DrapCode is Secure, and Scalable with LoanPro

Integrate with LoanPro

Build platform on DrapCode and integrate LoanPro as an Integration in your projects with ease.

DrapCode Integration with LoanPro: Simplifying Loan Management

Loan management is crucial for financial services, requiring an efficient system to handle loan origination, servicing, and tracking. DrapCode integration with LoanPro offers a streamlined solution by combining the flexibility of a no-code development platform with the robust loan management API provided by LoanPro. Businesses can now create fully customized loan management applications, using LoanPro API and DrapCode drag-and-drop interface. This integration allows businesses to manage their loan portfolios with ease, automate workflows, and deliver a seamless user experience.

What is DrapCode?

DrapCode is a no-code web application development platform that enables users to build web apps without writing complex code. Its intuitive interface lets users design, develop, and deploy applications quickly. One of DrapCode most attractive features is its ability to integrate with various third-party systems via APIs, making it a versatile tool for businesses across different industries. With DrapCode, businesses can easily customize their applications to suit their needs, including loan management.

What is LoanPro?

LoanPro is a cloud-based loan management software that offers a comprehensive API for managing loans throughout their lifecycle. From loan servicing to payment processing and reporting, LoanPro’s API allows businesses to automate many aspects of loan management. LoanPro provides financial institutions with the flexibility to integrate loan servicing directly into their existing applications or platforms. The LoanPro API offers powerful features such as real-time data updates, payment schedules, interest calculations, and more, making it an ideal solution for businesses seeking to manage complex loan portfolios.

Features provided by LoanPro as an Integration

Build apps quickly with your data stored in the external datasource and use DrapCode as a 100% frontend builder.

Loan Origination

LoanPro supports the entire loan origination process, from application intake to approval.

Automated Loan Servicing

LoanPro API enables automated loan servicing, including payment scheduling, processing, and tracking.

Customizable Payment Structures

The integration allows businesses to set up customizable payment schedules based on customer needs, including regular, interest-only, balloon, and custom installments.

Real-Time Data Updates

LoanPro provides real-time data updates, allowing businesses to track loan performance, payment history, and outstanding balances in real time.

Loan Modifications and Adjustments

The integration allows businesses to modify loan terms, adjust payment schedules, or update loan information based on customer requests.

Data Security

LoanPro adheres to industry-standard data security protocols, ensuring that sensitive loan information is protected.

How Does DrapCode Integration with LoanPro Work?

The integration between DrapCode and LoanPro is made possible through LoanPro’s API, which enables businesses to connect their loan management data with DrapCode user interface (UI). This process allows users to create a seamless loan management experience by combining LoanPro’s backend functionalities with a custom-built DrapCode front-end.

API Connection

Users can connect LoanPro’s API to DrapCode through API integration modules. This allows them to access loan data and manage it directly within the DrapCode application.

Custom User Interface

Businesses can build custom dashboards and borrower portals using DrapCode’s drag-and-drop UI.

Automated Workflows

Automate approvals, payments, collections, and loan servicing.

Benefits of DrapCode Integration with LoanPro

Integrating DrapCode with LoanPro is a powerful way to streamline loan management. By leveraging LoanPro’s comprehensive API and DrapCode user-friendly interface, businesses can build and manage custom loan management applications without the need for extensive coding expertise. This integration simplifies loan management, increases efficiency, and ensures that businesses can scale their operations as needed.

Customizable UI Build branded loan dashboards and borrower portals.

Scalability Support thousands of active loans without performance issues.

Automation Reduce manual work using automated servicing.

Unified Data All loan data stays synced in real-time.

Cost Effective No engineering team required to build and scale.

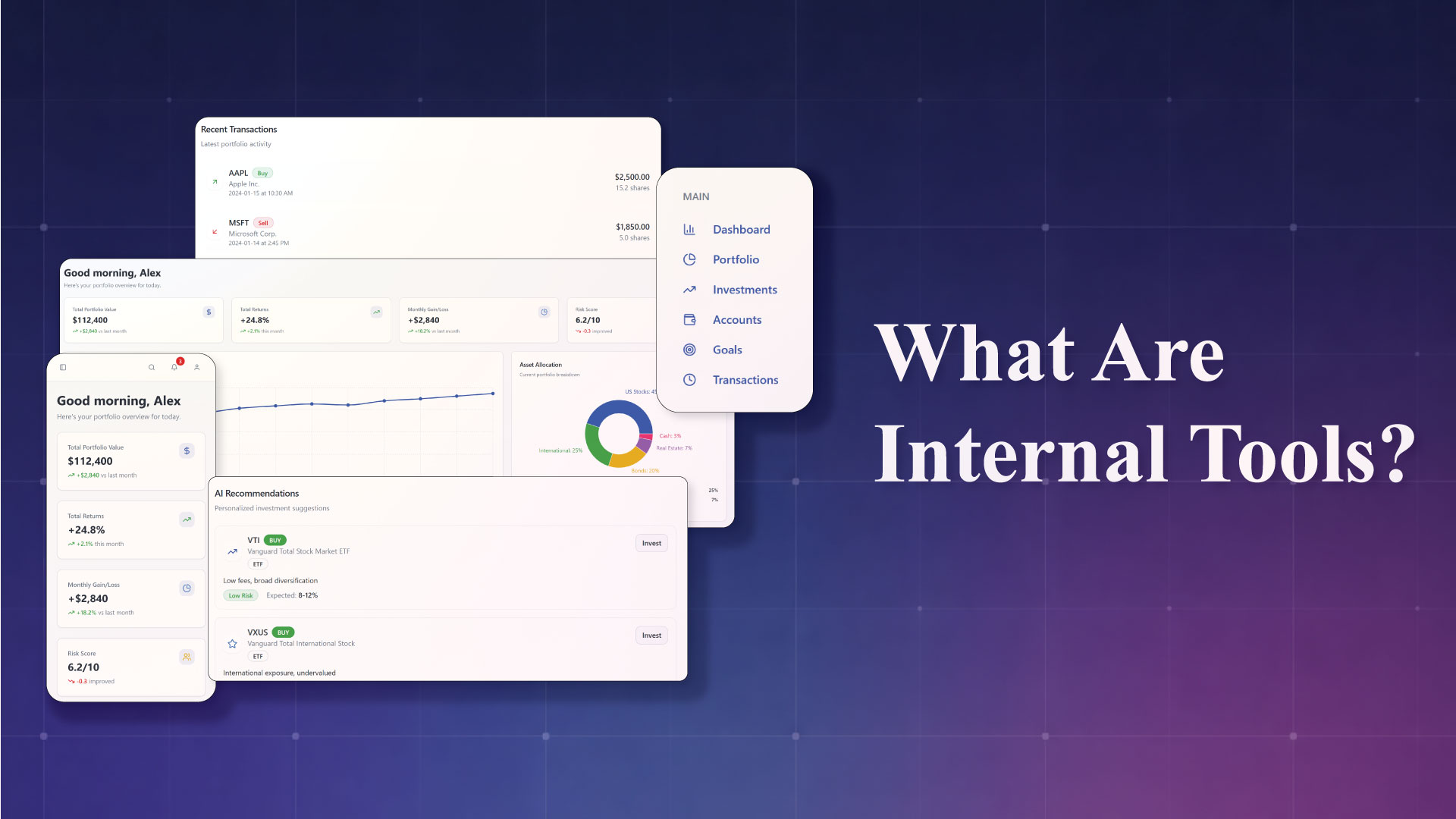

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Code Export

Design a website on drapCode and you can easily export the source code once you are done making it.

Customizable UI

We provide pre-built templates and features to promote loads of customization.

Enterprise Grade Standard

We offers enterprise-grade standards, ensuring a reliable and scalable platform for building robust solutions

Multi-Tenant

A single instance of the application made on Drapcode can serve multiple customers.

Self Hosting

You can easily deploy and host website using Drapcode.

Multiple Environment

Enable multiple environments such as Sandbox, QA, Pre-Prod to test your application before making it live for end users.

Why Choose DrapCode and LoanPro Integration?

The combination of DrapCode and LoanPro provides businesses with a complete solution for loan management. With DrapCode no-code app builder, businesses can quickly deploy a loan management solution tailored to their needs. LoanPro’s robust API ensures that businesses can manage loans efficiently, automate processes, and maintain compliance with financial regulations. Together, these platforms offer an end-to-end solution that meets the evolving needs of financial institutions.

Frequently Asked Questions

What is the DrapCode and LoanPro integration?

How can I connect LoanPro’s API?

Can I automate loan workflows?

Is coding required?

Is it secure?

Are you partnered with LoanPro?

Blogs & Insights

We'd love to share our knowledge with you. Get updates through our blogs & know what’s going on in the no-code world.