Build Custom Invoice Factoring Software

Digitize receivables financing with a robust invoice factoring platform that automates underwriting, tracking, and settlements.

Receivables Financing Overview

Invoice factoring software allows businesses to sell invoices to lenders for immediate cash flow. This system tracks invoice status, payment schedules, advance rates, and commission logic. Factoring operations require secure workflows, predictable payment engines, and structured risk controls. Manual spreadsheet management delays cash and increases operational risk.

Factoring Platform Architecture

A no-code web app builder enables teams to configure invoice intake, advanced logic, settlement rules, and notification automation visually. This removes backend coding while preserving governance and consistency. Factoring systems often integrate with credit evaluation and portfolio tracking environments. These workflows align well with working capital finance platforms that provide broader liquidity and receivables financing tools.

Core Factoring Capabilities

These capabilities define what a production-ready invoice factoring system must support for efficient working capital management.

Invoice Submission Engine

Securely capture and validate business receivables for financing.

Advance Rate Configuration

Set dynamic factoring rates based on credit criteria.

Payment Settlement Logic

Track repayments, fees, and cash settlements accurately.

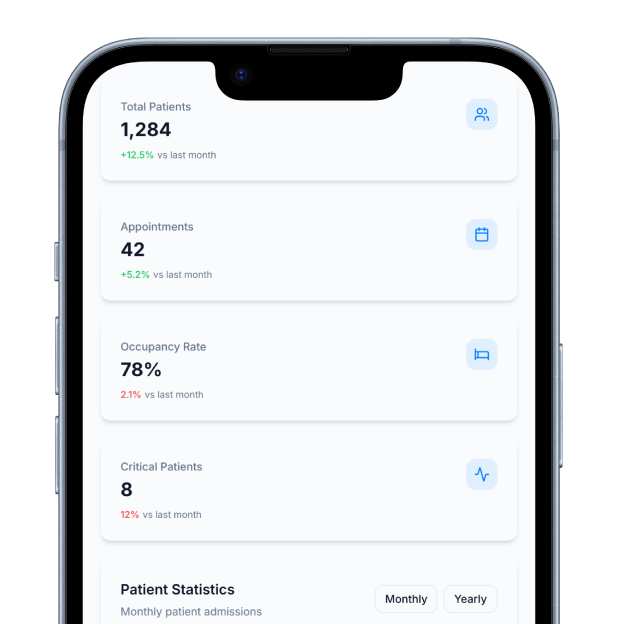

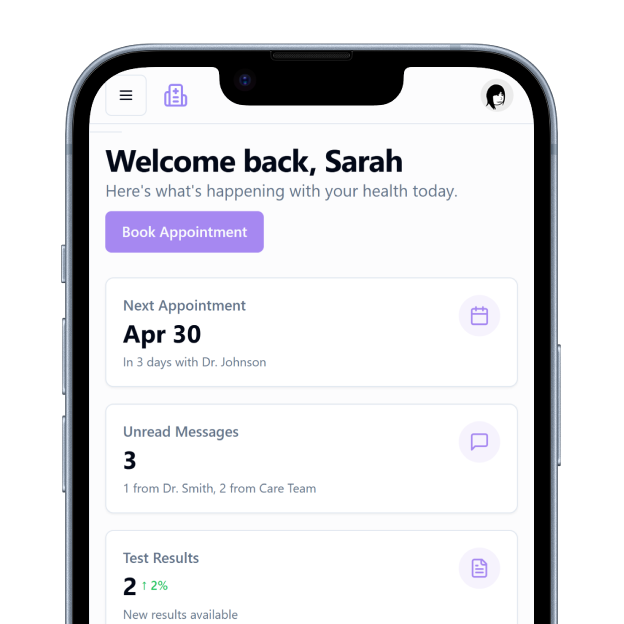

Customer Account Dashboards

Visualise invoice portfolios and financing status securely.

Risk & Credit Controls

Apply structured risk assessments to invoice eligibility.

Audit & Transaction Recording

Maintain detailed logs of all factoring decisions made.

Governance & Platform Controls

These controls ensure the factoring platform is secure, compliant, and enterprise-ready.

Role-Based Access Controls

Securely configure admin, client, and operations access.

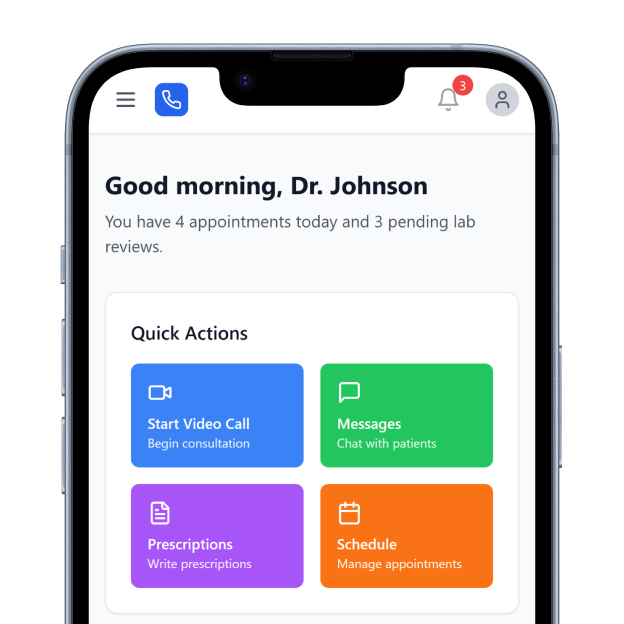

Workflow Automation Tools

Design advance and settlement flows without backend code.

API Integration Layer

Connect factoring to payment, reporting, and verification services.

Scalable Deployment Architecture

Support high invoice volumes with a resilient backend design.

Use Case Applications

How It Works

Configure Invoice Rules

Build Workflow Logic

Link Payment Systems

Deploy to Production

Compliance & Risk Governance

Invoice factoring platforms must enforce encryption, audit trails, and controlled access permissions. These safeguards ensure compliance and protect business financials. Receivables data often informs portfolio analysis and decision-making. This insight aligns with trade finance portals that support broader working capital and financing workflows.

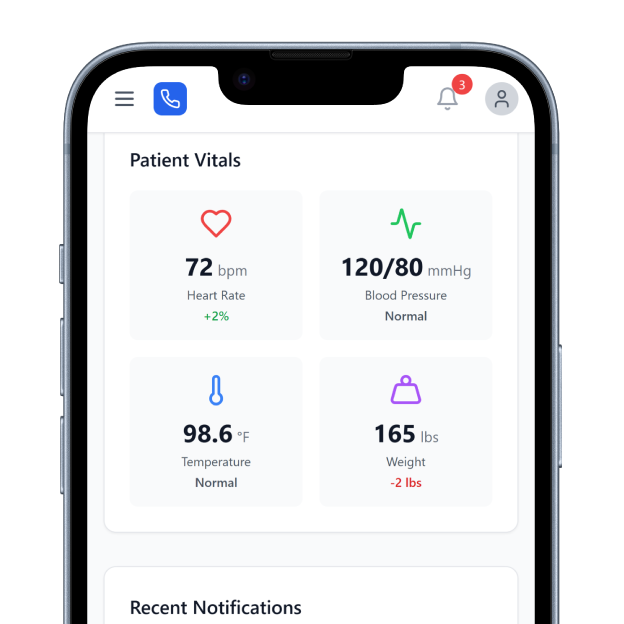

Operational Scalability

Factoring workflows require resilient infrastructure capable of high throughput and transaction accuracy. Performance monitoring and metrics dashboards improve visibility into operational risk and cash flow forecasting. This enables organizations to build governed, production-ready invoice factoring platforms with reduced engineering complexity.