Integrate Signzy ITR and 26AS APIs on DrapCode

Integrate Signzy ITR and 26AS APIs with DrapCode to automate tax return verification. Extract financial insights, validate income details, and enhance credit assessment with real-time tax data.

Trusted by 1000+ brands across the world!

Automated Tax Validation

DrapCode enables seamless integration of Signzy ITR and 26AS APIs, allowing businesses to verify tax returns, deductions, and income statements instantly.

Secure Income Assessment

Ensure accurate financial profiling by fetching tax details directly from ITR filings and Form 26AS, reducing manual errors.

Key Features provided by Signzy ITR and 26AS APIs as an Integration

Automated ITR Retrieval

Fetches income tax return details directly from IT department records.

Real-Time 26AS Analysis

Extracts TDS, tax payments, and refunds for financial validation.

API Integration

Connects with lending, banking, and financial platforms effortlessly.

Fraud Detection System

Identifies discrepancies in declared and actual tax records.

Multi-Year Tax Insights

Provides historical tax data for in-depth financial evaluation.

Regulatory Compliance Support

Ensures adherence to tax verification norms for secure processing.

Faster Credit Approvals

Signzy’s ITR and 26AS APIs help lenders assess tax records quickly, improving loan approvals and financial decisions.

Fraud Prevention System

DrapCode allows businesses to integrate Signzy ITR and 26AS APIs, reducing tax-related fraud risks effectively.

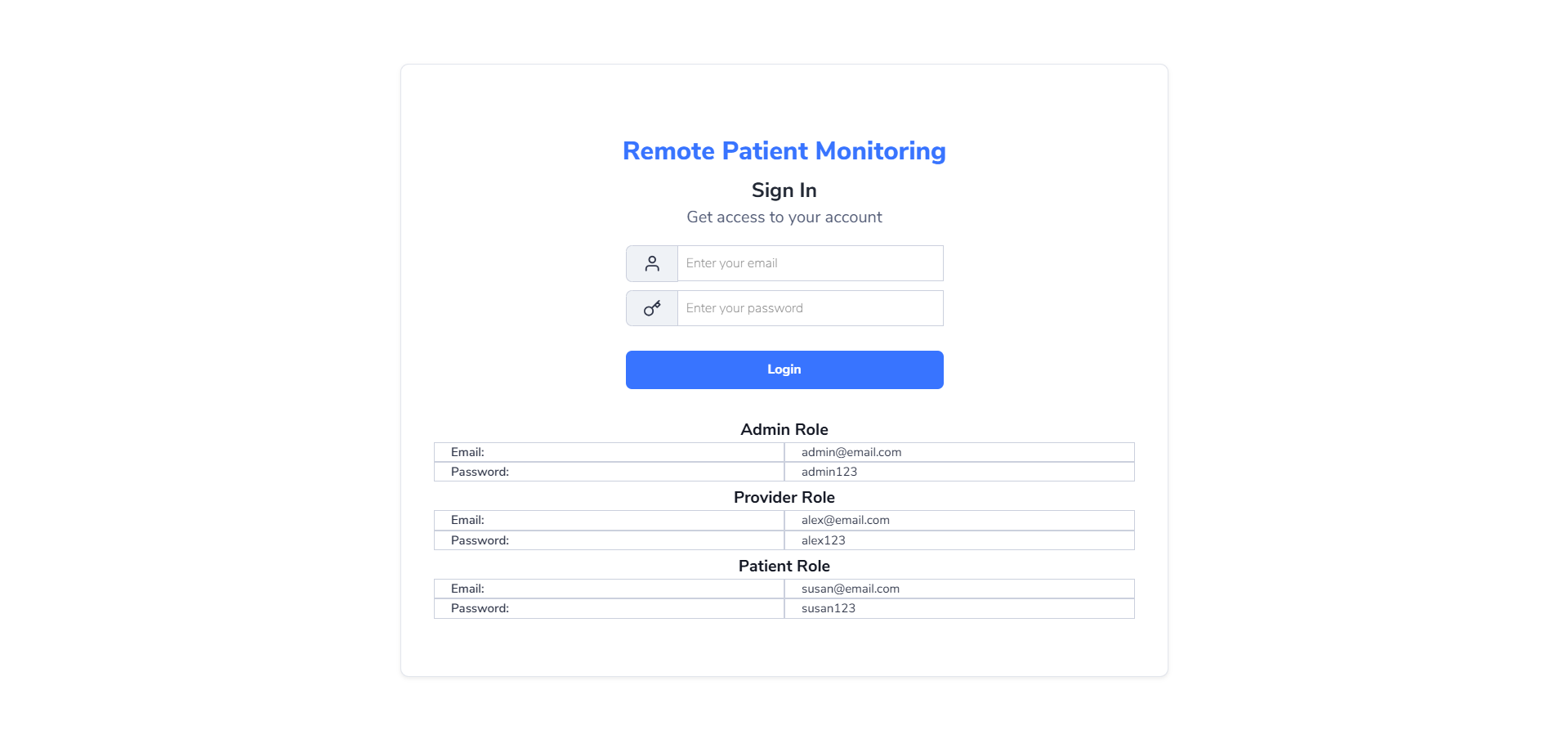

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code API Integration

Connect Signzy ITR and 26AS APIs without coding for quick implementation.

API-First Framework

Ensures smooth integration with fintech and compliance applications.

Secure Data Processing

Encrypts tax data to prevent unauthorized access and fraud.

Custom Validation Rules

Configurable checks for income verification and tax compliance.

Multi-Platform Compatibility

Supports ITR and 26AS data extraction across web and mobile apps.

Automated Compliance Checks

Verifies tax details for loan processing, audits, and financial analysis.

Effortless Financial Analysis

Automate tax data extraction, streamline income validation, and enhance financial decision-making.

Start Tax Validation with Signzy APIs on DrapCode

Frequently Asked Questions

How do Signzy ITR and 26AS APIs work?

Why is tax validation important for businesses?

Can the API detect discrepancies in tax data?

Can I integrate ITR and 26AS APIs without coding?

What industries benefit from automated tax validation?

Is DrapCode partnered or associated with the software it integrates with?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software