Build a Powerful Lending & Financing Portal

Launch customized lending and finance software solutions with automated workflows, credit integrations, and complete borrower lifecycle management—no manual coding needed.

Deliver Modern Lending Experiences

In today’s digital-first world, banks and fintechs require responsive, scalable online lending platforms that simplify origination, underwriting, disbursement, and repayment. DrapCode enables you to visually develop portals tailored to commercial, consumer, and institutional lending needs with full automation and compliance in place.

Key Features of Lending & Financing Portal

Loan Origination

Digitally capture borrower data, verify documents, and configure approval logic for fast loan issuance.

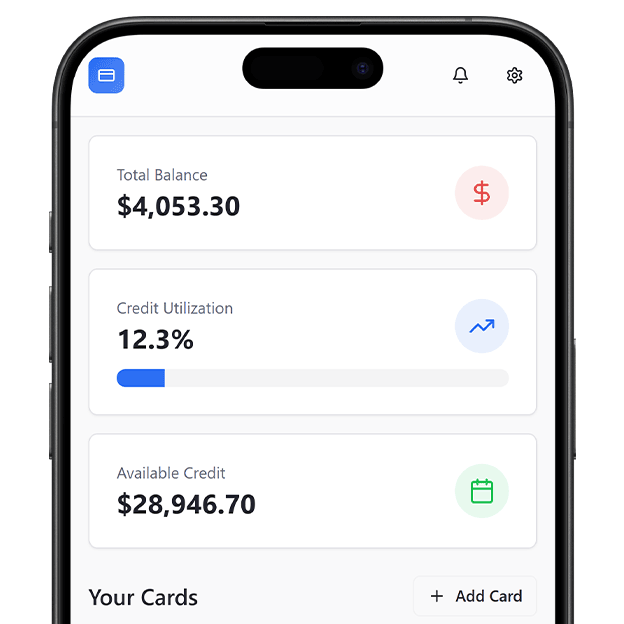

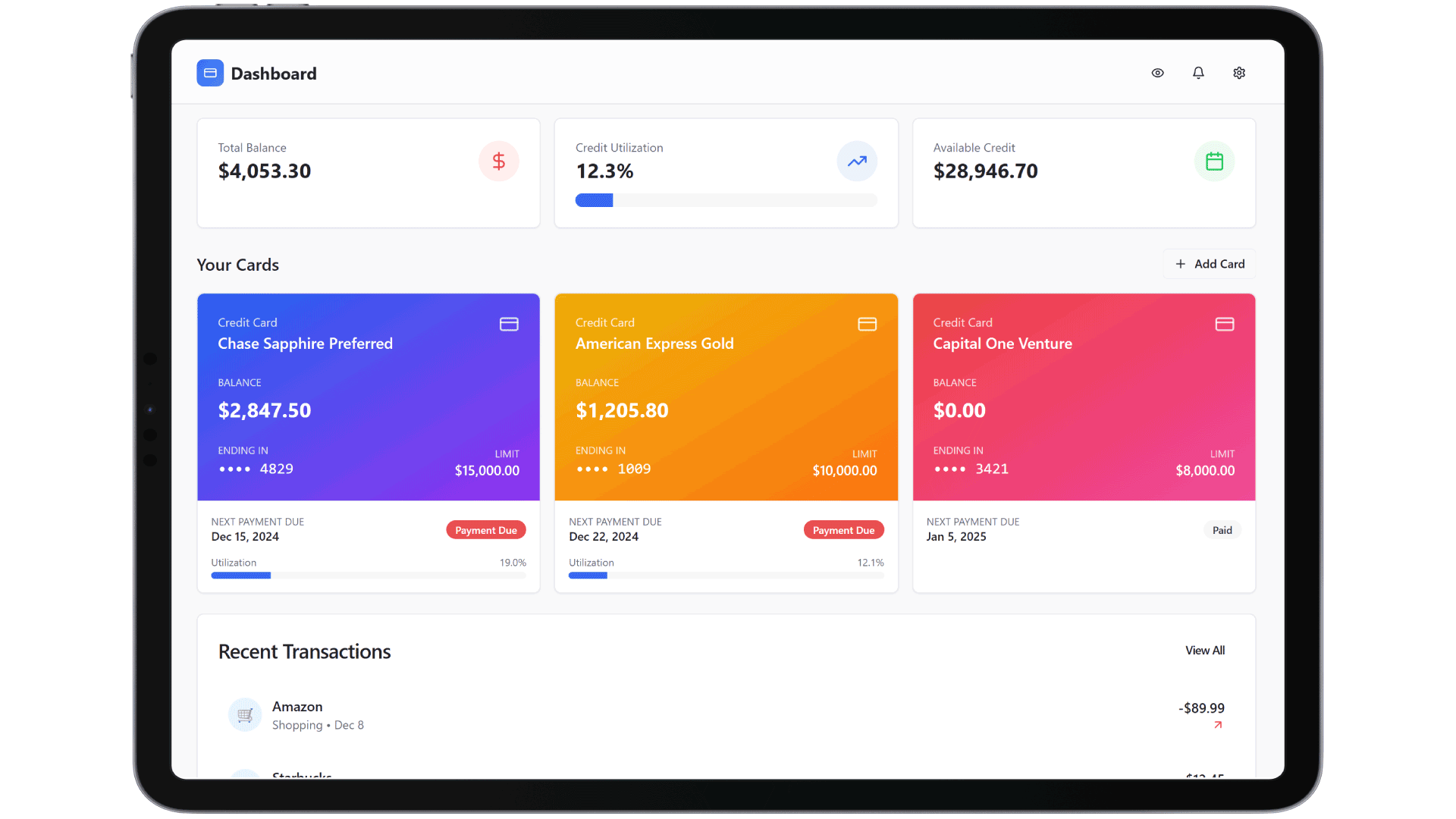

Customer Portal

Offer a white-labeled borrower portal with application tracking, status updates, and support messaging.

Underwriting Logic

Set customizable rules and integrate third-party APIs for real-time credit checks and risk profiling.

Repayment Tracking

Automate EMI schedules, send reminders, and generate reports for all active disbursed loans.

Multi-Tier Access

Assign permission levels for credit officers, underwriters, and operations teams within a secure backend.

KYC & Compliance

Enable KYC/AML checks and ensure regulatory compliance with embedded validations and secure data storage.

Why Build with DrapCode

Visual Builder

No need for development teams—create lending workflows, portals, and admin panels using drag-and-drop tools.

API Ready

Connect seamlessly with credit bureaus, payment gateways, and e-signature platforms through prebuilt API libraries.

Banking-Grade Security

DrapCode ensures encrypted storage, secure authentication, and detailed audit trails for compliance.

Connected Ecosystem

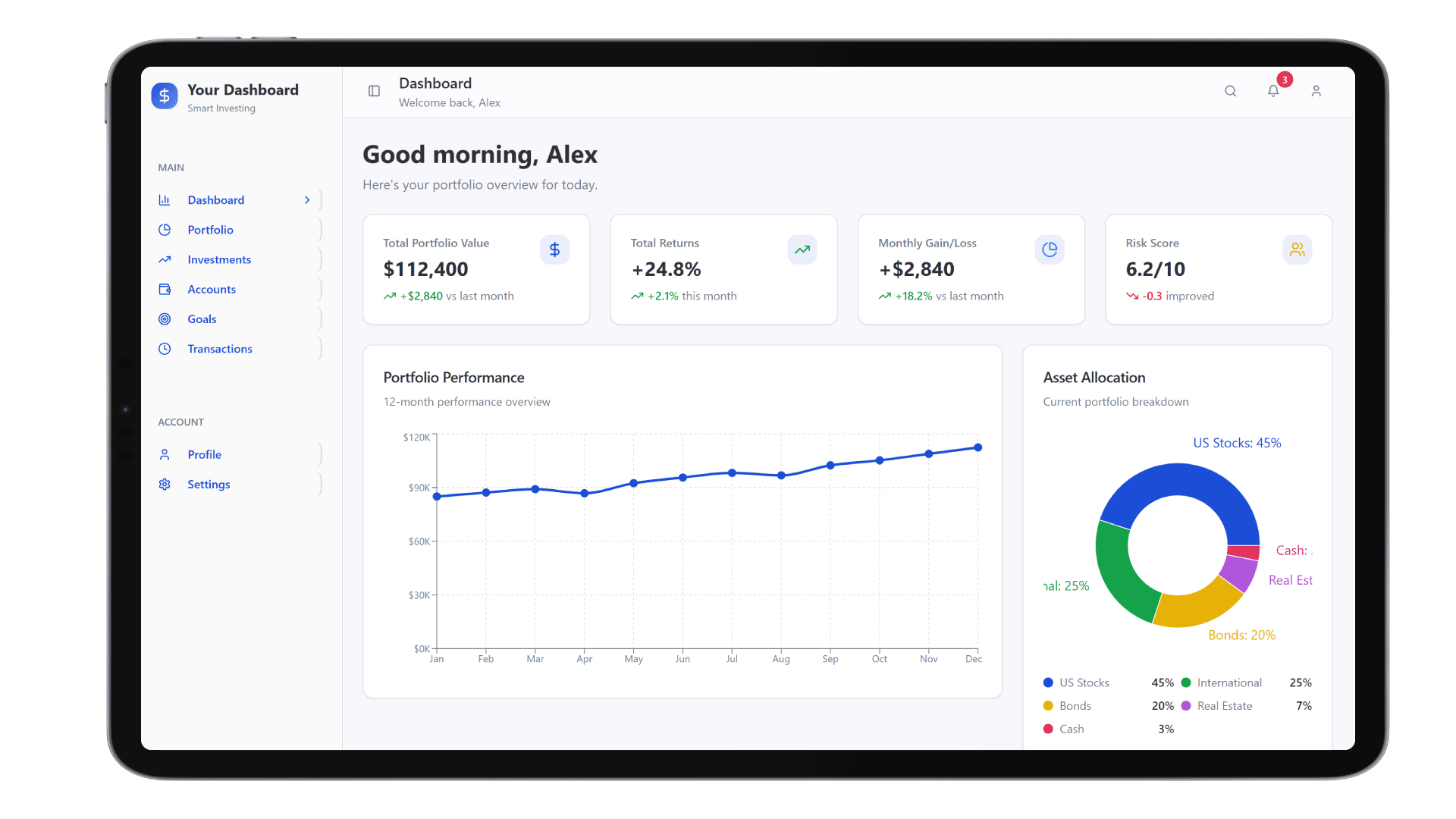

Easily integrate with robo-advisory platforms, insurance portals, or credit card portals to offer a unified customer journey.

Real-World Use Cases in Lending Innovation

Credit-Linked Loan Approvals

Integrate KCB Credit Integration APIs to automate loan eligibility checks and assign dynamic interest rates based on borrower scores.

AI-Powered KYC Verification

Use HyperVerge Integration to enable instant document recognition and facial verification for rapid borrower onboarding.

Compliance Automation Engine

Simplify regulatory onboarding with Signzy Integration to run eKYC, blacklist checks, and digital signatures—all inside your portal.

How to Launch Your Lending Portal

Design Layout

Define Workflows

Integrate APIs

Deploy Portal

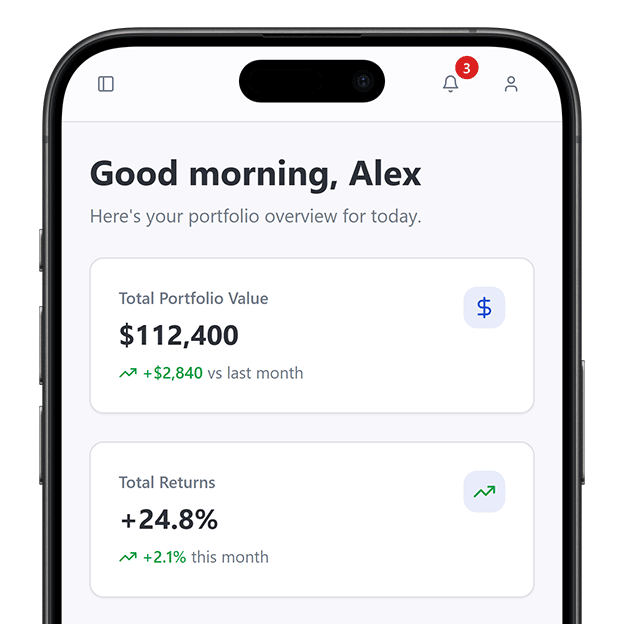

Expand to Full-Service Lending

Pair your portal with Investment & Robo-Advisory Platforms or an Insurance Portal to offer bundled financial services to borrowers, like wealth planning or credit protection, alongside loans.

Deliver Smarter Credit Services

Integrate insights from the Credit Cards Portal and automate limit assignments or pre-approval offers based on active borrower behavior. DrapCode lets you deliver personalized, proactive lending like never before.