AI for Financial Services: Smarter Solutions for Finance

Leverage AI for financial services to transform banking and finance operations, improve decision-making, and enhance customer experiences.

Streamlined Financial Operations

Enhanced Risk Management

Key Features Provided By DrapCode

Predictive Analytics

Analyze transaction patterns, customer behavior, and market trends to forecast risks and opportunities with high accuracy.

Fraud Detection

Detect anomalies and potential fraud in real time to safeguard financial transactions and customer data.

AI Chatbots

Provide automated support for customer queries, loan processing, account management, and troubleshooting 24/7

Credit Scoring Models

Generate data-driven credit assessments for individuals and businesses using AI-powered scoring algorithms.

Portfolio Optimization

Use AI to suggest personalized investment strategies based on risk tolerance and financial goals.

Regulatory Compliance

Ensure real-time monitoring of transactions and reporting to meet legal and regulatory requirements efficiently.

Why Use AI in Financial Services with DrapCode

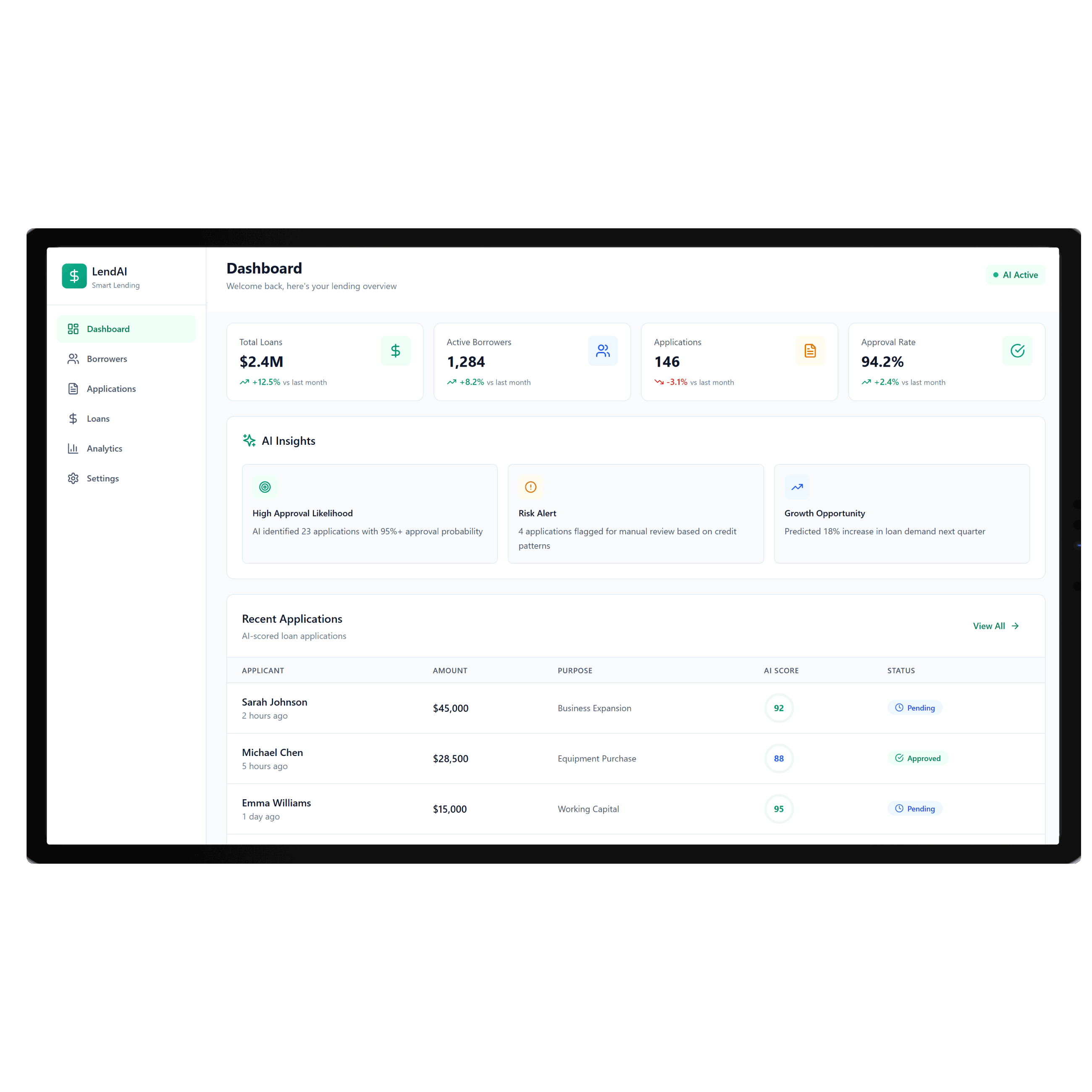

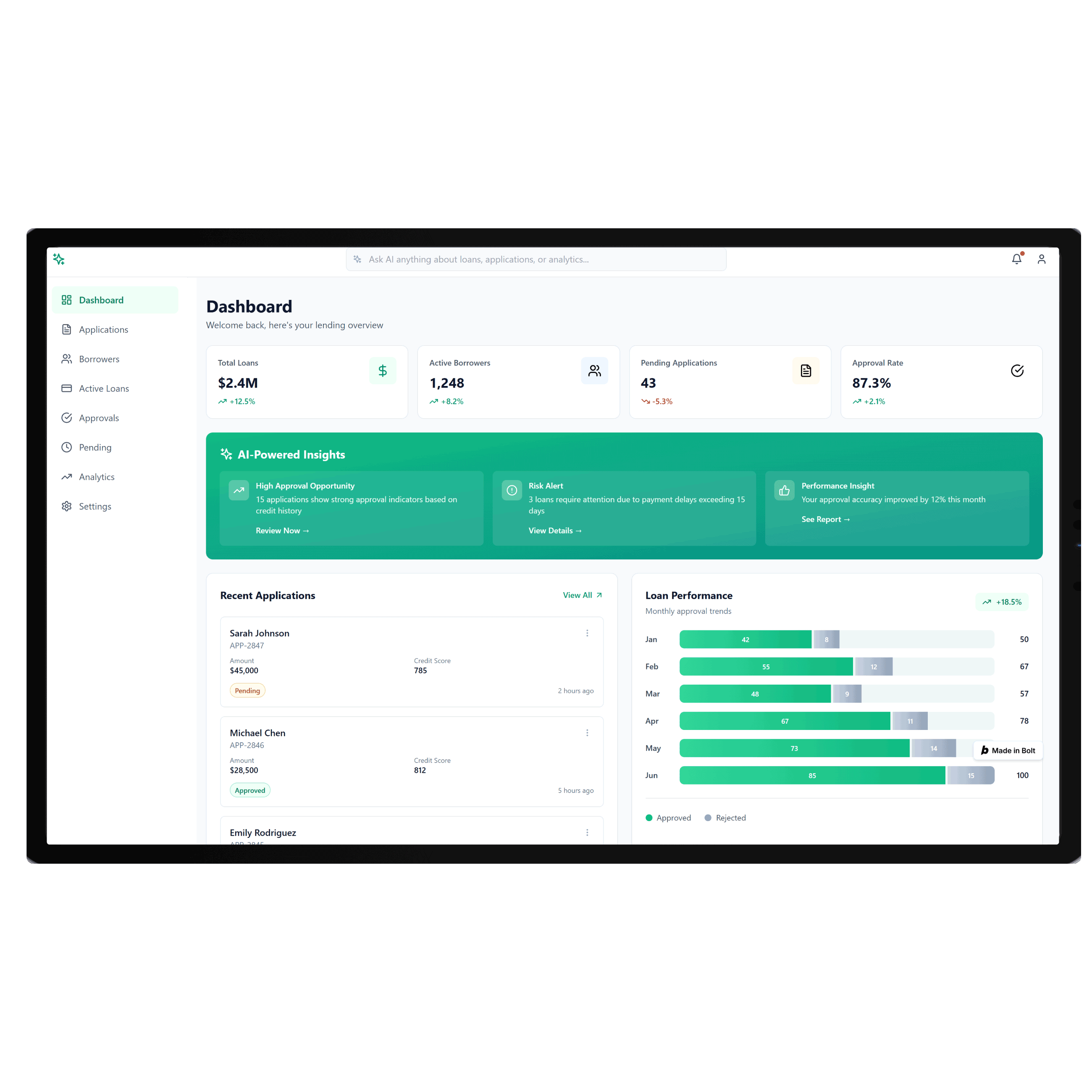

Data-Driven Decisions

Build AI applications that generate actionable insights for loans, credit approvals, and financial advisory services.

Reduced Operational Errors

Automate transaction verification and reporting to minimize human error and improve efficiency across departments.

Scalable Solutions

Create AI-driven platforms adaptable to banks, fintech startups, and lending organizations without writing complex code.

Rapid Deployment

Launch intelligent financial services apps quickly using DrapCode’s no-code builder with pre-built AI integrations.

Common Use Cases

Build in Four Simple Steps

Define Objectives

Collect Data Sources

Apply AI Models

Deploy & Monitor

Integrate Across Financial Workflows

Embed your AI solutions with ChatGPT, AI App Generator, or AI in Healthcare platforms for enhanced financial decision-making, real-time insights, and cross-industry efficiency improvements. Building Healthcare App Functionalities