Integrate HyperVerge Penny Less Verification API on DrapCode

Integrate HyperVerge Penny Less Verification API with DrapCode to instantly verify bank account ownership without transferring funds. Enable secure, real-time financial authentication.

Trusted by 1000+ brands across the world!

Instant Account Validation

Verify user bank accounts in real time without moving any money. Reduce fraud and accelerate onboarding with secure authentication.

Secure Financial Authentication

Ensure encrypted, AI-powered validation that complies with banking and regulatory standards for safe financial verification.

Key Features Provided by HyperVerge Penny Less Verification API as an Integration

Real-time bank account validation without transactions, built for secure financial operations.

Zero Transaction Verification

Verify bank account ownership without transferring any money, saving cost and time.

Real-Time Validation

Instantly confirm account holder details with live banking data.

Fraud Detection Engine

Identify discrepancies and risky accounts using AI-powered analysis.

Multi-Bank Support

Validate accounts across multiple banks through a single API integration.

Seamless API Connectivity

Integrate easily into existing fintech, lending, and payment systems.

Regulatory Compliance

Meets financial and KYC standards for secure and compliant account verification.

No-Code API Integration

Connect the Penny Less Verification API visually using DrapCode’s no-code builder and automate account validation workflows.

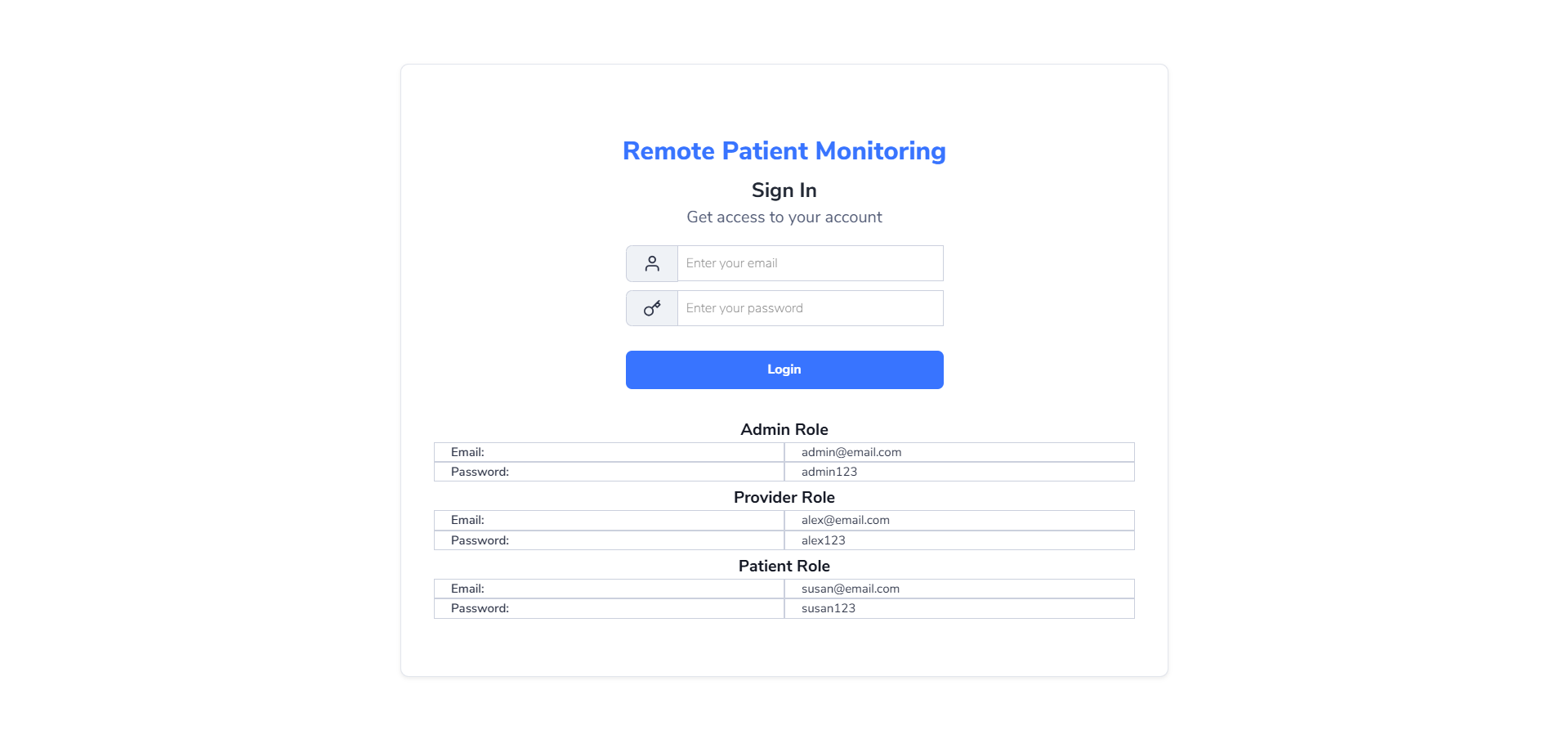

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code API Connectivity

Connect Penny Less Verification APIs visually without writing any code.

Custom Verification Workflows

Configure validation steps based on your business logic and risk policies.

Secure Data Handling

All financial data is encrypted and securely processed across workflows.

Scalable Infrastructure

Process thousands of account verifications reliably and efficiently.

Cross-Platform Deployment

Deploy bank verification flows on web, mobile, and enterprise applications.

Real-Time Processing

Speed up onboarding and payouts with instant account authentication.

Faster Financial Verification

Reduce delays with automated, real-time bank account checks that improve compliance and onboarding speed.

Enhanced Fraud Protection

Detect suspicious or mismatched accounts instantly to prevent financial fraud and unauthorized access.

Integrate Penny Less Verification API on DrapCode Today

Frequently Asked Questions

What is the HyperVerge Penny Less Verification API?

How does this API prevent fraud?

Can I integrate this API on DrapCode without coding?

Which industries use penny-less verification?

Does the API comply with financial regulations?

Is DrapCode partnered with HyperVerge?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software