real-time notifications for customers.

Underwriting Logic

Add configurable rules for risk assessment, approval triggers, and premium calculations—without writing code.

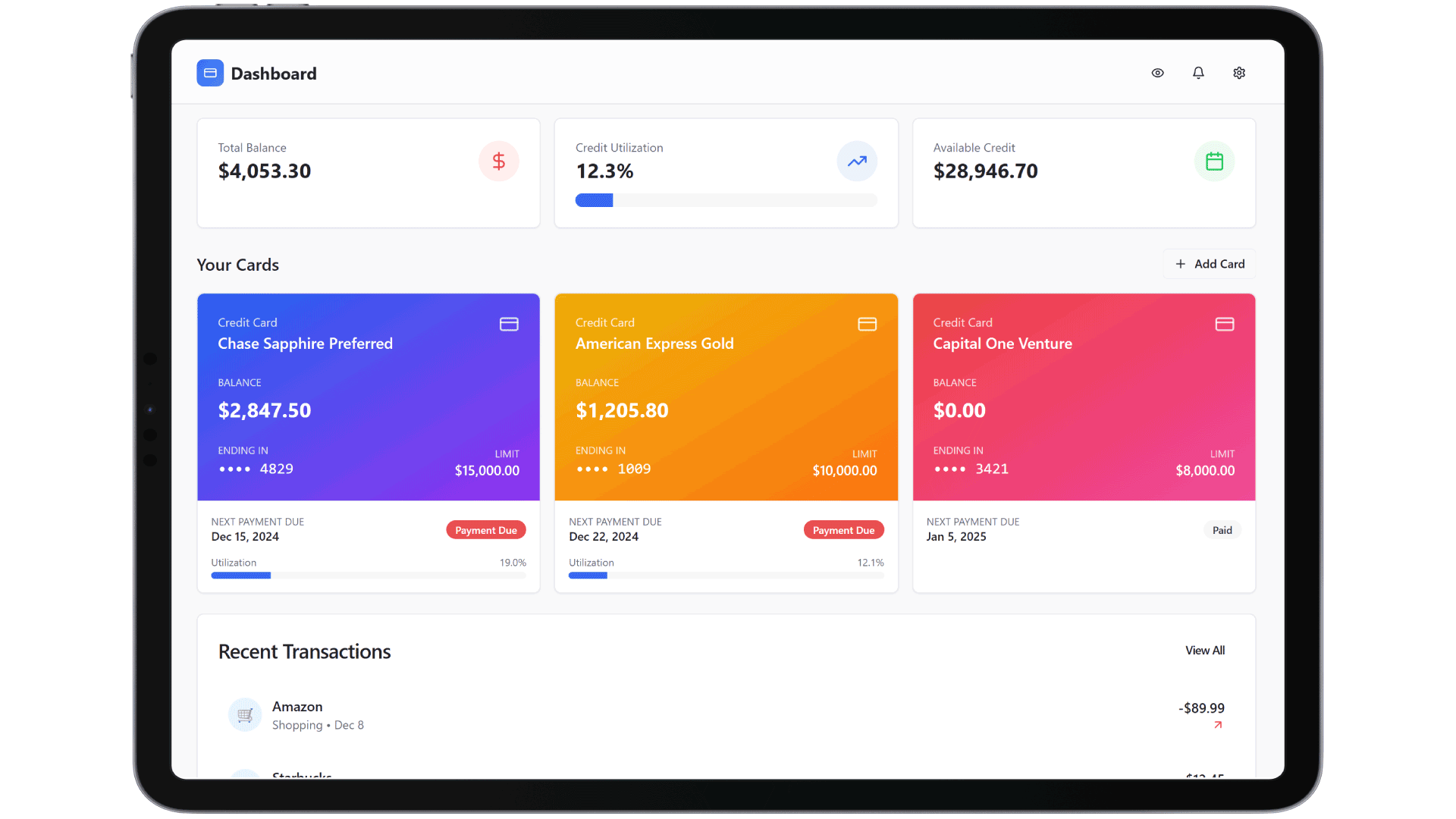

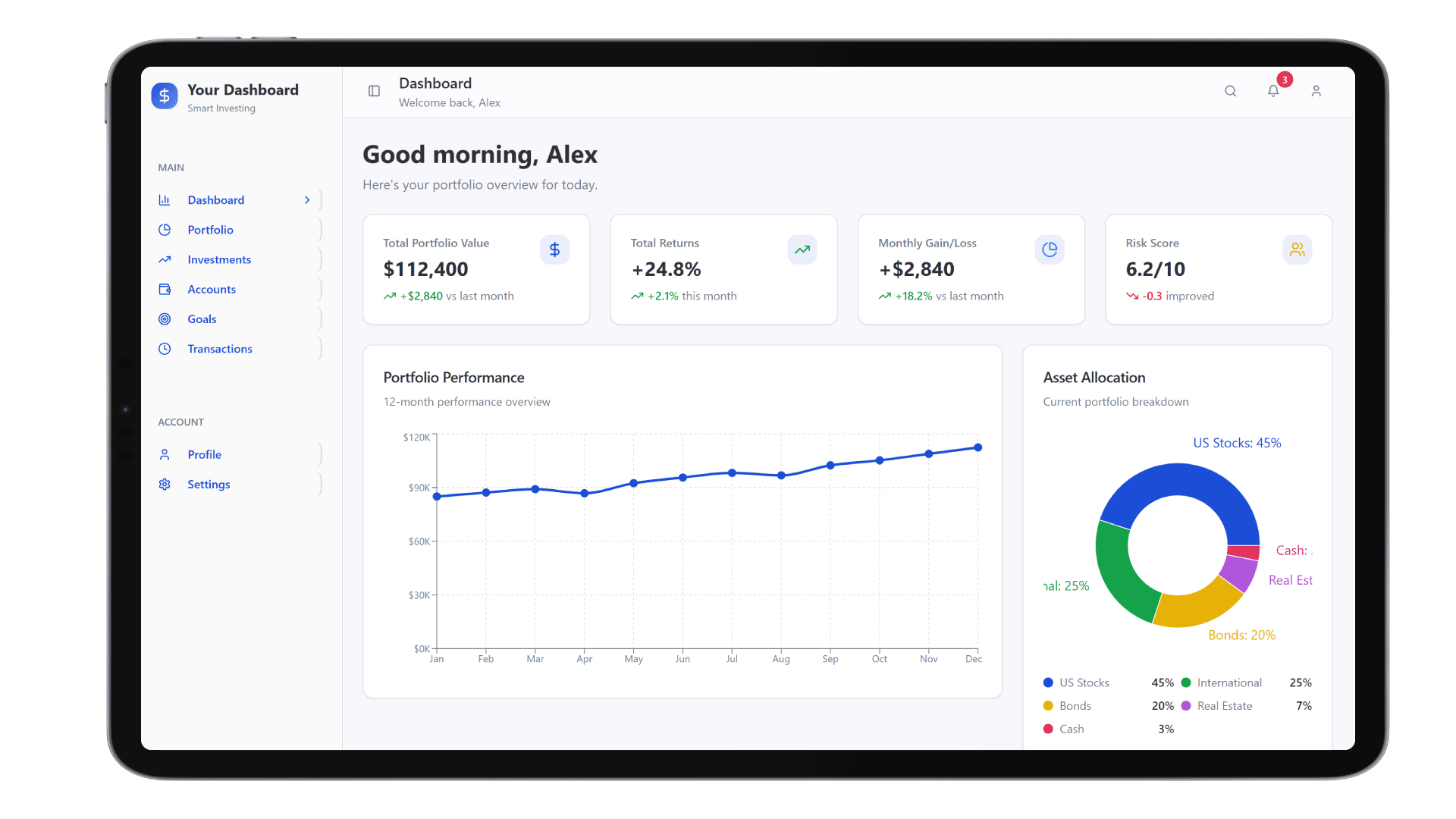

Role-Based Dashboards

Create different dashboards for customers, agents, and admin users with secure access control.

Document Management

Store policy documents, KYC proofs, and correspondence securely with auto-expiry and tagging options.

Customer Notifications

Set up automated SMS and email alerts for renewals, claims status, or missing documentation.

Why Build with DrapCode

Rapid Go-to-Market

Build and launch your insurance software platform in days using DrapCode’s ready-to-use components.

Zero-Code Customization

Tailor workflows and interfaces across multiple insurance product lines—without any coding.

API-Ready Architecture

Integrate third-party verification, payments, and CRM tools using built-in support for external APIs.

Secure & Compliant

Ensure customer data is encrypted and access-controlled, supporting regulatory needs like IRDAI, HIPAA, or GDPR.

Real-World Use Cases

Claims and Billing Automation

Integrate your portal with Peach Finance Integration to automate premium billing, recurring payments, and refund processing.

Embedded Insurance for Lenders

Connect with LoanPro Integration to bundle insurance products with loans, offering seamless underwriting and claims triggers.

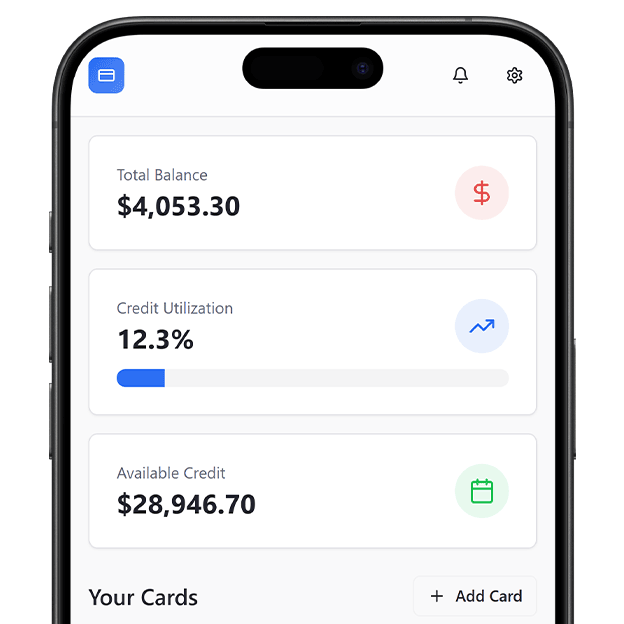

Unified Financial & Insurance Dashboard

Use Finastra Integration APIs to create a unified customer view combining banking, lending, and insurance information.

How to Build Your Insurance Portal

Plan Layout

Configure Modules

Connect Systems

Test & Launch

Expand Beyond Insurance Operations

Once deployed, your portal can plug into broader fintech ecosystems. Connect with a Crowdfunding Platform or a Lending & Financing Portal to offer value-added bundled insurance during user onboarding or financing journeys.

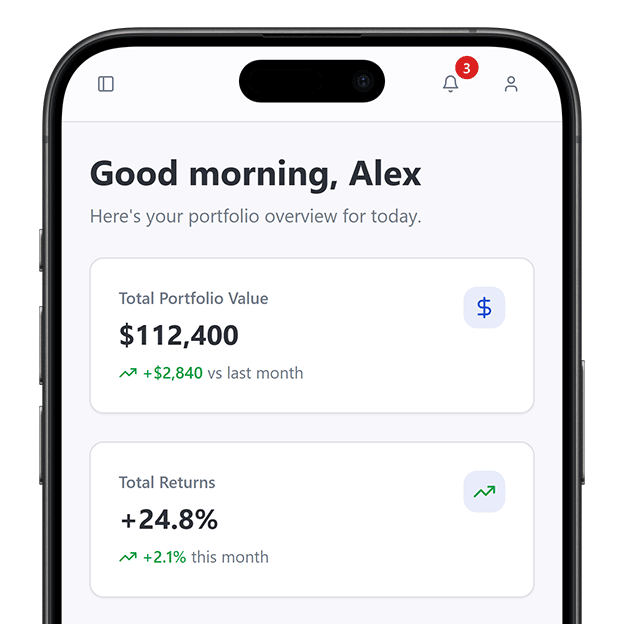

Enhance Customer Financial Wellness

Go further by linking your portal with Personal Finance Management Tools, helping policyholders track premiums, assess gaps in coverage, and improve financial planning—all in one view. Personal Finance Management Tools