Build a Scalable Merchant Cash Advance Platform

Build a merchant cash advance platform with DrapCode, automate approvals, manage funding workflows, and launch secure lending tools without writing code.

Business Advance Overview

Merchant cash advance platforms provide upfront funds to businesses in exchange for future receivables. These systems manage application intake, revenue-based repayment logic, and advanced reconciliation securely. Because repayments depend on future sales, merchant advance workflows require flexible modelling and structured risk controls. Without automated back-end logic, manual reconciliation and tracking increase business error and operational friction.

Platform Infrastructure Logic

A no-code web app builder allows teams to configure advanced rules, repayment schedules tied to revenue, and verification triggers visually. This eliminates custom backend development while maintaining governance controls. Merchant cash advance systems commonly integrate with point-of-sale and transaction processing systems to ensure revenue continuity. This alignment works seamlessly with point-of-sale lending software aimed at retail financing experiences.

Core Advance Capabilities

These capabilities define what a production-ready merchant cash advance platform must support for scalable business cash flow automation.

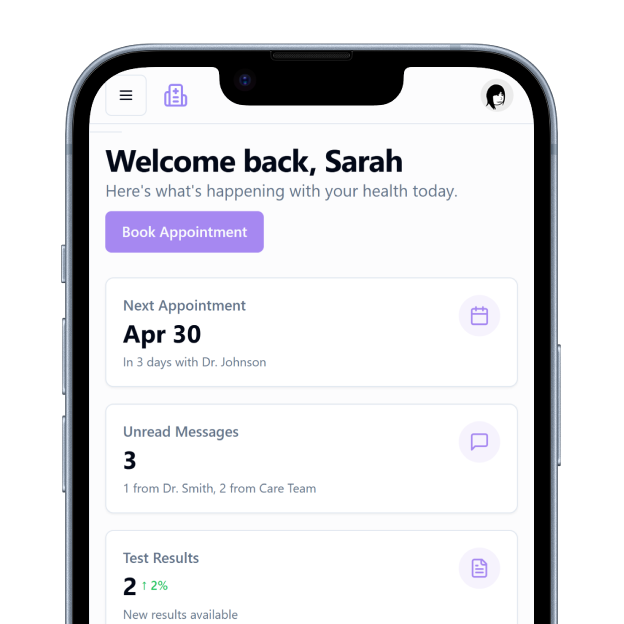

Advance Application Intake

Securely capture business finance requests online with structured workflows.

Revenue-Based Repayment Logic

Automate repayment percentages tied to real-time sales volumes.

Flexible Advance Terms Setup

Configure term lengths, holdbacks, and payout conditions visually.

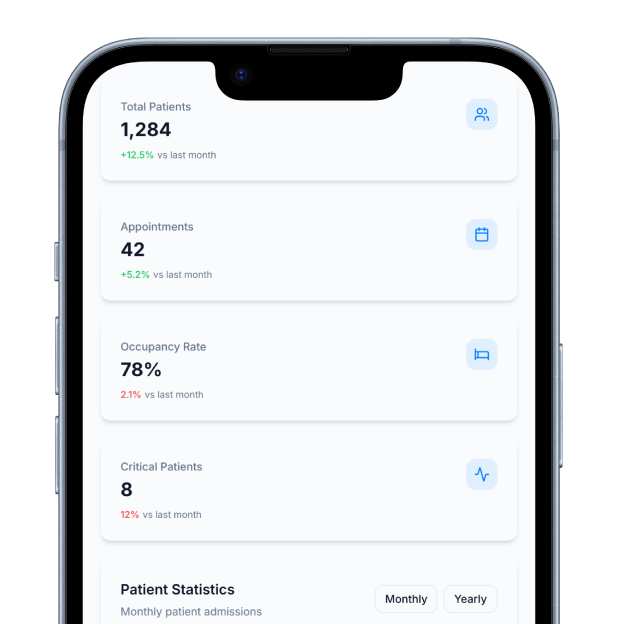

Performance Monitoring Dashboards

Visualise merchant cash flows and repayment status metrics.

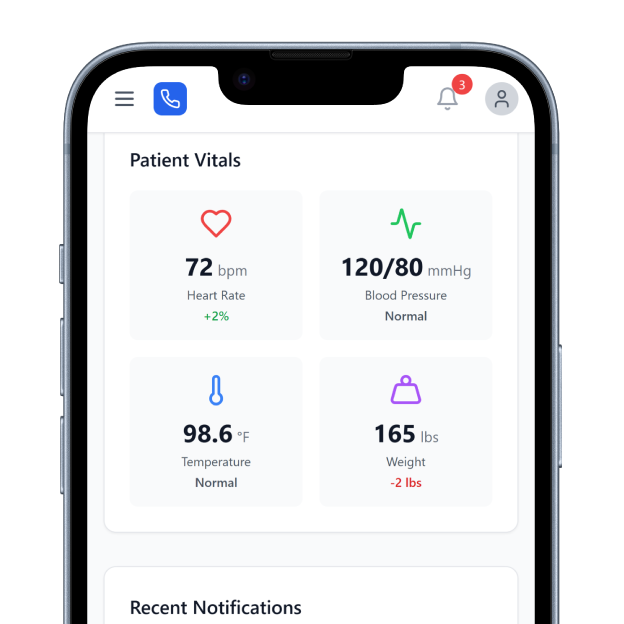

Notification & Alert Engine

Automatically trigger reminders and status alerts for merchants.

Audit & Compliance Trails

Record advance decisions and changes with secure logs.

Integration & Control Features

These features ensure the platform remains secure, compliant, and ready for enterprise business financing.

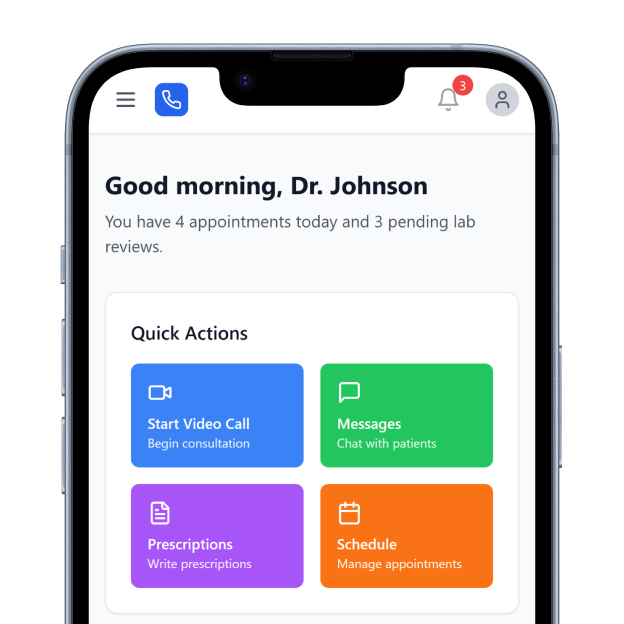

Role-Based Access Permissions

Manage merchant, admin, and agent roles securely without code.

Visual Workflow Automation

Design advanced logic and routing without backend development complexity.

API Connectivity Framework

Connect sales, payment, and verification services via secure APIs.

Scalable Deployment Backbone

Support large volumes of merchant data with resilient performance.

Use Case Applications

How It Works

Build Intake Engine

Define Advanced Logic

Integrate POS Systems

Deploy Production System

Compliance & Risk Governance

Merchant cash advance systems must enforce strict encryption, audit logging, data governance, and access control to protect business and merchant data. These safeguards ensure compliance with financial and data protection standards. Structured reconciliation and performance tracking improve risk visibility and repayment predictability across merchant portfolios.

Operational Scalability

High-frequency transaction environments demand resilient infrastructure, real-time calculations, and automated reconciliation engines. Scalable design ensures smooth cash flow processing even during peak business cycles. Portfolio dashboards provide insights into advanced performance, repayment patterns, and operational trends.