Integrate HyperVerge AML Screening API on DrapCode

Integrate HyperVerge AML Screening API with DrapCode to detect high-risk users and entities. Ensure global AML compliance and prevent fraudulent financial activities effortlessly.

Trusted by 1000+ brands across the world!

Risk Screening Process

Identify users involved in money laundering, fraud, and financial crimes by screening against global watchlists and regulatory databases.

Fraud Prevention Measures

Analyze sanctions lists, PEP databases, and adverse media reports to detect potential financial risks before onboarding.

Key Features by HyperVerge AML Screening API as an Integration

AI-driven AML checks, sanctions screening, and fraud risk scoring for regulated businesses.

Global Sanctions Check

Verify users against FATF, OFAC, EU, and worldwide regulatory databases for compliance.

PEP Detection System

Identify politically exposed persons (PEPs) to mitigate financial and reputational risks.

Adverse Media Monitoring

Scan negative news sources to flag individuals linked to suspicious activities.

AI-Powered Risk Scoring

Assign real-time risk levels based on fraud detection and AML compliance checks.

Automated Compliance Reports

Generate audit-ready risk assessment reports for financial institutions.

API Integration

Easily integrate with banking, fintech, and risk management workflows.

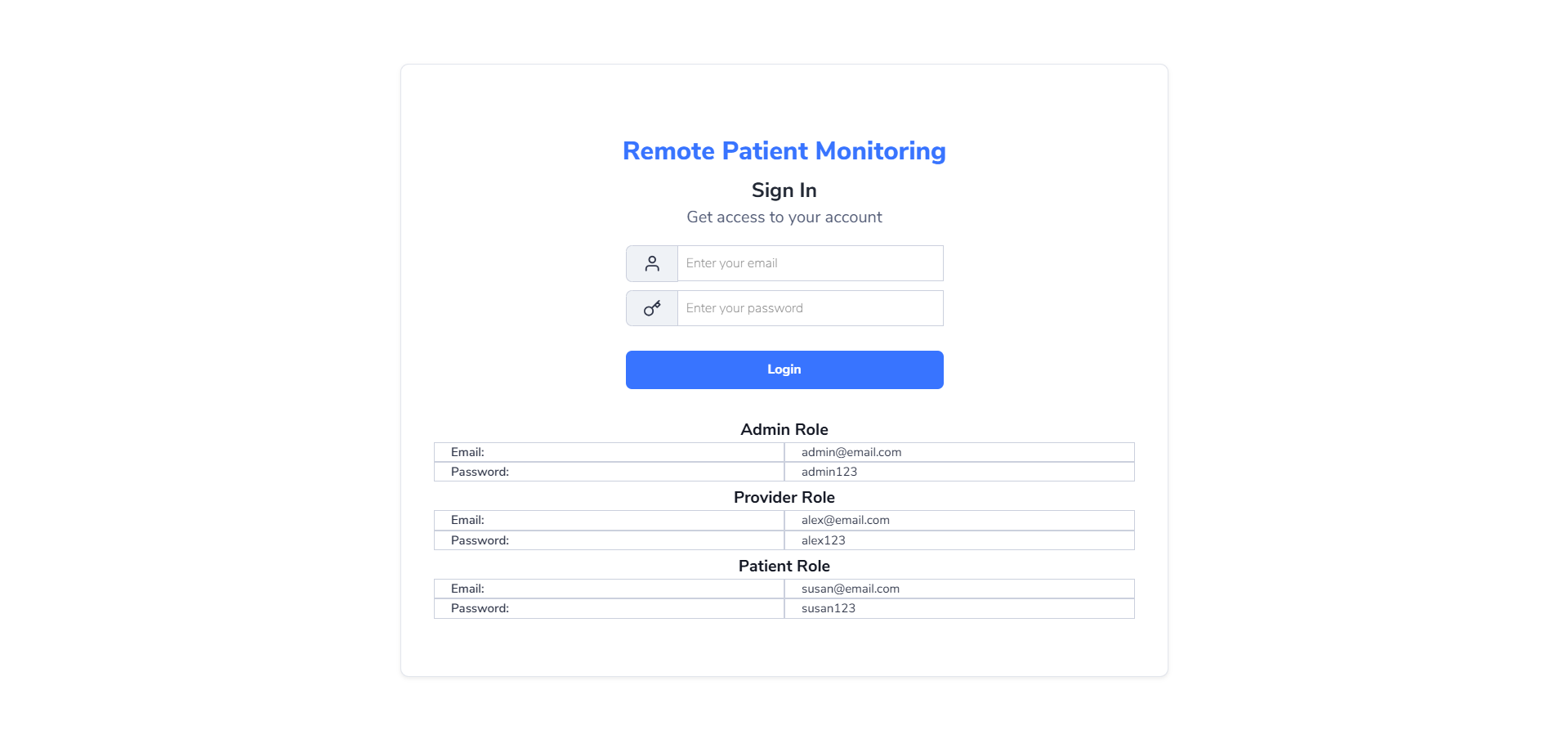

No-Code API Integration

DrapCode provides simple and secure integration of the AML Screening API using a no-code, drag-and-drop interface.

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code AML Setup

Connect the AML Screening API without coding for fast deployment.

Automated Risk Alerts

Trigger real-time alerts for flagged users based on compliance results.

Encrypted Data Processing

Ensure secure handling of sensitive financial data during verification.

Scalable AML Checks

Perform high-volume screenings for banking, fintech, and crypto platforms.

Cross-Platform Integration

Use the API in banking, investment, and digital payment systems.

Customizable Compliance Workflows

Automate AML checks, fraud detection, and user onboarding processes.

Regulatory Compliance Made Easy

Stay compliant with AML, FATF, and global financial regulations by screening users before account approval.

Advanced Fraud Detection

Detects high-risk individuals and prevents financial fraud through AI-powered AML screening solutions.

Integrate AML Screening API on DrapCode Today!

Frequently Asked Questions

What does HyperVerge AML Screening API do?

How does it help prevent fraud?

Can I integrate this API on DrapCode without coding?

Who can use this API?

Does it support bulk AML screenings?

Is DrapCode partnered or associated with the software it integrates with?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software