Integrate HyperVerge Fraud Detection API on DrapCode

Enhance fraud prevention by integrating HyperVerge Fraud Detection API on DrapCode. Detect fraudulent transactions, minimize security risks, and ensure real-time risk assessment with AI-powered analytics.

Trusted by 1000+ brands across the world!

AI-Based Security

Analyze user behavior and transaction patterns in real time to detect anomalies, prevent unauthorized activities, and stop financial fraud.

Seamless Authentication

Combine fraud detection with identity verification and face authentication to prevent account takeovers and impersonation.

Key Features of HyperVerge Fraud Detection API as an Integration

AI-driven risk scoring, transaction monitoring, and compliance-ready fraud prevention.

Real-Time Fraud Detection

Monitor transactions continuously and flag suspicious activity instantly.

AI-Powered Risk Scoring

Assign fraud risk levels to users based on behavior, device, and transaction patterns.

Multi-Layer Authentication

Combine behavioral, biometric, and document checks to prevent identity fraud.

Automated Compliance Checks

Identify high-risk users and ensure AML and regulatory compliance automatically.

Seamless API Integration

Connect fraud detection with web and mobile applications without disrupting workflows.

Scalable Fraud Prevention

Protect millions of transactions and users across financial, fintech, and e-commerce platforms.

No-Code Implementation

DrapCode allows you to integrate HyperVerge Fraud Detection API visually without coding and build automated fraud prevention workflows.

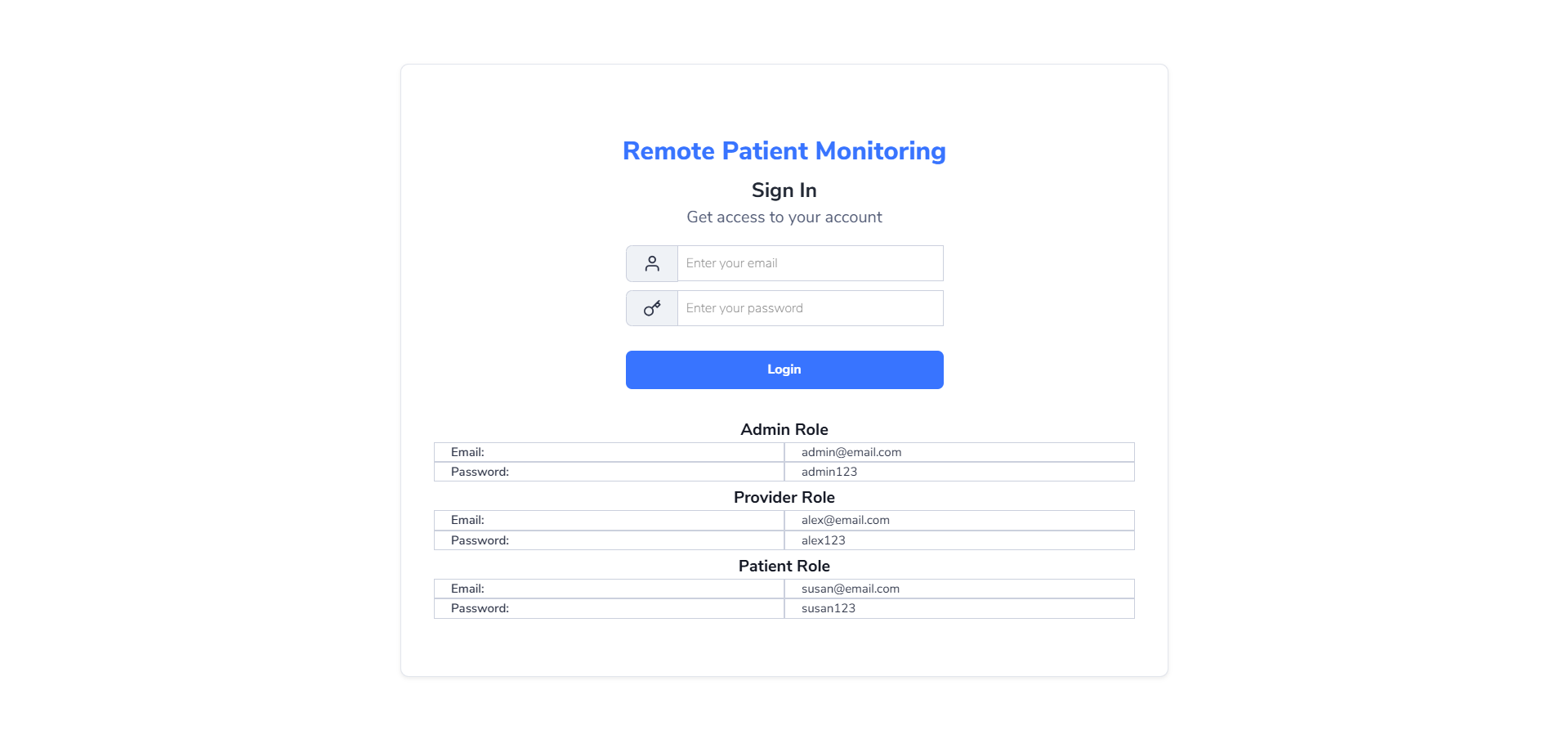

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Drag-and-Drop Integration

Build fraud detection workflows without writing code using DrapCode’s visual builder.

Instant Fraud Alerts

Receive real-time notifications when suspicious activity is detected.

Scalable Monitoring

Analyze large volumes of transactions with AI-driven risk monitoring.

Customizable Workflows

Configure fraud rules, risk thresholds, and verification steps based on business needs.

Unified Dashboard

Manage fraud detection, alerts, and verification flows from a single interface.

Multi-Platform Support

Deploy fraud detection across web apps, mobile apps, and enterprise systems.

Enhanced Fraud Prevention

Automate security controls and continuously monitor suspicious behavior to reduce financial and identity fraud risks.

Regulatory Compliance

Ensure compliance with AML, KYC, and financial regulations using AI-powered fraud monitoring and reporting.

Secure Your Platform with HyperVerge Fraud Detection API on DrapCode

Frequently Asked Questions

How does HyperVerge Fraud Detection API identify fraud?

Can I integrate this API on DrapCode without coding?

Is this API suitable for fintech and e-commerce platforms?

Does the API provide real-time fraud alerts?

Does it help with regulatory compliance?

Is DrapCode partnered or associated with HyperVerge?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software