Integrate HyperVerge Bank Account Verification API on DrapCode

Ensure secure and accurate bank account verification with HyperVerge Bank Account Verification API on DrapCode. Authenticate account ownership instantly and prevent fraudulent transactions.

Trusted by 1000+ brands across the world!

Instant Bank Account Validation

This API enables real-time verification of bank details by cross-checking them with official banking records. It ensures accuracy, reducing errors in transactions and financial operations.

Fraud Prevention & Risk Mitigation

By confirming ownership before processing payments, businesses can prevent unauthorized transactions. It enhances security and minimizes the risks of fraud and identity theft.

Key Features by HyperVerge Bank Account Verification API as an Integration

Secure, real-time bank account validation and fraud prevention for regulated financial platforms.

Account Authentication

Instantly verifies bank details against official databases for seamless transactions.

Fraud Detection Mechanisms

Identifies discrepancies in user-provided information to prevent fraudulent activities.

API Integration

Easily integrates with banking, fintech, and financial platforms for smooth operations.

Bulk Verification Support

Allows businesses to validate multiple bank accounts simultaneously.

Regulatory Compliance

Ensures adherence to KYC and AML guidelines for secure financial verification.

Secure Data Transmission

Uses encryption and security protocols to protect sensitive banking information.

No-Code Implementation

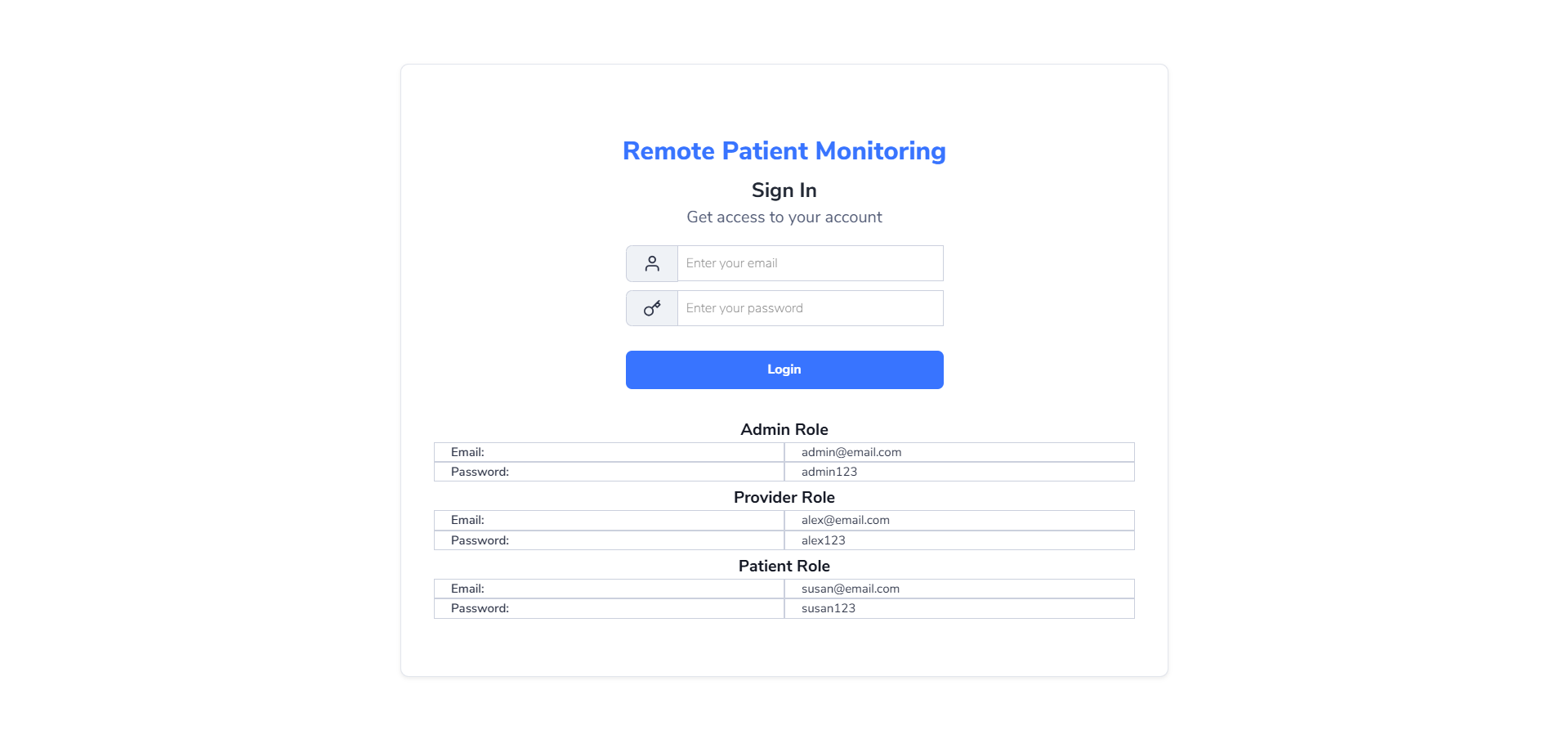

DrapCode enables businesses to integrate HyperVerge Bank Account Verification API effortlessly. It simplifies authentication while reducing manual efforts and technical complexities.

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Drag-and-Drop Interface

No coding is required to set up seamless API connections for account verification.

Automated Verification Process

Ensures real-time validation, eliminating manual errors and delays.

Custom Workflow Integration

Adapts to fintech, banking, and lending applications with ease.

Secure and Scalable

Handles high-volume verifications without compromising security or efficiency.

Cross-Platform Compatibility

Works across various financial platforms for smooth integration.

User-Friendly Dashboard

Manage verification workflows with an intuitive, no-code dashboard for better visibility.

Ensuring Financial Security

Verifying bank account ownership helps businesses minimize fraud risks and ensure transaction accuracy. It also enhances the trustworthiness of financial platforms.

Simplifying KYC Compliance

Automate bank account verification to meet regulatory requirements with ease. This API helps fintech firms and financial institutions stay compliant without manual intervention.

Integrate HyperVerge Bank Account Verification API on DrapCode Today

Frequently Asked Questions

How does the HyperVerge Bank Account Verification API work?

How does this API help in fraud prevention?

Can businesses perform bulk verifications using this API?

How does this API integrate with DrapCode?

Is the verification process compliant with financial regulations?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software