Integrate Decentro Goods and Services Tax GST API on DrapCode

Integrate Decentro GST API on DrapCode to verify GST details instantly. Automate tax compliance with real-time GSTIN validation and business authentication.

Trusted by 1000+ brands across the world!

Instant GST Verification

Retrieve GST registration details and validate taxpayer information instantly using Decentro GST APIs.

Secure Data Processing

Safeguard business data with encrypted GST verification and secure GSTN connectivity.

Key Features by Decentro GST API as an Integration

Real-time GSTIN verification, compliance automation, and business authentication powered by GSTN connectivity.

GSTIN Validation

Verify GST numbers instantly by connecting directly with the GSTN database.

Business Detail Retrieval

Fetch legal name, registration status, and filing details of any GST-registered business.

Tax Compliance Automation

Ensure GST verification workflows follow regulatory requirements automatically.

Fraud Detection System

Identify invalid or fake GSTINs to prevent tax evasion and financial fraud.

Bulk GST Verification

Process thousands of GSTIN checks at scale for enterprise compliance teams.

API Connectivity

Integrate GST verification into accounting, ERP, and fintech systems easily.

No-Code GST Integration

DrapCode enables seamless GST API integration without writing code. Build automated tax verification workflows visually.

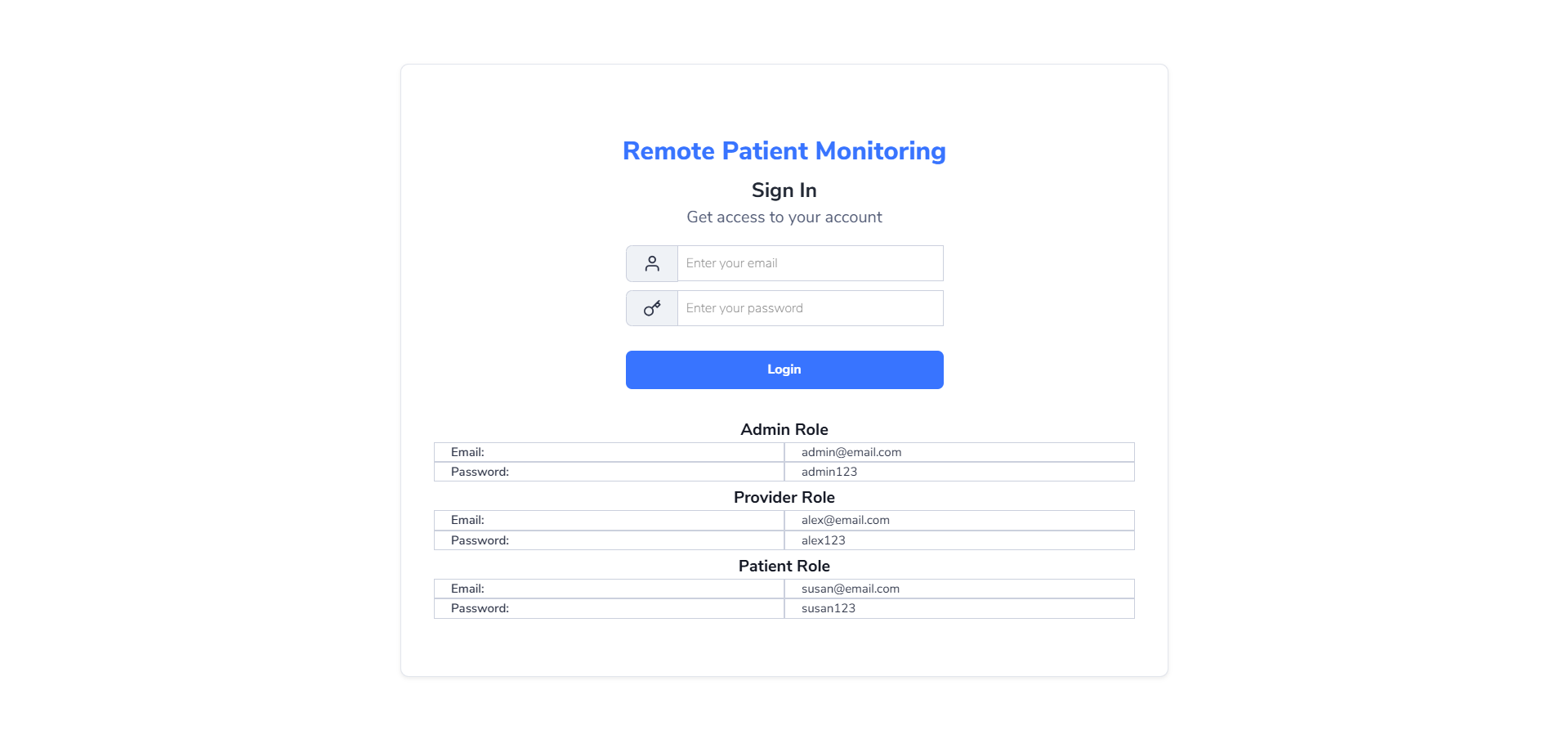

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Drag-and-Drop API Setup

Integrate Decentro GST API visually without requiring any backend development.

Automated Compliance Workflows

Build GST verification and tax compliance logic using no-code automation.

Secure Data Handling

Encrypt GST and business data across all integrations and workflows.

Scalable Verification Engine

Run bulk GSTIN validations reliably with enterprise-grade infrastructure.

Cross-Platform Deployment

Deploy GST workflows on web, mobile, and enterprise applications.

Faster Tax Compliance

Automate GST checks to reduce manual work and accelerate business onboarding.

Faster GST Processing

Automate GST validation to improve tax compliance, reduce errors, and speed up onboarding.

Fraud Prevention

Detect fake GSTINs and prevent financial fraud using real-time GST verification and AI-driven checks.

Frequently Asked Questions

What does Decentro GST API do?

How does GST verification help businesses?

Can I integrate GST API on DrapCode without coding?

Who uses GST verification?

Is DrapCode partnered with Decentro?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software