Integrate Signzy Bank Statement Analysis API on DrapCode

Integrate Signzy Bank Statement Analysis API with DrapCode to analyze bank transactions instantly. Automate financial assessments, detect fraud, and streamline credit decision-making with real-time insights.

Trusted by 1000+ brands across the world!

Instant Transaction Analysis

DrapCode enables seamless Signzy Bank Statement Analysis API integration, allowing businesses to extract and analyze financial data for better decision-making.

Financial Risk Assessment

Identify spending patterns, income sources, and anomalies in bank statements to enhance credit evaluation and fraud detection.

Key Features provided by Signzy Bank Statement Analysis API as an Integration

Transaction Categorization

Classifies deposits, withdrawals, and expenses for easy financial assessment.

Income & Expense Analysis

Extracts patterns from bank statements to evaluate financial stability.

Fraud & Anomaly Detection

Flags suspicious transactions and inconsistencies in financial statements.

Instant Data Extraction

Fetches structured insights from unstructured bank statements in real time.

API Integration

Connects with fintech, lending, and financial platforms for automated analysis.

Creditworthiness Evaluation

Assesses borrower credibility using historical banking transactions.

Loan Approval Optimization

Signzy’s Bank Statement Analysis API enhances lending decisions by providing accurate financial insights from transaction data.

Fraud Detection System

DrapCode allows businesses to integrate Signzy Bank Statement Analysis API effectively, reducing financial fraud risks.

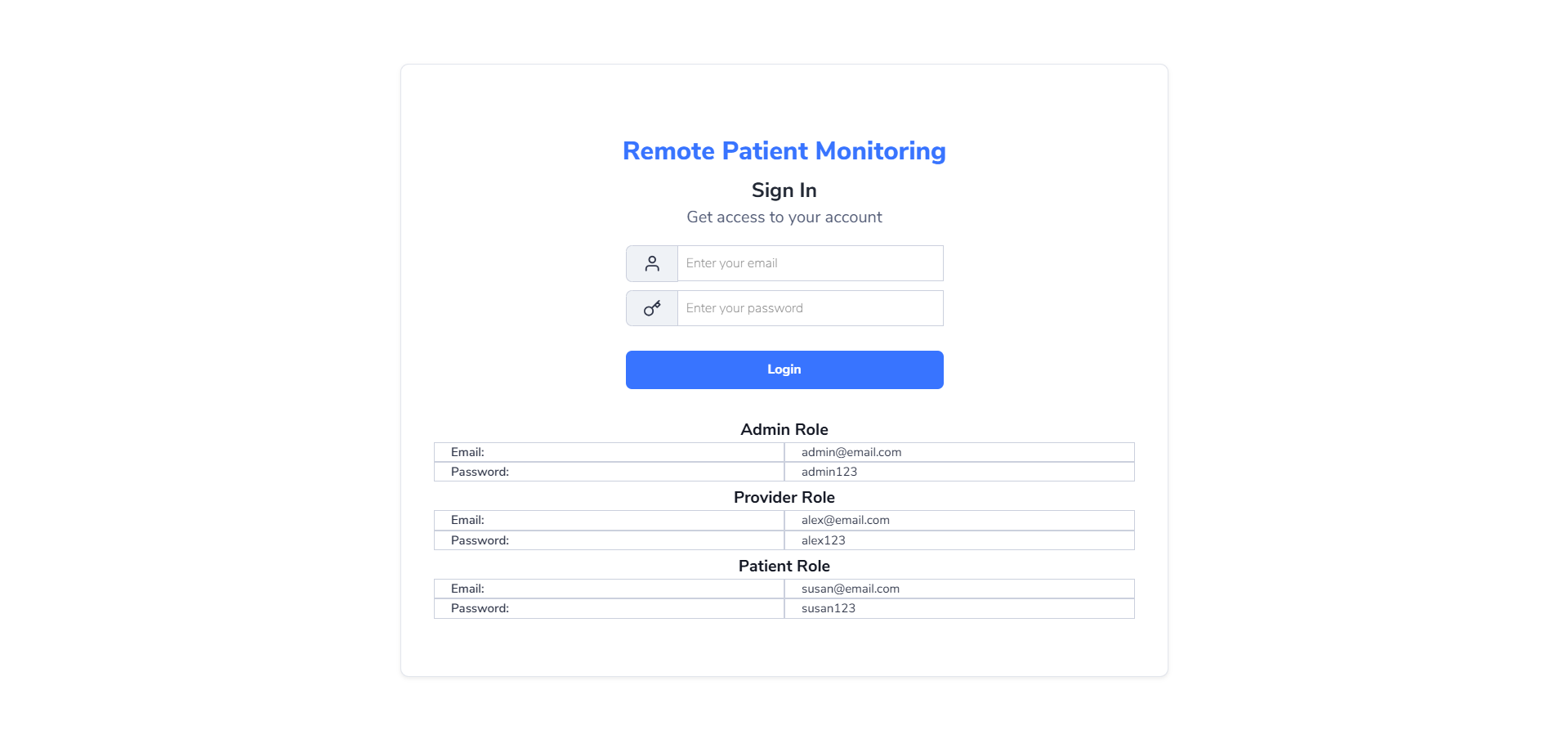

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code API Integration

Easily integrate bank statement analysis without coding for quick deployment.

API-First Infrastructure

Seamlessly connects Signzy Bank Statement Analysis API with financial platforms.

Secure Data Processing

Encrypts sensitive banking data to ensure privacy and prevent data breaches.

Custom Risk Metrics

Configure financial assessment parameters based on lending and compliance needs.

Multi-Platform Compatibility

Supports bank statement analysis across web, mobile, and enterprise applications.

Automated Decision Support

Enables businesses to automate financial analysis and risk assessment efficiently.

Faster Credit Assessment

Automate bank statement evaluation to minimize manual review efforts and improve loan processing speed.

Start Bank Statement Analysis with Signzy API on DrapCode

Frequently Asked Questions

How does Signzy Bank Statement Analysis API work?

Why is bank statement analysis important?

Can this API detect fraudulent transactions?

Can I integrate the Bank Statement Analysis API without coding?

What industries benefit from bank statement analysis?

Is DrapCode partnered or associated with the software it integrates with?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software