Integrate CERSAI Search API on DrapCode

Integrate CERSAI Search API with DrapCode to verify property mortgage details and prevent fraudulent transactions. Automate lien searches with a seamless no-code setup.

Trusted by 1000+ brands across the world!

Automated Lien Checks

Retrieve mortgage and lien details instantly from CERSAI records. Enhance loan processing with real-time property verification.

Fraud Prevention System

Detect fraudulent property transactions by validating ownership and encumbrance details against the CERSAI database.

Key Features provided by CERSAI Search API as an Integration

Real-time secured asset, mortgage, and encumbrance validation for regulated lending operations.

Instant Mortgage Verification

Retrieve property lien details in real time from the CERSAI registry to streamline loan approvals.

Automated Encumbrance Checks

Identify property disputes, pending loans, and ownership history with AI-powered database search.

Regulatory Compliance Support

Ensure adherence to RBI and NBFC guidelines by validating property collateral records.

Bulk Data Processing

Perform large-scale property searches for banks and financial institutions, reducing manual workload.

Fraud Risk Assessment

Detect inconsistencies in property ownership and mortgage claims to prevent financial fraud.

Seamless API Integration

Connect CERSAI Search API with existing systems for quick and automated property verification.

No-Code API Integration

DrapCode simplifies CERSAI Search API integration, allowing businesses to automate property verification without coding.

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code API Connectivity

Integrate CERSAI Search API effortlessly into applications using DrapCode’s visual interface.

Drag-and-Drop Workflow

Design mortgage verification processes without writing a single line of code.

Secure Data Handling

Ensure encrypted data transmission for property search requests and responses.

Customizable Verification Rules

Configure property validation workflows based on business compliance needs.

Scalable Infrastructure

Handle high-volume mortgage verification requests efficiently.

Cross-Platform Deployment

Implement CERSAI search across web and mobile applications seamlessly.

Faster Loan Processing

Enhance loan approvals by verifying property mortgages with CERSAI Search API on DrapCode. Reduce risks and manual efforts.

Enhanced Regulatory Compliance

Automate property verification while ensuring adherence to RBI and banking regulations for secure lending.

Integrate CERSAI Search API on DrapCode Today!

Frequently Asked Questions

What does CERSAI Search API do?

How does CERSAI Search API prevent fraud?

Can I integrate CERSAI Search API on DrapCode without coding?

Who benefits from the CERSAI Search API?

Does CERSAI Search API support bulk property verification?

Is DrapCode partnered or associated with the software it integrates with?

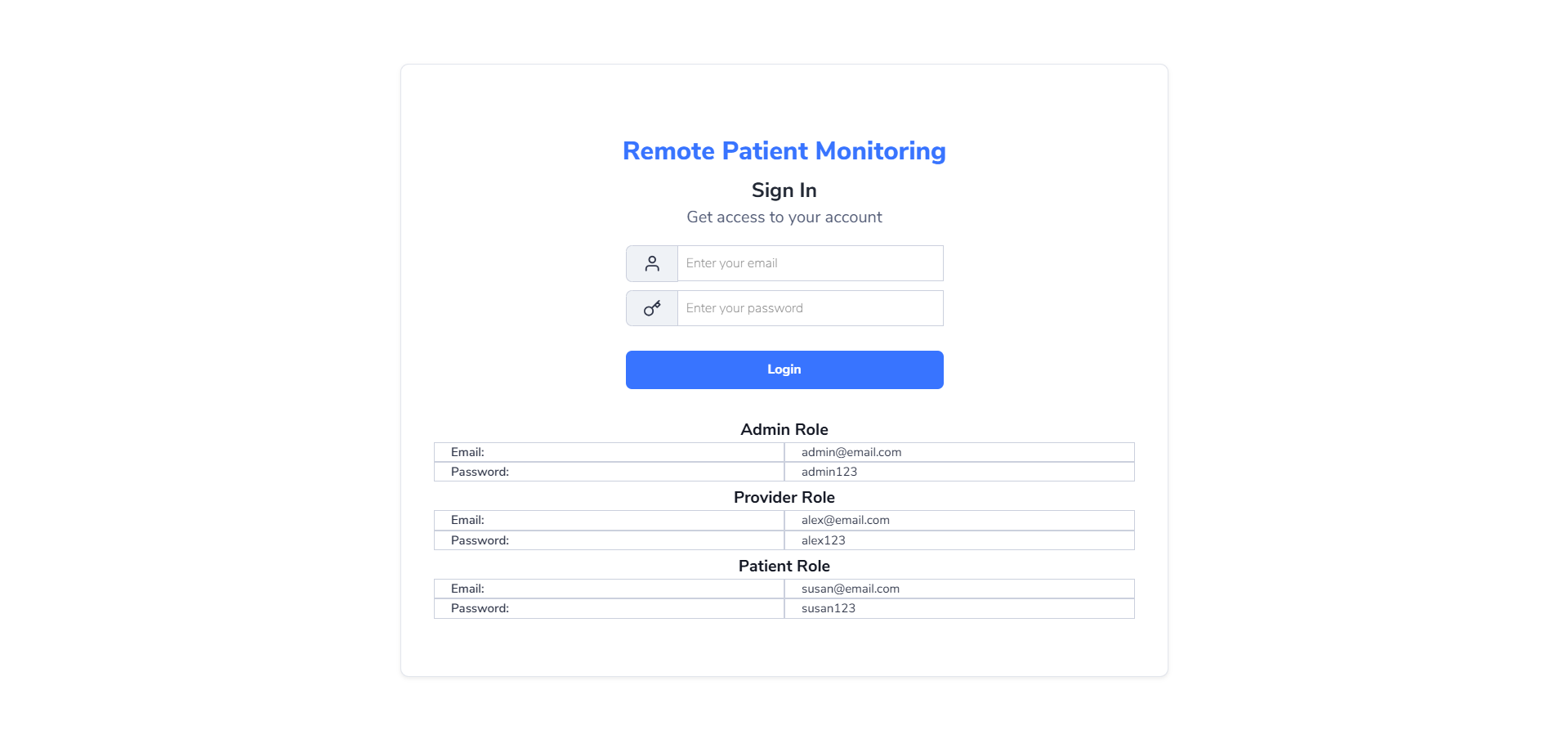

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software