Integrate HyperVerge Account Aggregator API on DrapCode

Integrate HyperVerge Account Aggregator API with DrapCode to streamline financial data access. Enable secure, consent-based data sharing for faster loan approvals and financial analysis.

Trusted by 1000+ brands across the world!

Financial Data Access

Retrieve user-permitted financial data from multiple banks and institutions. Automate income verification and credit assessments seamlessly.

Secure & Compliant Transactions

Ensure data privacy with encrypted transmission. Meet RBI Account Aggregator (AA) framework compliance for secure financial data exchange.

Key Features by HyperVerge Account Aggregator API as an Integration

RBI compliant, consent driven financial data connectivity for modern fintech platforms.

Consent-Based Data Sharing

Allow users to share financial data securely with regulated financial institutions.

Multi-Bank Connectivity

Access account details from multiple banks through a unified interface.

Real-Time Data Retrieval

Fetch financial statements, transactions, and income details instantly.

Regulatory Compliance

Align with RBI’s Account Aggregator framework for secure data access.

API Integration

Connect effortlessly with lending, banking, and fintech applications.

Enhanced Fraud Detection

Verify financial authenticity and detect anomalies in transaction history.

No-Code API Integration

DrapCode allows seamless account aggregator API integration without coding. Automate financial data access workflows with ease.

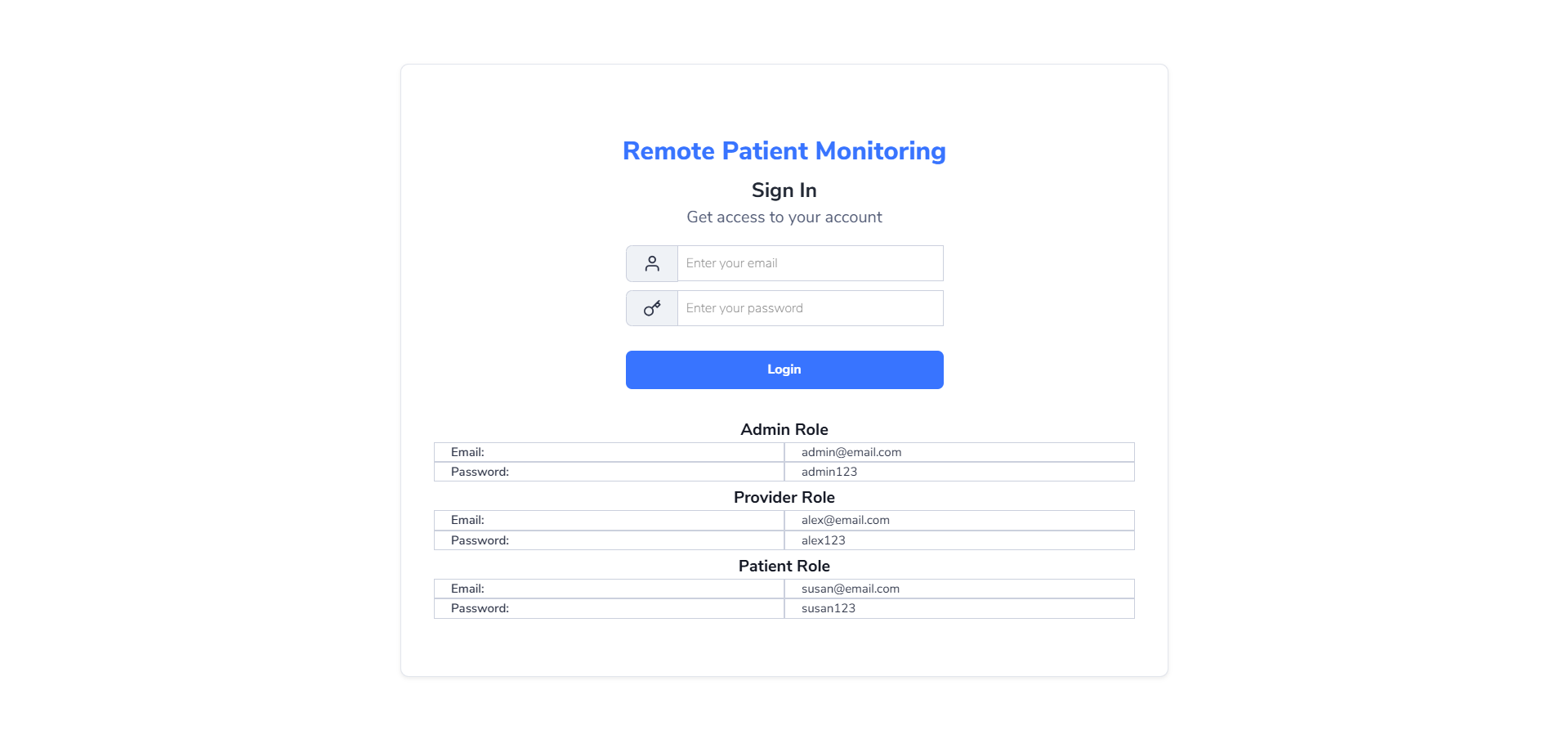

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

No-Code API Connectivity

Integrate Account Aggregator API visually with a drag-and-drop interface.

Custom Data Workflows

Configure data-sharing processes based on business requirements.

Secure Data Processing

Encrypt and store financial data securely for compliance.

Scalable Financial Data Access

Handle bulk data requests efficiently with a high-performance infrastructure.

Cross-Platform Compatibility

Deploy Account Aggregator functionality across web, mobile, and enterprise applications.

Faster Credit Assessments

Automate financial verification for quick and accurate decision-making.

Improved Financial Data Sharing

Enable seamless financial data retrieval from multiple institutions. Enhance loan processing and risk assessment workflows.

User Data Privacy

Ensure secure data exchange with user consent-based sharing. Comply with financial regulations for safe transactions.

Integrate Account Aggregator API on DrapCode Today!

Frequently Asked Questions

What is the HyperVerge Account Aggregator API?

How does the API ensure data privacy?

Can I integrate the Account Aggregator API on DrapCode without coding?

What industries benefit from Account Aggregator API?

How does DrapCode improve Account Aggregator integration?

Is DrapCode partnered or associated with the software it integrates with?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software