Build a Scalable Payday Loans Platform

Launch end-to-end payday loan software with KYC, disbursal, repayment tracking, and credit bureau integrations—built securely with DrapCode.

Credit Workflow

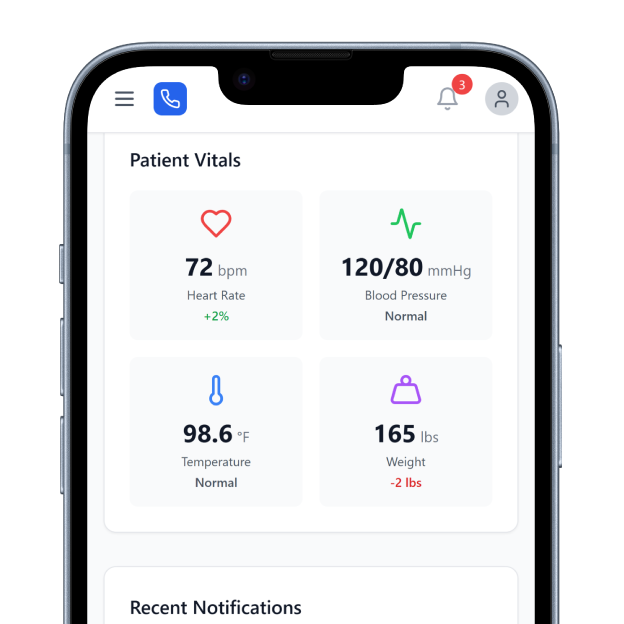

Payday loans platforms manage short-term borrower intake, eligibility verification, automated decisioning, and structured repayment tracking. They are designed for rapid credit cycles with controlled risk evaluation. Because repayment durations are short and volumes are high, these systems require precise backend workflows and automated notifications. Manual processing increases risk exposure and operational inefficiencies.

Platform Architecture

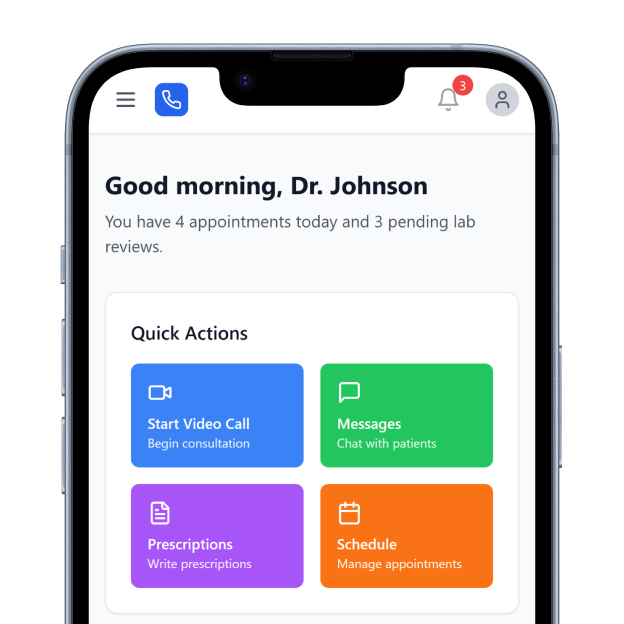

A no-code web app builder lets lenders visually configure intake forms, scoring logic, repayment cycles, and access permissions. This eliminates custom backend coding while maintaining structured governance. Payday systems must integrate seamlessly with underwriting and servicing workflows. These processes often integrate with structured loan origination software to automate application intake and approvals.

Core Payday Capabilities

These capabilities define what a production-ready payday loans platform must support for compliant short-term credit operations.

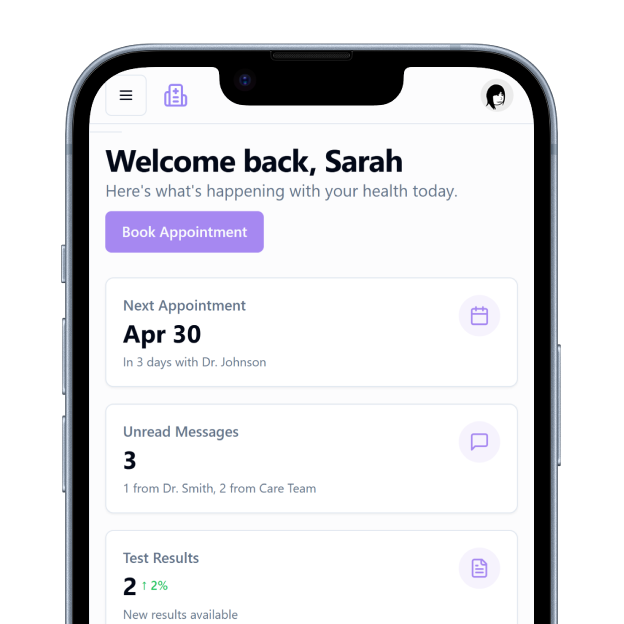

Rapid Application Intake

Securely capture borrower data with optimized digital forms.

Automated Eligibility Checks

Apply configurable risk rules for instant qualification decisions.

Frequent Repayment Scheduling

Manage daily or weekly repayment cycles efficiently.

Identity Verification Controls

Securely validate borrower credentials and compliance attributes.

Payment & Notification Automation

Trigger reminders, confirmations, and status alerts automatically.

Audit & Activity Logging

Maintain secure records of all credit decisions.

Risk & Governance Controls

These controls ensure payday lending systems remain secure, scalable, and regulatory-ready.

Visual Workflow Builder

Design risk logic and repayment flows without writing any code.

Role-Based Permissions

Securely control borrower, agent, and admin access.

API Integration Framework

Connect verification, payment, and compliance services reliably.

Scalable Deployment Infrastructure

Handle high-volume short-term credit applications smoothly.

Use Case Applications

Compliance Framework

Payday lending systems must enforce encryption, controlled access, and complete audit tracking. These safeguards are essential for regulated financial operations. Short-term lending often extends into portfolio servicing workflows. These operations integrate with structured loan management software for repayment tracking and lifecycle control.

Operational Scalability

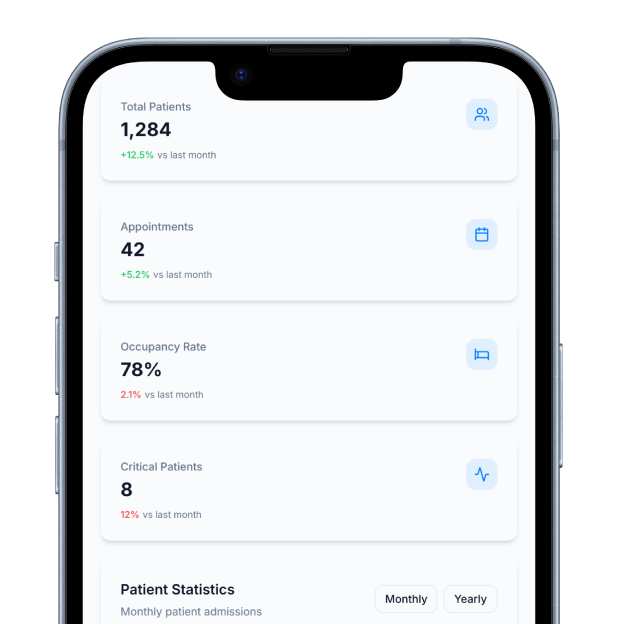

High-frequency lending requires reliable system uptime, rapid performance, and structured monitoring dashboards. Scalable infrastructure ensures consistent credit delivery even during peak demand periods. Strong system architecture reduces operational risk and improves borrower experience across rapid lending cycles.

Build Forms

Build Forms