How to Build a Digital Loan Origination System with DrapCode

Nov 24, 2025

Digital lending has shifted from a “nice-to-have” to a strategic growth pillar for banks, NBFCs, and fintech lenders. Borrowers expect instant approvals, digital document submission, automated decision-making, and seamless onboarding without visiting a branch or dealing with paperwork. As a result, lenders are modernizing their tech stack to stay competitive, compliant, and scalable.

But building a loan origination system (LOS) from scratch is costly, complex, and slow. Traditional development can take 8–14 months, require large engineering teams, and demand continuous maintenance. This is where no-code technology is enabling a faster path to launch, and platforms like DrapCode are helping fintech teams build enterprise-grade digital lending products in weeks, not months.

This blog breaks down, step by step, how to build a fully digital Loan Origination System using DrapCode, along with key components, architecture, workflows, and best practices relevant to fintech founders, lenders, and digital transformation teams.

Why Build a Digital Loan Origination System?

A modern Digital LOS enables lenders to:

- Streamline customer onboarding and verification

- Automate credit assessment and risk checks

- Reduce operational costs per loan

- Improve TAT from days to minutes

- Enhance compliance and audit trails

With the rise of no-code platforms, the LOS no longer needs to be built with traditional coding. DrapCode provides a secure, scalable, and configurable foundation tailored for digital lending workflows, enabling lenders to launch and iterate more quickly.

For teams evaluating digital lending transformation, DrapCode’s Digital Lending Suite, including Loan Origination Software and Loan Management Software, offers modular building blocks that reduce development effort and accelerate rollout.

Core Features of a Digital Loan Origination System

Before building, align on the core modules your LOS must include. A typical digital LOS consists of:

1. Digital Application & Intake

- Multi-device loan application forms

- Eligibility screening

- Pre-approved & personalized journeys

- Support for multiple loan products

2. KYC & Document Collection

- Digital KYC (Video KYC, Aadhaar/SSN verification depending on region)

- Document upload and OCR extraction

- Automated data validation

3. Credit Assessment & Decisioning

- Credit score pulling from bureaus

- Banking statement analysis

- Risk rule engine & automated decisioning

- Manual underwriting layer for exceptions

4. Offer Generation & e-Signing

- Personalized offers based on risk models

- Digital agreement creation

- e-Sign workflow for approval

5. Disbursement & Handover to LMS

- Post-approval disbursement triggers

- APIs to hand off to the Loan Management System

Why Use DrapCode to Build Your Digital LOS?

DrapCode is designed for business-critical web application development, particularly in sectors such as fintech, healthcare, and enterprise SaaS. It provides visual development with the flexibility to integrate advanced logic, automations, and external services without heavy engineering dependency.

Some of the strongest advantages for LOS development include:

1. End-to-End Workflow Automation

A digital LOS requires a multi-stage workflow: onboarding → KYC → assessment → approval → disbursement. DrapCode automates all these steps using workflows, triggers, and rules, thereby minimizing manual intervention.

2. Integrations-Ready

The lending ecosystem requires connectivity with multiple third-party systems, such as:

- KYC & identity verification APIs

- Credit bureaus

- Banking statement analyzers

- e-Sign services

- Core banking systems

DrapCode supports API-based integrations, event-driven automations, and secure data flow, enabling seamless integration with any fintech stack.

3. Enterprise-Grade Security & Compliance

Fintech apps demand strict governance. DrapCode is ISO 27001 certified, ensuring adherence to global security standards.

With role-based access controls, audit logs, encryption, and secure hosting, lenders can confidently build sensitive financial workflows.

4. Custom Logic Without Engineering Bottlenecks

No-code doesn’t mean “no flexibility.” DrapCode enables:

- Conditional logic

- Custom user roles and permission controls

- Data modeling

- Backend workflows

- Custom code when needed

This balance of visual development + extensibility ensures your LOS can evolve with regulatory and business needs.

How to Build a Digital LOS Using DrapCode (Step-by-Step)

Step 1: Structure Your Data Model

Map out the core data objects:

- Borrower profile

- Application form

- KYC document set

- Risk & scoring metrics

- Underwriting review notes

- Offer & agreement data

Create these as Collections in DrapCode to define the database foundation.

Step 2: Design the User Journey

Use DrapCode’s UI builder to design borrower and internal portal interfaces.

- Borrower Portal: Application, doc upload, application tracking

- Back-Office Portal: Verification, underwriting, approval dashboard

Add conditional visibility to show different UI based on loan stage or user role.

Step 3: Build the KYC + Document Workflow

Create a flow that triggers when an application is submitted:

- Auto-validate basic data

- Request documents

- Flag missing/incorrect documents

- Trigger KYC API integration

OCR can be added for auto-extraction to reduce manual work.

Step 4: Configure Credit Assessment Logic

Add automations for:

- Risk scoring rules

- Credit bureau API pull

- Bank statement analysis

- Approval conditions (auto/manual)

Underwriters can override decisions only with justification.

Step 5: Generate Loan Offers & Agreements

Once approved, the system should:

- Generate a personalized loan offer

- Create loan documents dynamically

- Send them for e-Signing

This stage also prepares the record for disbursement.

Step 6: Disbursement & Syncing With LMS

Upon digital signing:

- Trigger disbursement API

- Transfer application data to the Loan Management System

- Change status to “active loan”

This completes the origination cycle.

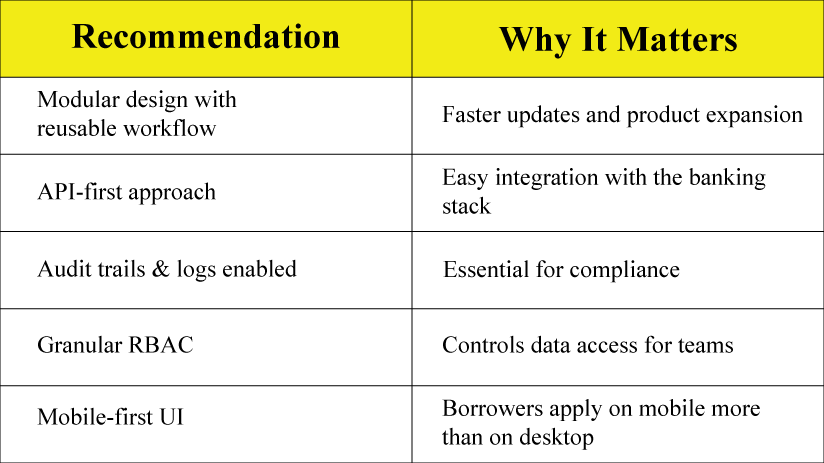

Best Practices for a Scalable Digital LOS

The No-Code Advantage for Fintech Teams

Traditional LOS builds are expensive and rigid. With DrapCode, teams gain:

- Faster deployment cycles

- Lower dev + maintenance cost

- Flexibility to tweak workflows anytime

- Ability to experiment and iterate without code

For lenders facing competitive pressure or looking to scale their operations, no-code solutions offer a significant time-to-market advantage.

Final Thoughts

Building a digital loan origination system no longer requires months of engineering. With DrapCode, lenders can create a secure, automation-driven LOS tailored to their products and compliance needs without sacrificing control or speed.

By leveraging DrapCode’s workflow engine, integrations, and enterprise-grade security, fintech founders and digital lending teams can launch digital lending products more quickly and continue iterating as market or regulatory conditions change.

Blogs & Insights

We'd love to share our knowledge with you. Get updates through our blogs & know what’s going on in the no-code world.