Integrate HyperVerge Bank Statement Analysis API on DrapCode

Automate financial data analysis by integrating HyperVerge Bank Statement Analysis API on DrapCode. Extract, categorize, and analyze bank transactions efficiently.

Trusted by 1000+ brands across the world!

Automated Data Extraction

This API uses AI to extract transaction details, categorize expenses, and generate financial insights without manual intervention.

Real-Time Insights

Businesses can assess creditworthiness and detect financial anomalies with instant statement analysis, improving risk assessment accuracy.

Key Features by HyperVerge Bank Statement Analysis API as an Integration

AI-driven transaction analysis, credit scoring, and compliance-ready financial insights.

Transaction Categorization

Automatically classifies deposits, withdrawals, and recurring payments for structured financial insights.

Income Verification & Fraud Detection

Analyzes salary credits, tax deductions, and inconsistencies to detect fraudulent activities.

Cash Flow Assessment

Evaluates account balances, spending patterns, and cash inflows for better financial decision-making.

Multi-Bank Support

Processes statements from multiple banks in various formats, ensuring seamless compatibility.

Instant Credit Scoring

Generates financial risk scores based on transaction behavior, aiding loan approvals and underwriting.

Compliance Checks

Ensures adherence to financial compliance regulations by verifying income sources and account details.

Seamless No-Code Integration

DrapCode simplifies the integration process, allowing businesses to add bank statement analysis functionality without coding expertise.

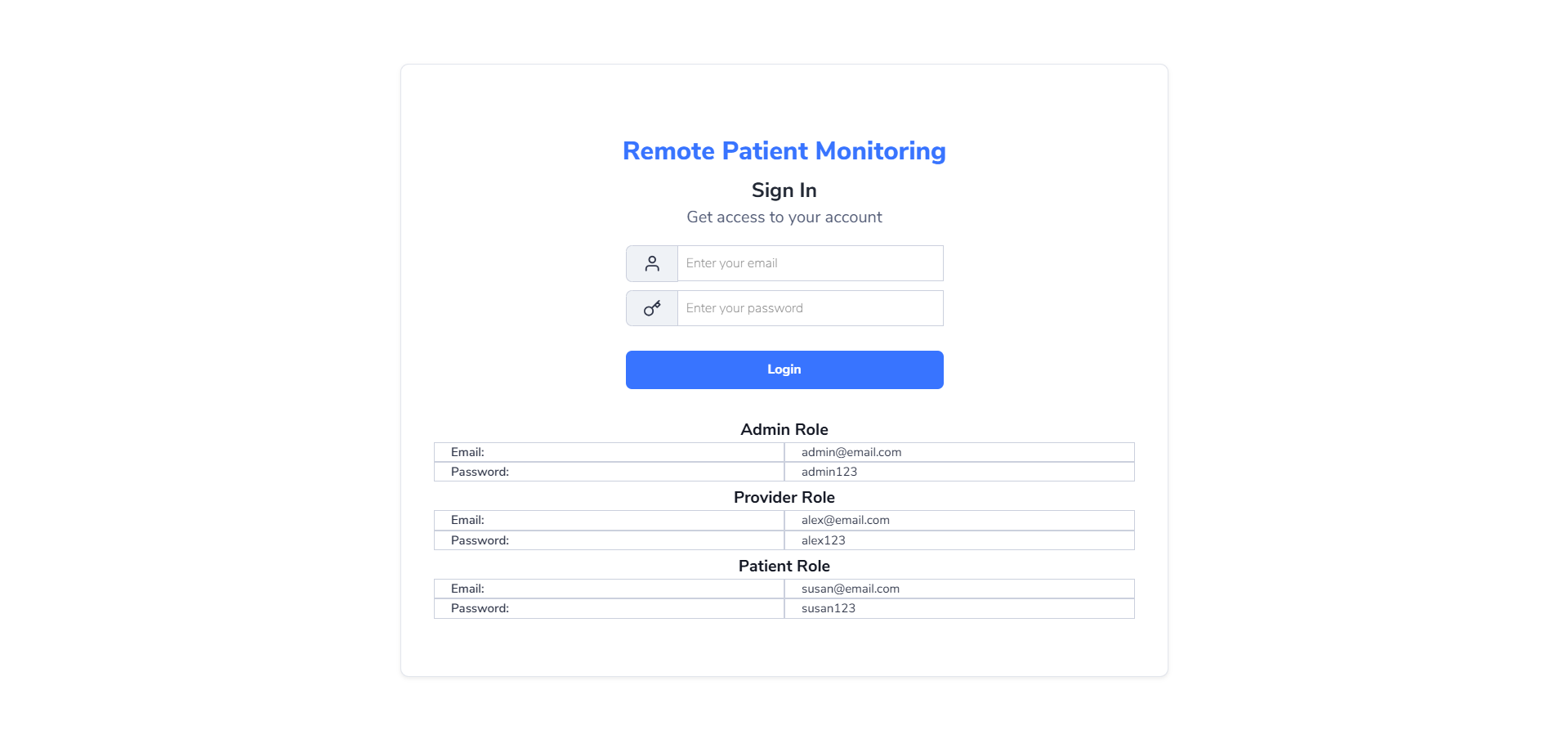

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Drag-and-Drop Interface

Enables financial data analysis workflows without writing a single line of code.

Real-Time Analytics Dashboard

Displays categorized transactions, balances, and financial trends for better decision-making.

Secure Data Processing

Encrypts financial data and ensures compliance with security standards for safe transactions.

Customizable API Workflows

Allows businesses to modify transaction analysis rules based on industry needs.

Third-Party Integrations

Connects with other APIs, such as Know Your Business API, for comprehensive financial verification.

Scalable for Enterprise Use

Supports large-scale financial data analysis, making it ideal for banks and fintech companies.

Enhanced Financial Analysis

With HyperVerge Bank Statement Analysis API on DrapCode, businesses can automate transaction categorization and improve financial decision-making.

Fraud Prevention and Compliance

This API ensures transaction integrity by detecting inconsistencies, verifying income sources, and adhering to financial compliance requirements.

Automate Financial Data Analysis with Bank Statement Analysis API!

Frequently Asked Questions

How does HyperVerge Bank Statement Analysis API categorize transactions?

Can DrapCode integrate this API without coding?

How does this API help in credit risk assessment?

Is the API compatible with statements from different banks?

Can this API detect fraudulent transactions in bank statements?

Is DrapCode partnered or associated with the software it integrates with?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software