Integrate Decentro Credit Bureau API on DrapCode

Integrate Decentro Credit Bureau API with DrapCode to access real-time credit scores and financial history. Automate credit checks for seamless loan approvals and risk assessment.

Trusted by 1000+ brands across the world!

Automated Credit Checks

Retrieve customer credit scores instantly from leading credit bureaus. Minimize risk and improve decision-making with accurate financial data.

Risk Assessment

Analyze financial history, repayment trends, and creditworthiness effortlessly. Make informed lending decisions with AI-powered insights.

Key Features by Decentro Credit Bureau API as an Integration

Real-time, multi-bureau credit intelligence built for modern lending platforms.

Instant Credit Reports

Fetch credit scores and financial history in real time from trusted credit bureaus.

Fraud Detection

Identify discrepancies and suspicious credit activities with automated alerts.

Custom Risk Models

Create personalized credit risk models based on business and lending policies.

Seamless API Integration

Integrate credit checks into existing lending and onboarding workflows easily.

Multi-Bureau Access

Retrieve credit data from multiple bureaus for complete borrower profiling.

Regulatory Compliance

Ensure compliance with RBI, NBFC, and financial regulations.

No-Code API Setup

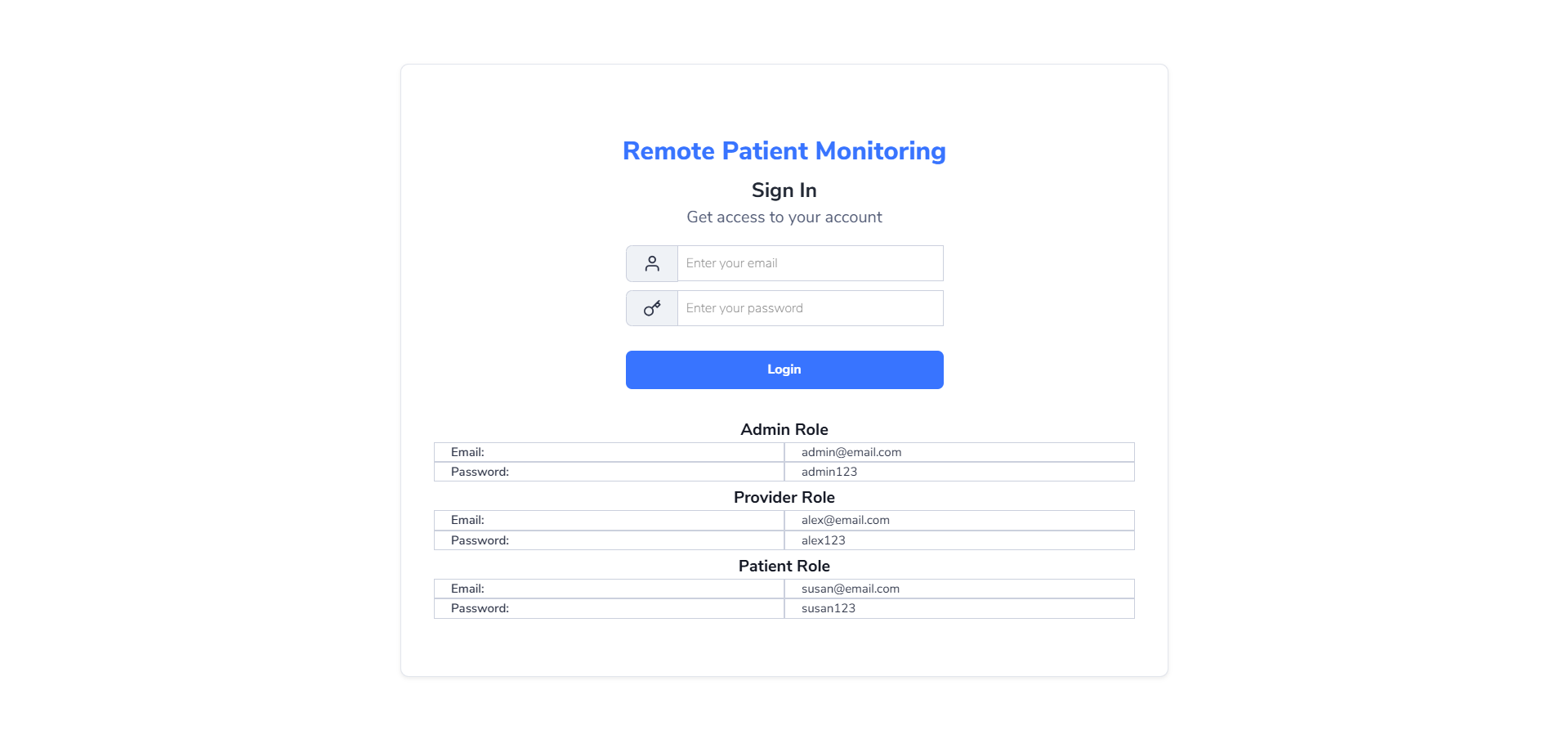

DrapCode allows seamless integration of Decentro’s Credit Bureau API without coding. Set up automated financial assessments efficiently.

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Visual API Builder

Connect Decentro Credit Bureau APIs using DrapCode’s no-code visual workflows.

Automated Credit Checks

Trigger credit score retrieval automatically during onboarding and loan processing.

Secure Data Handling

Encrypt and protect sensitive financial data across all workflows.

Scalable Performance

Process thousands of credit verifications without performance degradation.

Custom Rule Engine

Apply custom scoring rules and approval logic for advanced risk profiling.

Cross-Platform Deployment

Run credit workflows on web, mobile, and enterprise applications.

Faster Loan Processing

Reduce approval times by automating credit verification with Decentro Credit Bureau API on DrapCode. Enhance user experience with instant decisions.

Enhanced Financial Insights

Gain deeper financial insights with AI-driven credit analysis. Improve risk assessment for lending and financial services.

Frequently Asked Questions

What does Decentro Credit Bureau API do?

Can I integrate this API on DrapCode without coding?

Who uses Credit Bureau APIs?

How does this API help prevent fraud?

Is DrapCode partnered with Decentro?

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software