Integrate Signzy Account Aggregator API on DrapCode

Integrate Signzy Account Aggregator API with DrapCode to securely access and manage financial data. Enable seamless data sharing while ensuring compliance with regulatory standards.

Trusted by 1000+ brands across the world!

Unified Financial Data

DrapCode allows businesses to integrate Signzy Account Aggregator API, enabling easy access to bank, investment, and financial records from multiple sources.

Secure Data Access

Facilitate consent-based financial data sharing while ensuring security, encryption, and compliance with RBI’s Account Aggregator framework.

Key Features by Signzy Account Aggregator API

Multi-Bank Data Aggregation

Fetches financial data from various banks and financial institutions securely.

Consent-Based Data Sharing

Ensures user authorization before sharing financial information.

Real-Time Financial Insights

Provides instant access to transaction history, balances, and account details.

Seamless API Connectivity

Integrates with fintech, banking, and financial platforms for automated data access.

Regulatory Compliance Support

Adheres to RBI’s Account Aggregator guidelines for secure data exchange.

Automated Credit Assessment

Helps lenders analyze financial data for better decision-making.

Enhanced Credit Evaluation

Signzy’s Account Aggregator API simplifies financial data access, helping lenders and businesses assess creditworthiness instantly.

Fraud Prevention System

DrapCode enables businesses to integrate Signzy Account Aggregator API effectively, reducing risks related to unauthorized data access.

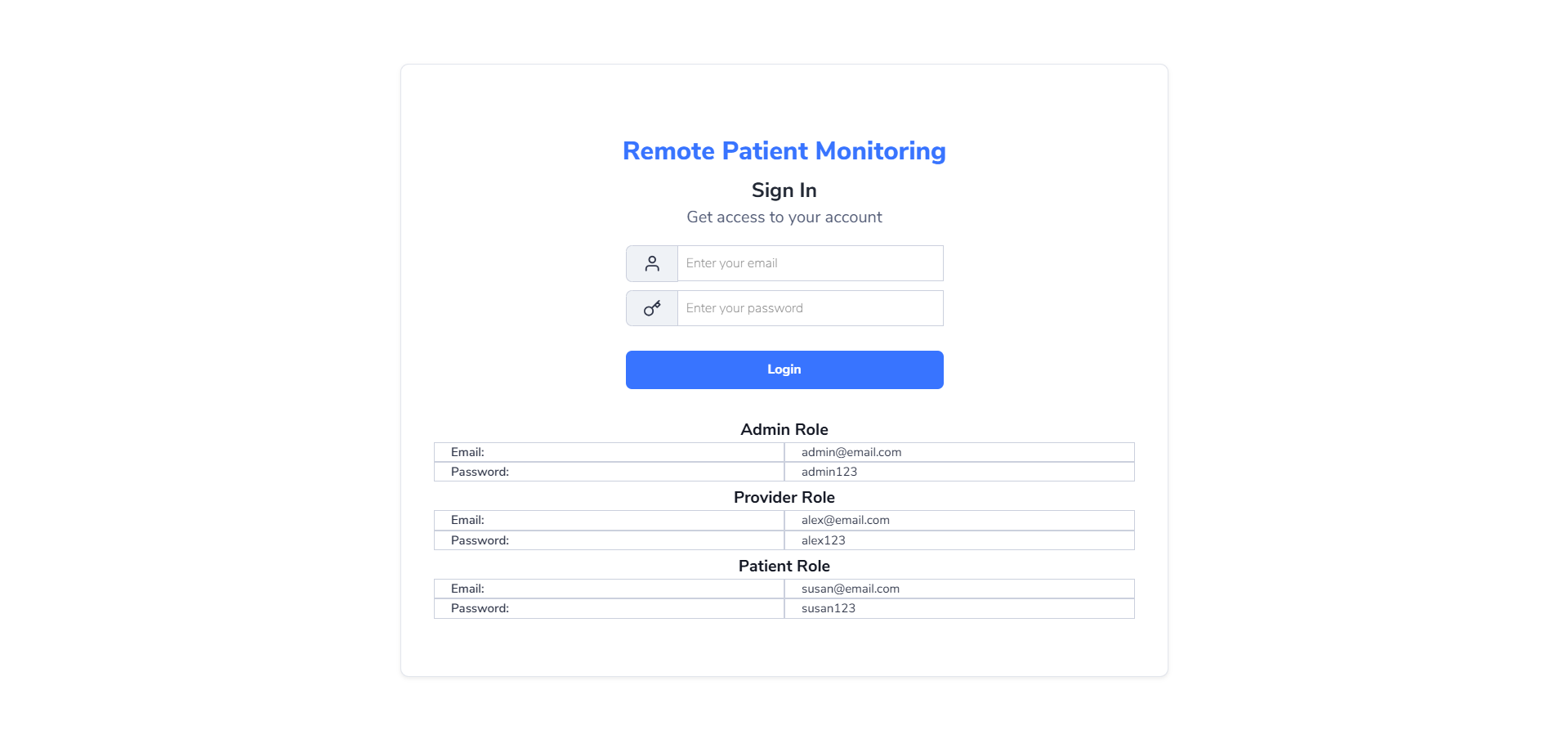

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code API Integration

Easily connect Account Aggregator workflows without coding for rapid deployment.

API-First Architecture

Enables seamless integration of Signzy Account Aggregator API with financial applications.

Secure Data Processing

Encrypts financial data to ensure privacy and prevent unauthorized access.

Custom Data Access Controls

Configure financial data permissions based on compliance needs.

Multi-Platform Compatibility

Supports account aggregation across web, mobile, and enterprise applications.

Automated Financial Insights

Reduces manual effort by extracting structured financial data for analysis.

Faster Financial Decisions

Automate financial data aggregation to enhance loan approvals, credit analysis, and wealth management services.

Start Account Aggregation with Signzy API on DrapCode

Frequently Asked Questions

How does Signzy Account Aggregator API work?

Why is Account Aggregation important?

Is the API compliant with RBI regulations?

Can I integrate the Account Aggregator API without coding?

What industries benefit from Account Aggregation?

Is DrapCode partnered or associated with the software it integrates with?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software