Mortgage Loan Application Software

Feb 24, 2026

The DrapCode Mortgage Loan Application Software Template is a comprehensive solution tailored for financial institutions to streamline the loan application and approval process. This visually build template simplifies data collection, verification, and tracking, providing an efficient and user-friendly platform for both applicants and administrators. Ideal for banks, credit unions, and loan agencies, it enhances the overall experience for all stakeholders.

Benefits

- Streamlined Application Process: Simplifies the collection and management of loan application data.

- Faster Approvals: Automates workflows, reducing processing times for loan approvals.

- Improved Communication: Facilitates seamless interaction between applicants and loan officers.

Advantages

- Customizable Fields: Tailor the template to meet specific loan requirements and criteria.

- Secure Data Handling: Protects sensitive financial information with advanced encryption.

- Multi-Platform Accessibility: Ensures a responsive experience across devices for both applicants and administrators.

Disadvantages

- Platform Dependency: Requires the DrapCode platform for functionality.

- Initial Setup Time: Advanced configurations might require additional time to fully implement.

User-Friendly

Designed for both applicants and loan officers, the Mortgage Loan Application Software Template features an intuitive drag-and-drop editor. Applicants can easily submit loan details and track application status, while administrators benefit from simplified workflow management without needing technical expertise.

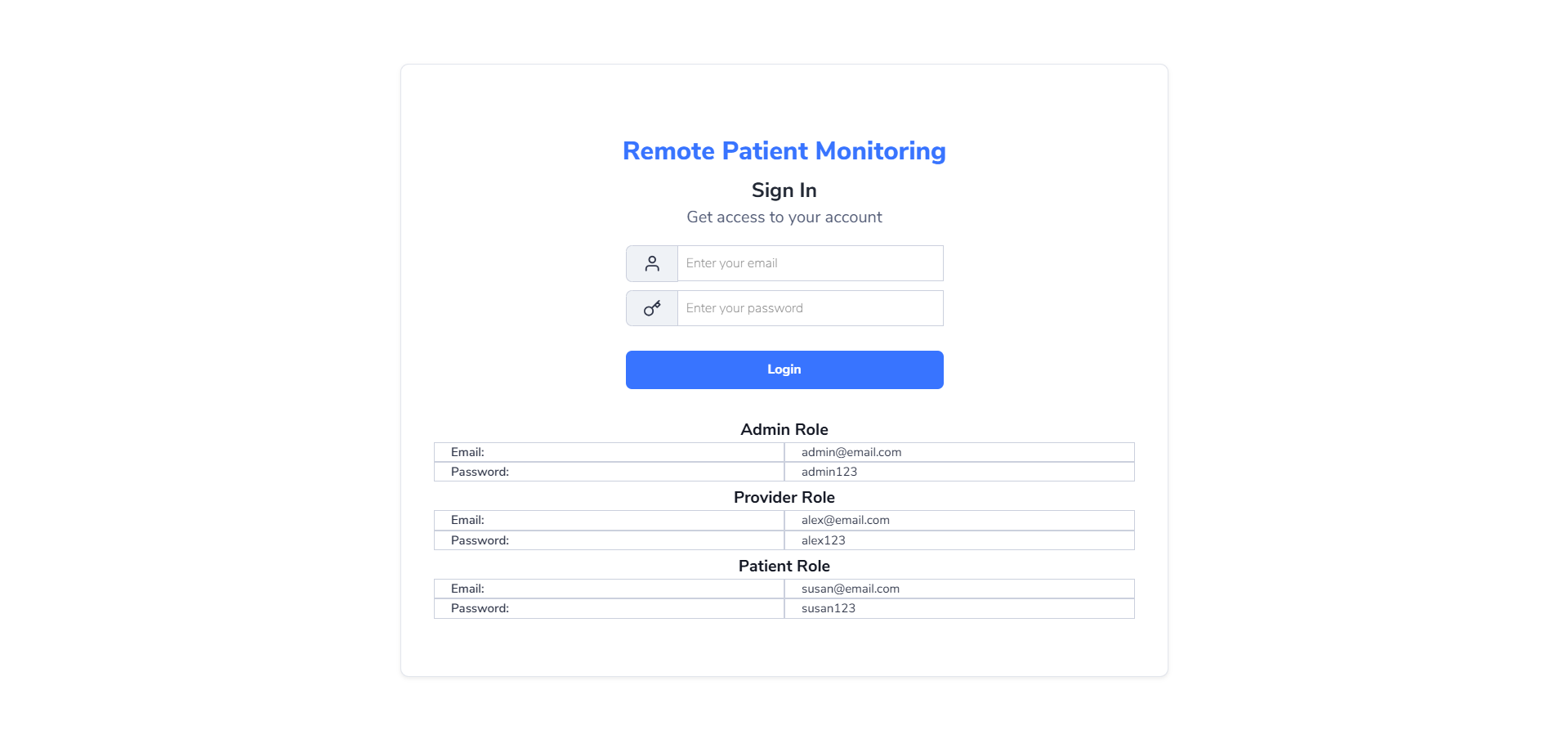

Overview of Pages

This template includes all the essential pages for a seamless loan application experience. The Login/Signup Page ensures secure access for applicants and administrators. The Dashboard Page provides an overview of application statuses and key metrics. The Loan Application Page allows applicants to submit required details and documents. The Application Status Page enables real-time tracking of loan progress, while the Profile Settings Page lets users manage their account information and preferences.

Conclusion

The DrapCode Mortgage Loan Application Software Template is an ideal tool for financial institutions looking to enhance their loan processing efficiency. With its secure infrastructure, customizable features, and user-friendly interface, it helps streamline the mortgage application process while improving customer satisfaction.

Need Any Help?

As this template is fully customisable, you can make changes as per your requirement. If you get stuck at any point while making any changes then check out the following resources:

You can also contact us directly via email or get in touch with us by leaving a message on our support tab.

Features

Ready to Become a "No Coder"?

Get started & build your low code no code apps now.

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software