Signzy GST Analytics API Integration on DrapCode

Integrate Signzy GST Analytics API with DrapCode to analyze GST data efficiently. Automate tax verification, assess financial health, and ensure compliance with real-time GST insights.

Trusted by 1000+ brands across the world!

Instant GST Analysis

DrapCode enables seamless Signzy GST Analytics API integration, allowing businesses to fetch, analyze, and validate GST details for tax compliance.

Tax Compliance Verification

Ensure accurate GST validation by verifying taxpayer details, filings, and transaction history to prevent fraud and tax evasion.

Key Features Provided by Signzy GST Analytics API as an Integration

Real-Time GST Validation

Instantly fetch and verify GST details from government databases for compliance.

Taxpayer Profile Analysis

Extracts business financial data, return filings, and compliance status.

Risk Assessment Insights

Identifies anomalies, potential fraud, and tax risks based on GST history.

Automated Data Processing

Reduces manual effort by extracting and analyzing GST data in real time.

Seamless API Integration

Connects with fintech, banking, and compliance platforms for automated tax validation.

GST Return Monitoring

Tracks filing status, turnover trends, and tax liability for better financial insights.

Financial Risk Detection

Signzy’s GST Analytics API helps businesses assess financial risks by analyzing tax compliance data and historical GST filings.

Fraud Prevention System

DrapCode enables businesses to integrate Signzy GST Analytics API efficiently, reducing tax fraud risks and ensuring compliance.

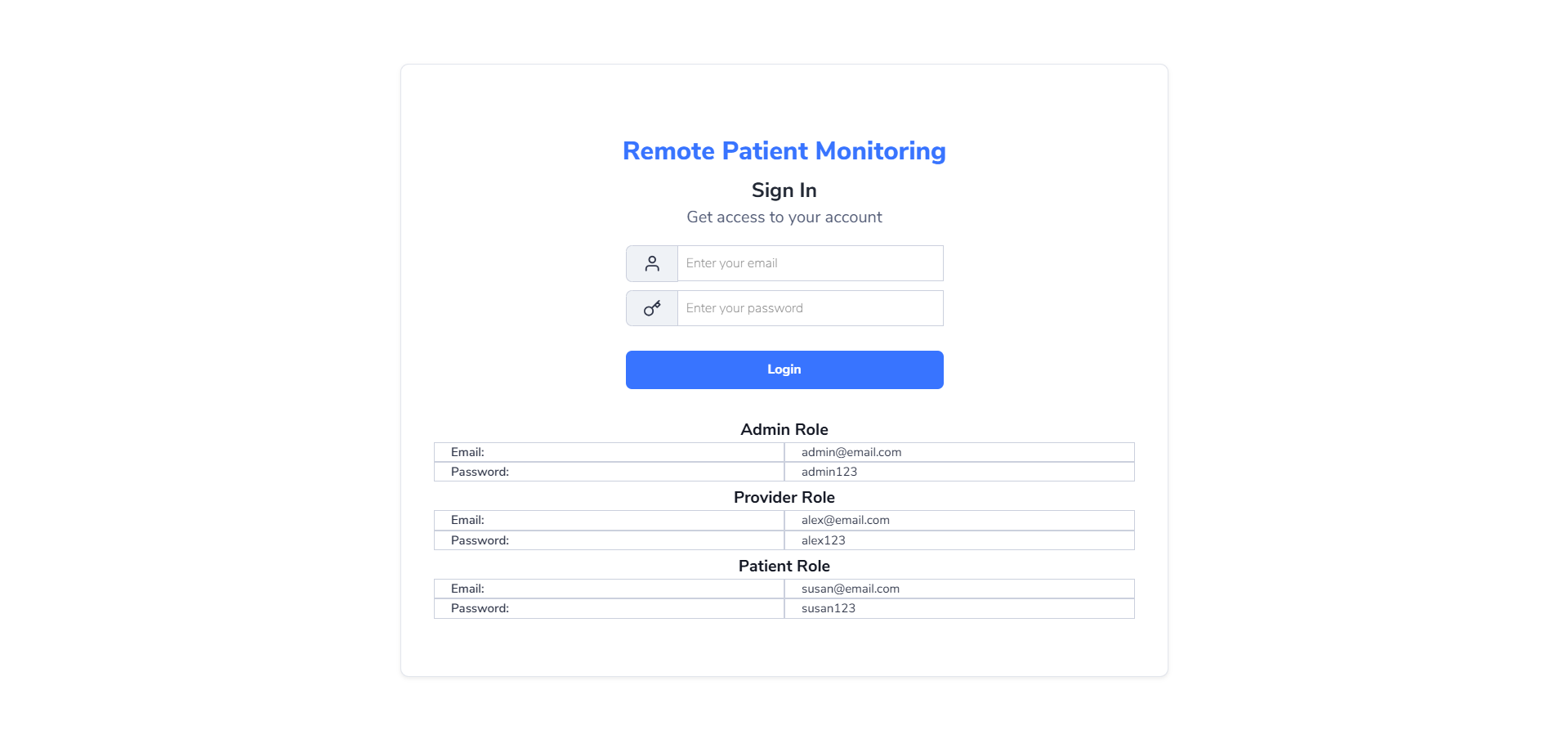

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code API Integration

Easily integrate GST analytics workflows without coding for faster implementation.

API-First Infrastructure

Seamlessly connects Signzy GST Analytics API with financial and compliance systems.

Secure Data Processing

Encrypts GST data to ensure confidentiality and prevent unauthorized access.

Custom Compliance Rules

Configure GST validation settings based on business-specific tax requirements.

Multi-Platform Compatibility

Supports GST analytics across web, mobile, and enterprise applications.

Automated Tax Assessment

Enables businesses to analyze tax records and ensure compliance efficiently.

Faster Tax Verification

Automate GST data validation to minimize manual errors and improve business tax compliance with real-time analytics.

Start GST Analytics with Signzy API on DrapCode

Frequently Asked Questions

How does Signzy GST Analytics API work?

Why is GST analytics important?

Can this API detect fraudulent GST filings?

Can I integrate the GST Analytics API without coding?

What industries benefit from GST analytics?

Is DrapCode partnered or associated with the software it integrates with?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software