Build BNPL Platforms for Credit Experiences

Launch scalable, flexible BNPL (Buy Now, Pay Later) platforms with custom billing, repayment logic, and merchant integrations using DrapCode.

Extend Credit with Buy Now Pay Later Logic

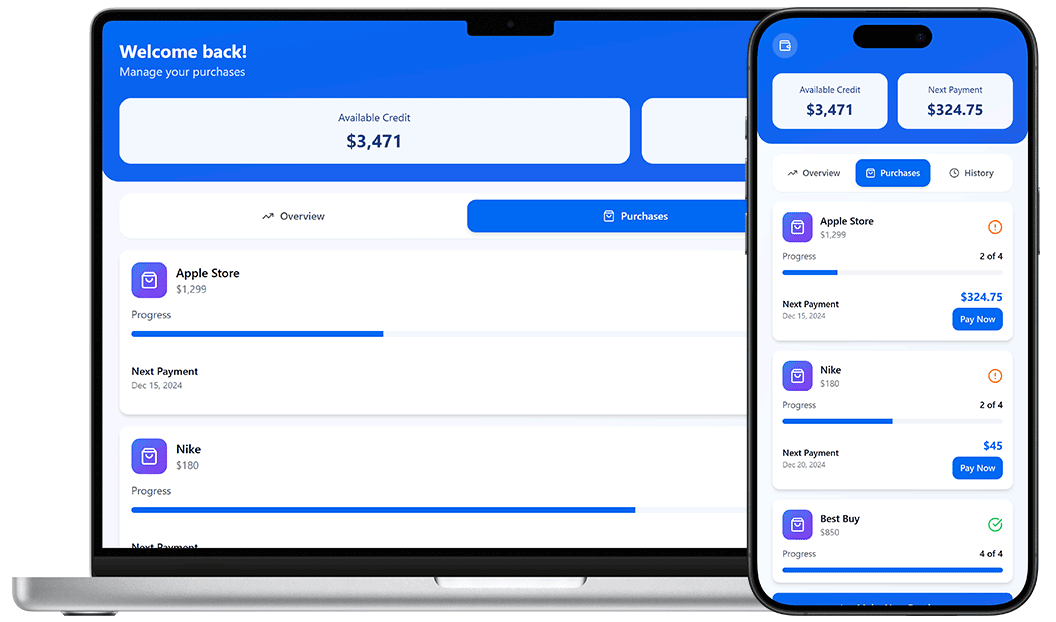

BNPL platforms allow customers to split purchases into installments while businesses receive upfront payments. DrapCode’s no-code platform helps you develop robust BNPL software, supporting merchants' onboarding, transaction workflows, credit checks, and compliance in record time.

BNPL for Business & Bill Payments

Whether building BNPL for business payments, consumer financing, or e-commerce bill splitting, DrapCode lets you configure repayment terms, integrate payment processors, and set merchant-specific rules—all from a single dashboard.

Key Features of BNPL Platforms

Merchant Onboarding

Register merchants, upload documents, and verify eligibility with custom KYC and onboarding workflows.

Dynamic Installment Rules

Define repayment structures, tenure limits, interest-free periods, and late fee policies per merchant or product type.

Payment Gateway Integration

Integrate seamlessly with providers like Razorpay, PayPal, or Stripe for secure checkout and instant fund transfer.

EMI Auto-Scheduler

Configure automated installment generation and reminders with built-in logic for early repayment and defaults.

User Credit Limits

Assign flexible spending limits per customer based on transaction history, credit score, and repayment patterns.

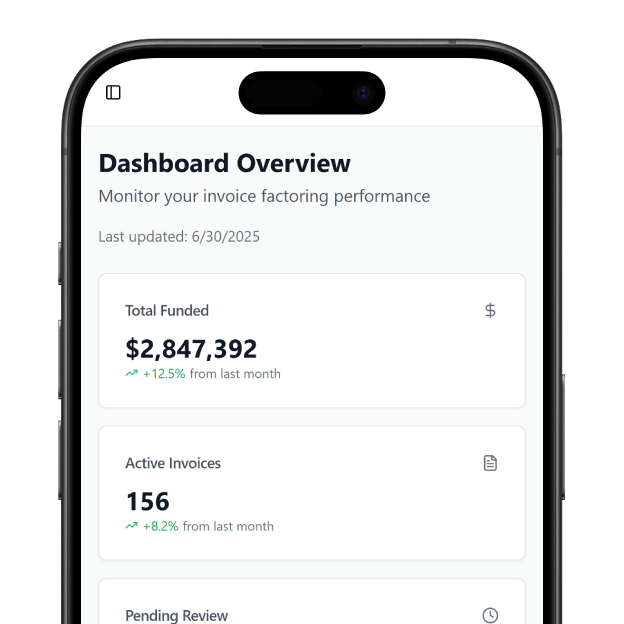

Billing Dashboard

Enable real-time tracking of bills, payments due, settled accounts, and transaction status from one screen.

Why Build with DrapCode

Launch Faster

Plug into Point of Sale Lending Software, Working Capital Finance Software, or a Mortgage Lending Platform to extend BNPL to new segments.

Regulatory Compliance

Support credit verification, interest calculations, and digital agreements that align with lending regulations.

Business & Consumer Models

Whether you're building BNPL for B2C or B2B, DrapCode helps you scale across retail, healthcare, or SaaS.

Integrate & Scale

Plug into Point of Sale Lending Software, Working Capital Finance Software, or a <nuxt-link to="/digital-lending/mortgage-lending-platform">Mortgage Lending Platform</nuxt-link> to extend BNPL to new segments.

Real-World Use Cases

Embedded BNPL at Checkout

Integrate with PayPal to offer split-payment options at checkout. Manage merchant terms, payouts, and buyer billing cycles dynamically.

BNPL for Utility Bill Payments

Use Payliance’s payment APIs to build BNPL bill payment systems for electricity, mobile recharge, and municipal services.

Credit-Checked Installment Loans

Enable BNPL for high-value items by integrating Factual Data for borrower credit score checks and automated limit assignment.

Deployment Process

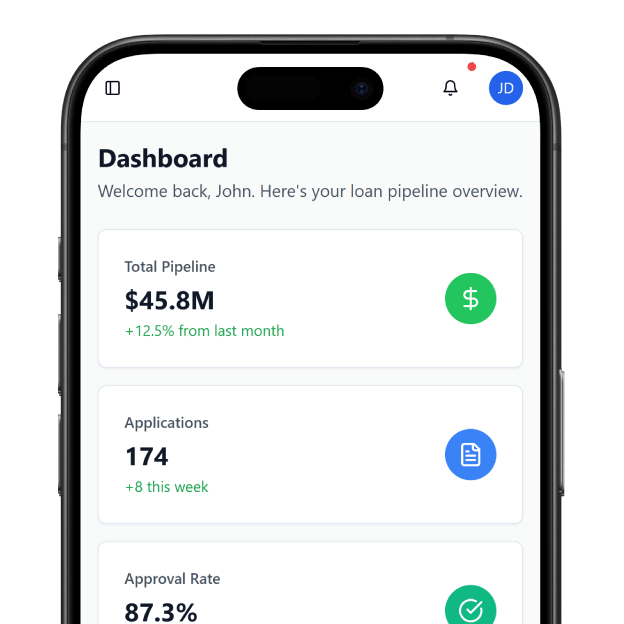

Customizable Loan Dashboards

Customizable Loan Dashboards

Borrower Profile Management

Borrower Profile Management

Loan Application Tracking

Loan Application Tracking

Credit Score Integration

Credit Score Integration

Adapt to Any BNPL Use Case

From B2B SaaS subscriptions to e-commerce retail and POS terminals, DrapCode’s modular platform supports any BNPL business model. Easily connect to your Working Capital Finance Software or POS Lending Systemfor a complete lending solution stack.

Scalable Credit Infrastructure

With prebuilt modules and full customization, DrapCode ensures you can evolve from basic BNPL features to full-fledged consumer credit offerings, including integrations with mortgage or buy-now-pay-later software.

Frequently Asked Questions

What is a BNPL platform?

Can I build a BNPL solution for bill payments?

Does DrapCode support credit checks?

How customizable are merchant rules?

Can I scale BNPL across industries?

Ready to Launch Your BNPL Platform?

Design scalable BNPL platforms for business or retail, customized for merchant needs and repayment workflows with DrapCode.