Integrate HyperVerge KYB API on DrapCode

Integrate HyperVerge Know Your Business (KYB) API with DrapCode to verify business details instantly, automate compliance checks, and prevent fraud with AI-driven verification.

Trusted by 1000+ brands across the world!

Business Verification

Authenticate businesses by cross-checking registration details against government and financial databases in real time.

Fraud Prevention

Detect shell companies and fraudulent entities using AI-powered risk assessment and business identity validation.

Key Features Provided by HyperVerge KYB API as an Integration

AI-powered business verification and compliance checks built for financial institutions and enterprises.

Instant Business Lookup

Verify company registration details, ownership, and legal status through official government registries.

Automated Risk Assessment

Identify high-risk businesses using AI-driven fraud detection and compliance analytics.

Regulatory Compliance

Ensure businesses meet AML, KYC, and financial regulatory requirements automatically.

Global Data Access

Fetch business verification data across multiple jurisdictions and regulatory frameworks.

Seamless API Integration

Easily integrate KYB checks into banking, fintech, and enterprise onboarding systems.

Bulk Verification Support

Process large volumes of business verifications efficiently at scale.

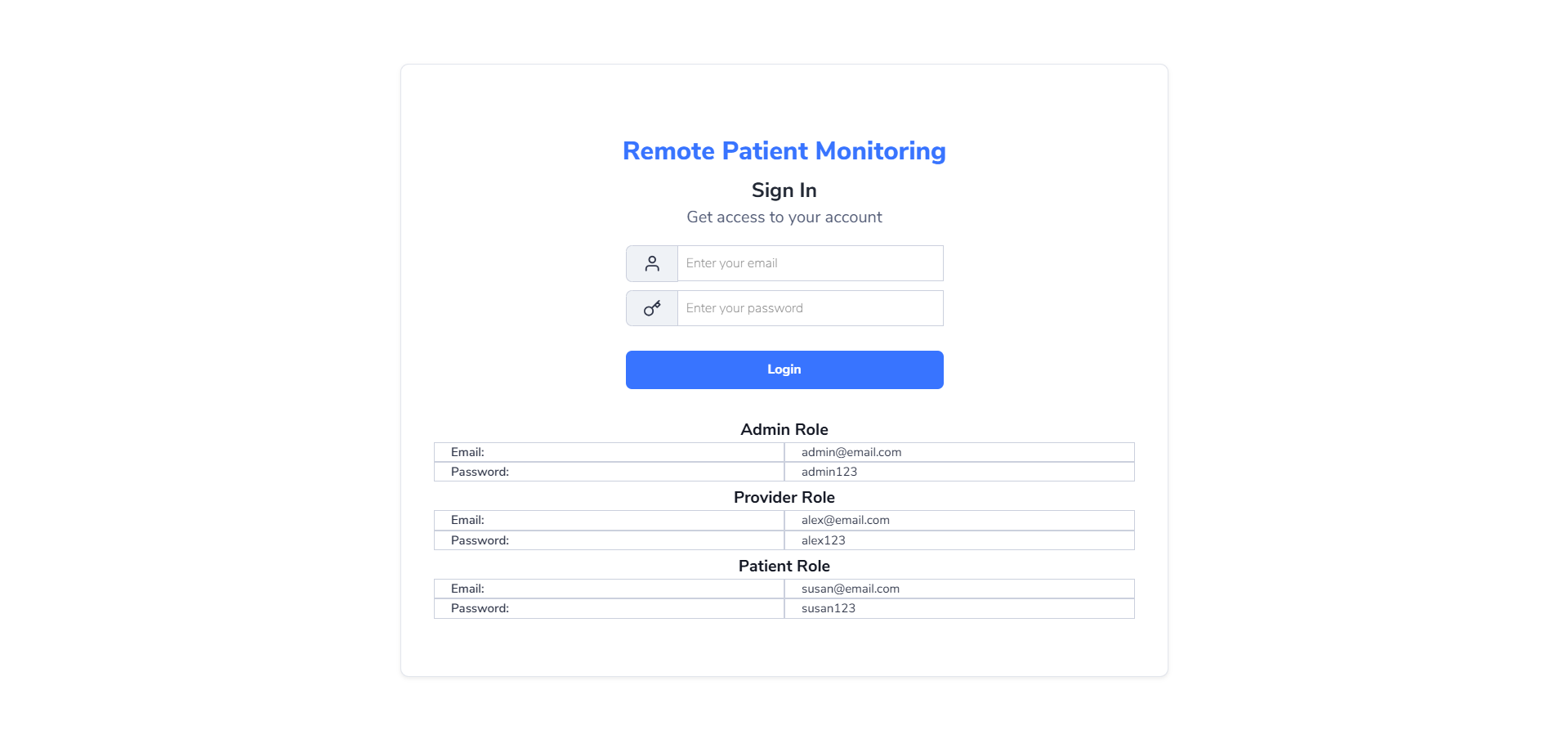

No-Code Integration

DrapCode enables quick KYB API integration without coding, allowing businesses to automate verification workflows effortlessly.

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Visual API Configuration

Connect HyperVerge KYB API using DrapCode’s drag-and-drop interface without technical complexity.

Scalable Data Processing

Handle large volumes of business verification requests without performance bottlenecks.

Real-Time Validation

Retrieve and validate company details instantly for faster decision-making.

Automated Risk Alerts

Receive alerts on suspicious business activity based on AI-powered risk analysis.

Industry-Agnostic Usage

Ideal for banks, fintechs, legal firms, and enterprises requiring business authentication.

Centralized Dashboard

Monitor and manage all business verification processes from one intuitive interface.

Regulatory Compliance

Ensure all business verifications align with AML, KYC, and financial regulations to reduce compliance risk.

Scalability & Speed

Process high volumes of business verifications efficiently with automated workflows and AI-driven validation.

Frequently Asked Questions

What does HyperVerge KYB API do?

How does KYB API help businesses?

Can I integrate the KYB API on DrapCode without coding?

Who typically uses KYB APIs?

Does HyperVerge KYB API support bulk business verification?

Is DrapCode partnered with HyperVerge?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software