Integrate Decentro CKYC APIs on DrapCode

Integrate Decentro CKYC APIs on DrapCode to automate customer KYC verification. Retrieve CKYC records instantly and ensure compliance in financial services.

Trusted by 1000+ brands across the world!

Automated Customer Verification

Fetch and validate CKYC records in real time to streamline customer onboarding while ensuring regulatory compliance.

Secure Data Processing

Encrypt CKYC data retrieval and validation to protect sensitive customer information and prevent unauthorized access.

Key Features by Decentro CKYC APIs as an Integration

Centralized, compliant, and real-time KYC verification infrastructure for financial institutions.

CKYC Retrieval

Fetch customer CKYC data from the central registry in real time for seamless onboarding.

Automated Data Validation

Verify customer details against CKYC records to prevent fraud and duplication.

Regulatory Compliance

Ensure adherence to RBI, SEBI, and banking regulations with secure CKYC validation.

Bank Integration

Connect with financial institutions for real-time CKYC checks and authentication.

Fraud Detection

Identify suspicious identities and prevent fraudulent account openings.

Bulk Processing

Process high-volume CKYC requests efficiently with scalable API infrastructure.

No-Code CKYC Integration

DrapCode enables seamless CKYC API integration without writing code. Design automated verification workflows using a drag-and-drop interface.

Features provided by DrapCode as a front-end

Using DrapCode as a 100% frontend builder.

Visual API Integration

Connect CKYC APIs using DrapCode’s no-code visual workflow builder.

Custom Verification Flows

Build CKYC authentication flows tailored to your business requirements.

Secure Data Handling

Encrypt CKYC data storage and transmission for maximum security.

Scalable Infrastructure

Process large volumes of CKYC checks with enterprise-grade performance.

Multi-Platform Deployment

Run CKYC verification across web, mobile, and enterprise apps.

Faster Onboarding

Automate CKYC validation to speed up onboarding and reduce manual errors.

Faster KYC Processing

Automate CKYC verification with Decentro CKYC APIs on DrapCode to reduce processing time and ensure regulatory compliance.

Fraud Prevention

Minimize risks with AI-driven CKYC validation to prevent identity fraud and unauthorized account access.

Frequently Asked Questions

What does Decentro CKYC API do?

How does CKYC improve onboarding?

Can CKYC APIs be integrated without coding?

Who uses CKYC APIs?

Is DrapCode partnered with Decentro?

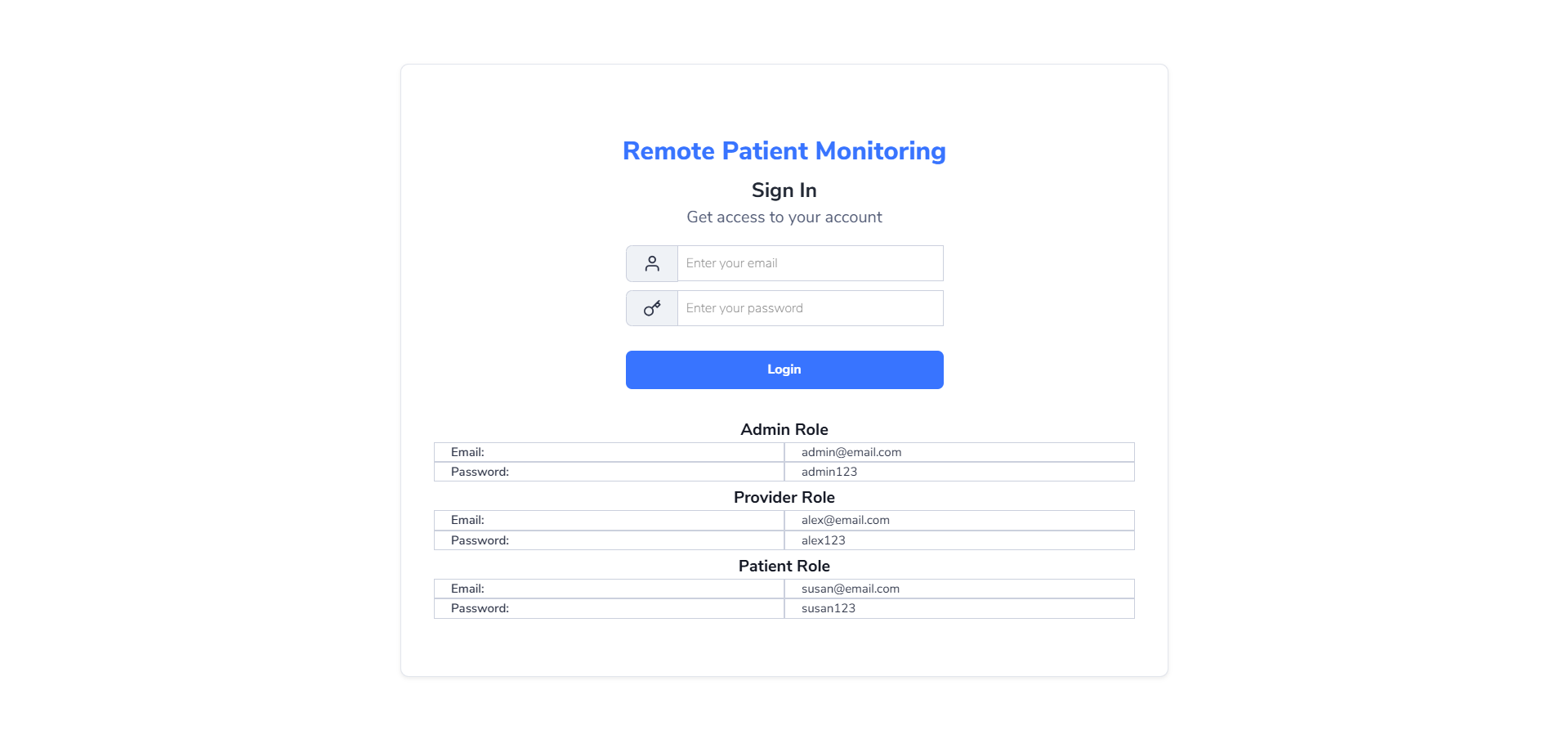

Readymade Templates

Don't start from scratch! Use our pre-configured ready-to-use responsive templates

and build your web apps faster.

P2P (Peer to Peer) Lending Software

Created on Jan 16, 2025

Explore P2P (Peer to Peer) Lending Software