Build a Custom Healthcare Lending Platform

Use DrapCode to build a healthcare lending platform, automate treatment financing, manage approvals, and deploy compliant solutions without coding.

Patient Financing Workflows

Healthcare lending platforms support financing for medical procedures, treatment plans, and care packages. These systems manage structured intake, eligibility assessment, and repayment tracking securely. Medical financing requires compliance controls, sensitive data governance, and structured risk evaluation. Without backend automation and governance, providers face operational complexity and credit risk exposure.

Platform Architecture Fundamentals

A no-code web app builder allows lenders to visually configure patient profiles, payment plans, underwriting logic, and notification workflows without backend coding. This accelerates delivery while maintaining structured governance and control. Healthcare lending systems often integrate with patient billing engines and treatment cost modules. This aligns well with medical billing and payment systems that provide structured invoicing and reconciliation workflows.

Core Healthcare Lending Features

These features define what a production-ready healthcare lending platform must support for compliant medical financing.

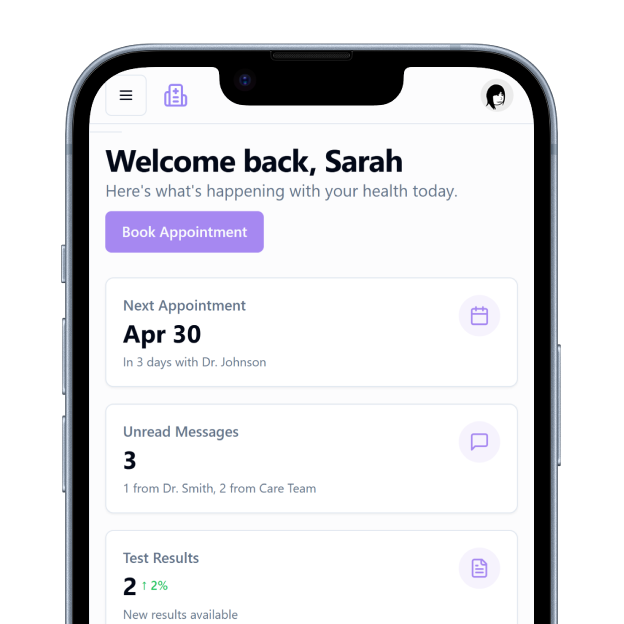

Patient Application Intake

Securely capture borrower and treatment financing details online.

Medical Risk Assessment Logic

Apply structured logic for patient credit eligibility decisions.

Flexible Payment & Installments

Design tailored repayment schedules for treatment affordability.

Compliance & Encryption Controls

Ensure secure data handling and regulatory protections throughout.

Automated Notification Engine

Trigger reminders and updates for payments and approvals.

Audit & Activity Logging

Record actions, decisions, and access events securely.

Governance & Integration Controls

These capabilities ensure healthcare lending systems remain secure, compliant, and enterprise-ready.

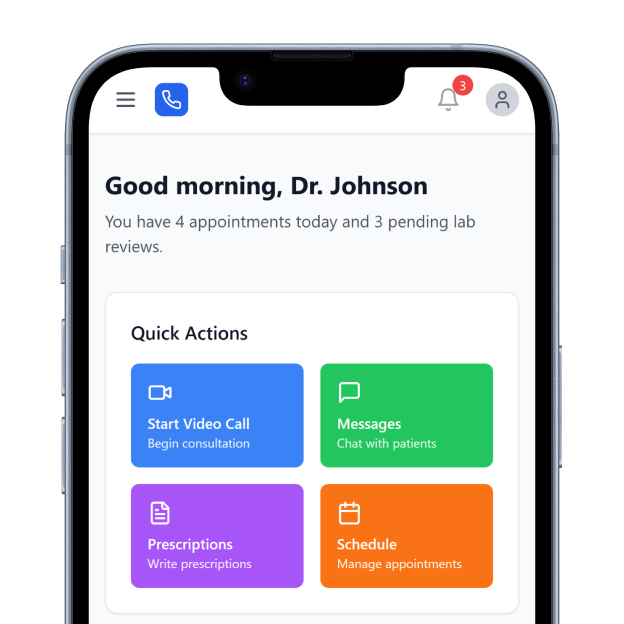

Visual Workflow Automation

Design underwriting, repayments, and eligibility flows without coding.

Role-Based Access Controls

Manage permissions for patients, agents, and admins securely.

API Connectivity Tools

Connect billing, payment gateways, and verification services.

Scalable Deployment Architecture

Support high application volumes and diverse payment schemes.

Use Case Applications

How It Works

Build Intake Forms

Define Eligibility Rules

Integrate Billing Engines

Deploy Production System

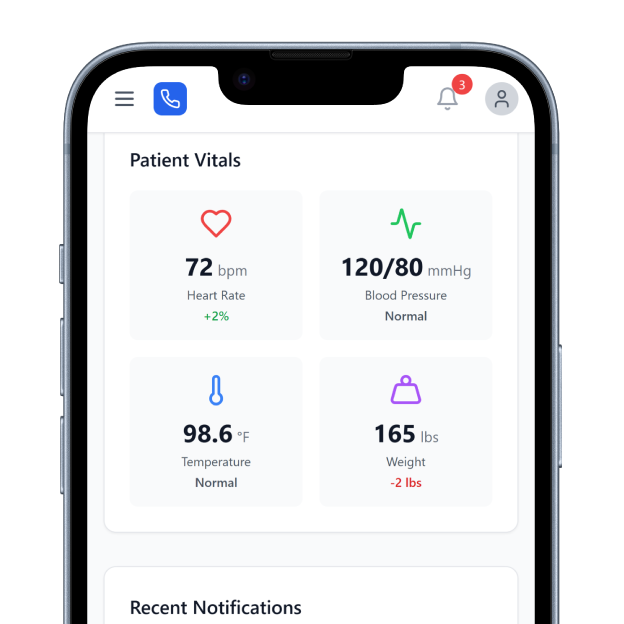

Compliance & Patient Data Protection

Healthcare lending systems must enforce strict encryption, audit logging, and regulated access permissions to protect patient health and financial data. These safeguards are critical for regulatory compliance and patient trust. Structured workflows improve transparency across credit decisions and repayment tracking, reducing risk and improving access to affordable credit.

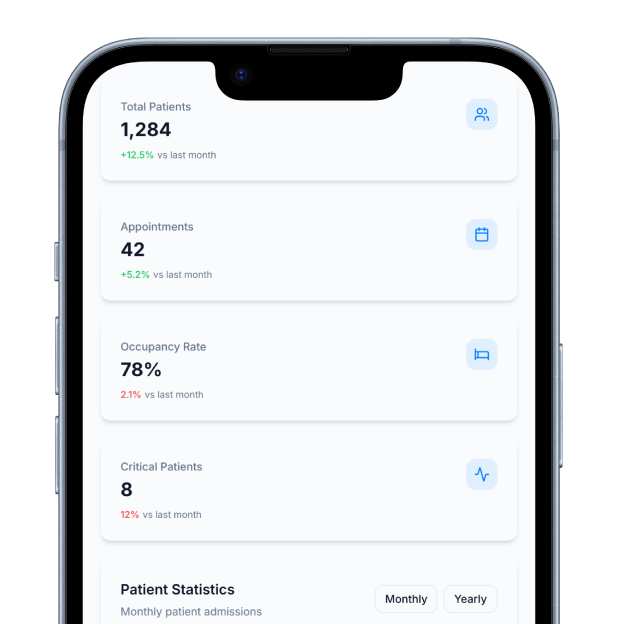

Operational Scalability

High-volume healthcare lending requires resilient infrastructure, real-time monitoring, and performance dashboards. Scalable design ensures smooth financing operations across hospitals, clinics, and patient programs. Robust systems increase provider confidence and seamless patient credit experiences.