Build Personal Finance Management Software

Develop secure, customizable personal finance management software for budgeting, investments, and financial wellness using DrapCode’s no-code platform.

Simplify Financial Wellness Digitally

Automated Money Management for Everyone

Key Features of Personal Finance Management Software

Budget Planner

Allow users to categorize income and expenses, set spending limits, and receive visual spending reports.

Savings Goals

Enable tracking of short-term and long-term savings targets with automatic contribution reminders and updates.

Spending Insights

Break down expenses into intuitive charts, highlighting trends, high-cost categories, and monthly comparisons.

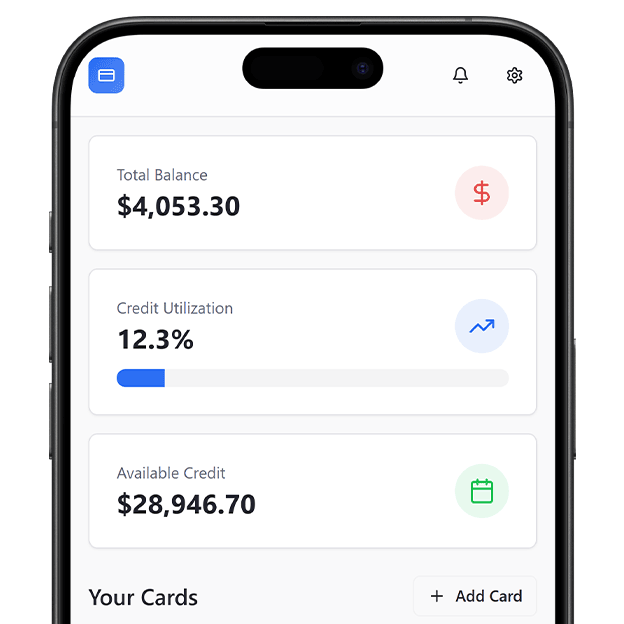

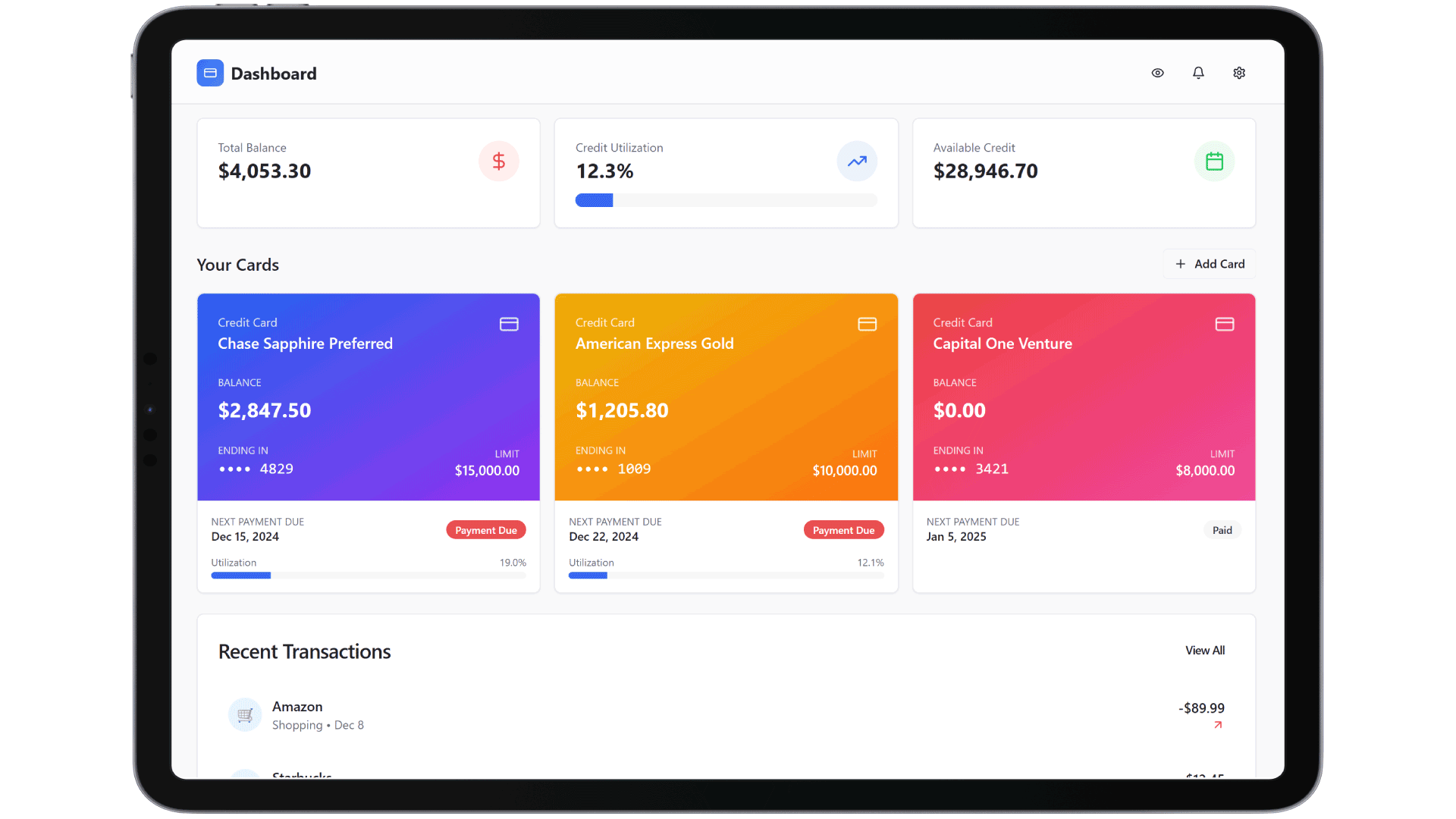

Bank Sync

Integrate user bank accounts securely to fetch real-time transactions and categorize spending automatically.

Alerts & Reminders

Send bill payment alerts, low balance warnings, and goal progress nudges via email or push notifications.

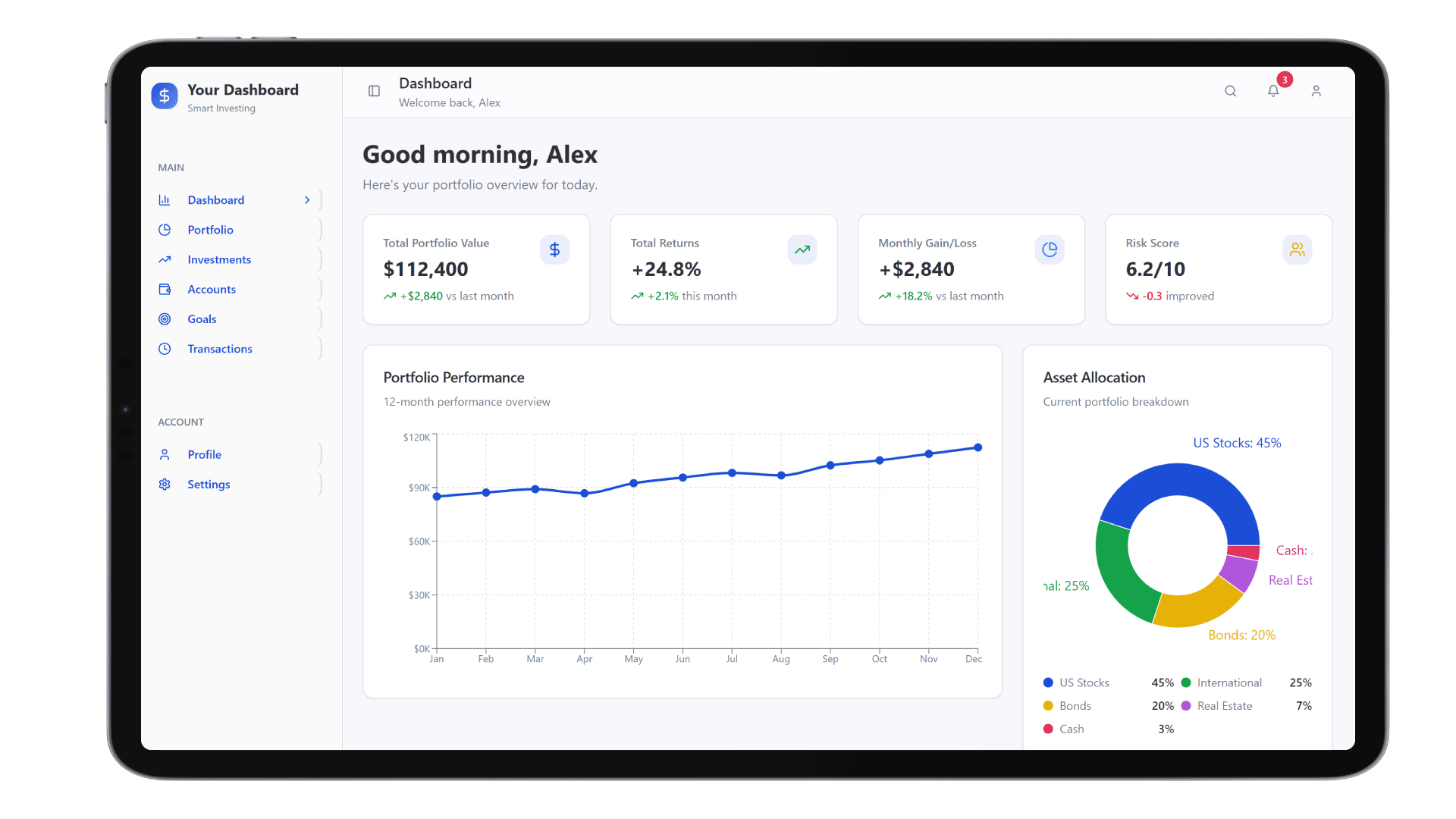

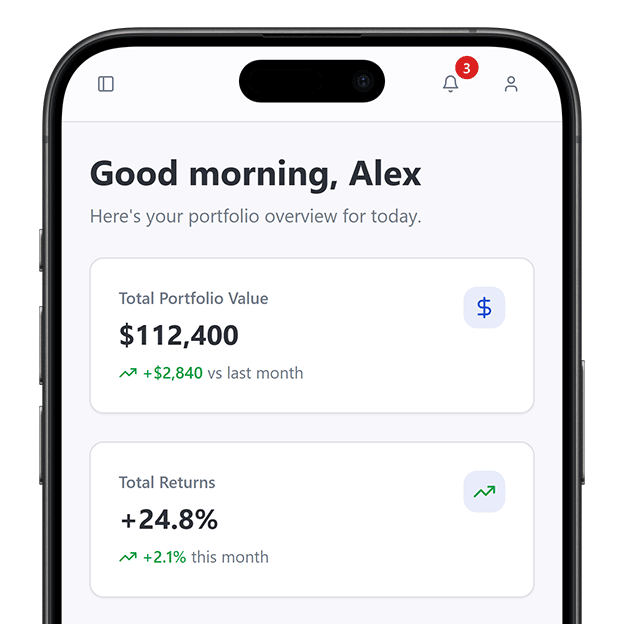

Custom Dashboards

Let users build their finance dashboard using drag-and-drop charts, graphs, and widgets.

Why Build with DrapCode

Launch Fast

Go from prototype to a fully functional personal finance dashboard in days using DrapCode’s visual builder.

Data Security

Ensure user trust with encryption, role-based access, and secure data APIs for financial data protection.

Custom Workflows

Design tailored flows for student budgeting, family finance, or HNIs—all without writing a single line of code.

API-Ready

Easily connect with payment gateways, bank APIs, investment tools, or insurance APIs using DrapCode’s built-in connectors.

Real-World Use Cases

Identity Verification for Finance Apps

Integrate HyperVerge Integration for seamless KYC onboarding during account setup, improving compliance and user experience.

Automated Expense Syncing

Connect Razorpay Integration APIs to automatically log recurring payments and categorize them for accurate expense tracking.

Smart Alerts for Bills

Use Cashfree Payments Integration APIs to trigger bill payment alerts and enable one-click payments from within the dashboard.

Launch in Four Functional Steps

Design UI

Connect Accounts

Configure Rules

Deploy App

Scale to Related Financial Use Cases

With DrapCode, your personal finance solution can evolve into a full-fledged fintech suite. Extend to Wealth Management Portal, Investment & Robo-Advisory Platform, or Insurance Portal using unified modules and prebuilt integrations.